A mobile-first investment app that offers actively managed crypto and stock investment strategies plus self-directed investing.

PROS

Low Investment Minimum

Professionally Managed Crypto Portfolio

0% commission on stock trades

An extensive number of crypto offerings

CONS

Limited Track Record

Somewhat high fees

At A Glance:

| About: | Domain Money is a newly launched investment app that offers actively managed crypto and stock investment strategies plus self-directed investing |

| Minimum Investment: | $100 – $500, depending on the strategy |

| Fees: | 1%, assessed monthly, no performance or lock-up fees |

| Investment Options: | 5 actively managed crypto and stock investment strategies and self-directed trading. Various levels of crypto and stock exposure, depending on your risk tolerance. |

| Domain Edge: | 100% Crypto |

| Domain Metaverse: | Capitalize on Metaverse |

| Domain Balanced: | 50% Crypto, 50% Stock |

| Domain Access: | 80% Stocks, 20% Crypto |

| Trading Platform: | 49 cryptocurrencies and 4,000 stocks and ETFs are available for trading. 0% transaction fees for stocks and ETFs |

| Other Fees: | Strategies with cryptocurrencies may also incur back-end service provider fees at execution. |

| Coming Soon: | Domain plans to release a cryptocurrency rewards credit cards, portfolio borrowing, and the ability to earn interest on crypto held at Domain |

What Is Domain Money?

Domain Money is a newly launched investment app that offers actively managed investment strategies that consist of various levels of crypto and stock exposure plus self-directed investing capabilities.

The company will soon launch a cryptocurrency rewards credit card and margin borrowing capabilities that allow individuals to borrow up to 40% of their portfolio.

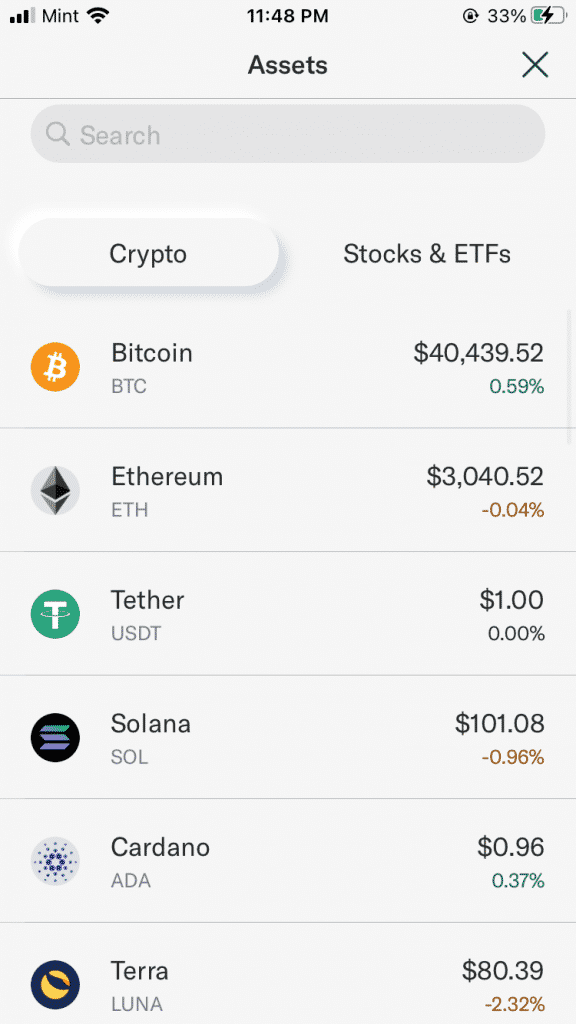

Domain’s self-directed trading platform features include 49 cryptocurrencies and more than 4,000 stocks and exchange-traded funds. Cryptocurrencies include Ethereum, bitcoins (BTC), bitcoin cash, and bitcoins tela.

The Domain Money team was founded by Adam Dell, who was most recently a Partner and Head of Product at Marcus by Goldman Sachs. Before Goldman, Adam founded and sold four companies. The rest of the Domain team comprises industry professionals who worked for Goldman Sachs, Morgan Stanley, Bridgewater Advisory Group, and many others.

Who Should Use Domain Money?

Domain Money Is Good For…

Aggressive Investors…

Interested in aggressive investment strategies across both stocks and crypto-assets.

Or having self-directed investing and professionally managed portfolios in one place.

Domain Money Is Not Good For…

Conservative Investors…

While the domain gives the user a degree of control over risk within a portfolio, its strategies are certainly not for the risk-averse.

Why Invest In Cryptocurrencies?

Over the next decade, investing in innovation areas like financial technology, blockchain, the Metaverse, cloud computing, big data, artificial intelligence, autonomous technologies, and the continued digitization of the economy have the potential to provide customers with superior investment returns.

Blockchain technology will transform the basic fabric of the financial system, and a carefully curated basket of cryptocurrencies is the best way to get exposure to this area of development.

According to Domain, their models estimate that blockchain technology is potentially a $10T-$100T investment opportunity over the next decade and that this value will primarily accrue to cryptocurrencies.

Actively Managed Crypto & Stock Portfolios

Domain Money’s investment strategies consist of five actively managed portfolios managed by a team of dedicated investment professionals.

The portfolios provide investors with various mixes of stock and crypto exposure, from 100% crypto to 100% stocks. Domain Money’s portfolios allow for multiple buys per day but only one sell.

*It’s also important to note that the performance listed on Domain’s site is hypothetical back-tested performance based on one or more Domain Money strategies from 3/31/21 to 3/31/22. Past performance or hypothetical performance does not guarantee future results.

Let’s look at each portfolio in detail.

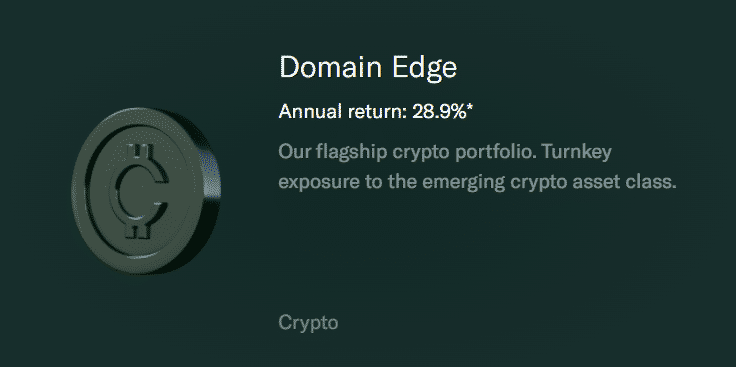

Domain Edge

Domain Edge is the company’s most aggressive strategy and consists of 100% cryptocurrency. This strategy is ideal for investors looking for broad exposure to cryptocurrencies. Since this strategy is crypto-only, you can trade 24/7/365.

Strategy: 100% Crypto

Investment Criteria: Established and emerging cryptocurrencies with >$500 million market cap, High, Quality Projects: Material product-market fit, defensible market share, robust developer community

Minimum Investment Amount: $100

Number of Holdings: 10 – 20 cryptocurrencies

Largest Holdings: Ethereum, Bitcoin, Terra, Polygon, Fantom

Domain Metaverse

The Metaverse strategy focuses on providing exposure to companies and decentralized protocols, tools, and platforms that support the NFT-powered Metaverse.

The concept of the Metaverse has exploded into popularity recently, and this strategy makes it incredibly easy to gain exposure to an actively managed portfolio focusing on the Metaverse without doing any legwork on your side.

Strategy: Crypto and securities

Investment Criteria: Mid and Large Cap Stock with greater than $2 billion market cap. Mid and Large Cap Crypto with greater than $500 million market cap.

Minimum Investment Amount: $500

Number of Holdings: 20-40 stocks and cryptocurrencies

Largest Holdings:

Cryptos: Ethereum, Polygon, Audius

Stocks: NVIDIA, Meta Platforms

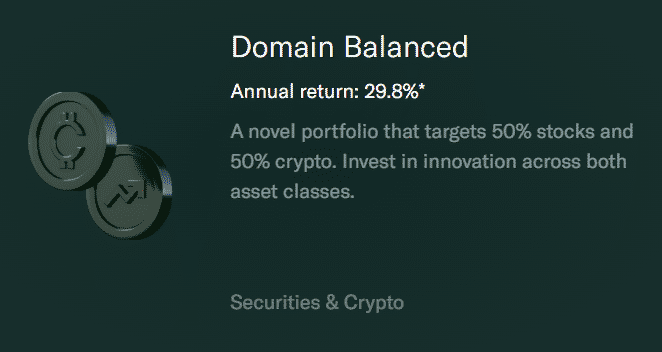

Domain Balanced

The strategy consists of 50% cryptocurrencies and 50% stocks. This strategy is ideal for investors looking for stable growth while maintaining considerable exposure to cryptocurrencies.

Investment Criteria: Mid and Large Cap Stock with greater than $2 billion market cap. Mid and Large Cap Crypto with greater than $500 million market cap.

Strategy: 50% crypto and 50% securities

Minimum Investment Amount: $500s

Number of Holdings: 20 – 40 stocks, 10 – 20 cryptocurrencies.

Largest Holdings:

Crypto: Ethereum, Bitcoin, Terra

Stocks: Microsoft, Apple, Amazon

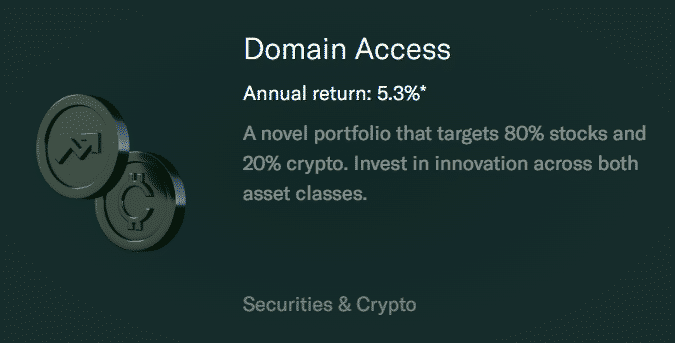

Domain Access

This strategy consists of 80% stocks and 20% percent cryptocurrencies. Investing in this strategy is ideal for individuals looking for stable growth and moderate exposure to cryptocurrencies.

Strategy: 80% stocks and 20% cryptocurrencies

Investment Criteria: Mid and Large Cap Stock with greater than $2 billion market cap. Mid and Large Cap Crypto with greater than $500 million market cap.

Minimum Investment Amount: $500

Largest Holdings:

Crypto: Ethereum, Bitcoin, Terra

Stocks: Microsoft, Apple, Amazon

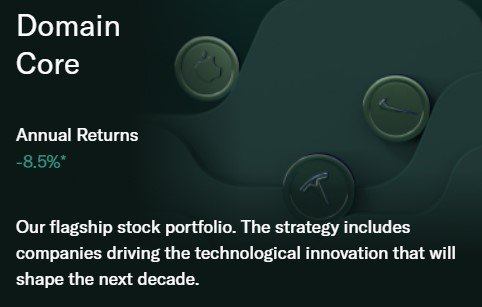

Domain Core

This strategy consists of 100% stocks and is Domain’s most conservative strategy. This portfolio is ideal for investors looking for growth above the S&P 500 Index returns.

Strategy: 100% stocks

Investment Criteria: Mid and large-cap U.S. companies with meaningful growth prospects, strong business franchises, and durable competitive advantages.

Minimum Investment Amount: $500

Largest Holding: Apple, Microsoft, Amazon, Alphabet Class A, Meta Platforms, Goldman Sachs Group

Self Directed Trading Platform Explained

In addition to Domain’s managed funds, Domain Money customers also can trade stocks, ETFs, and cryptocurrencies through the Domain app.

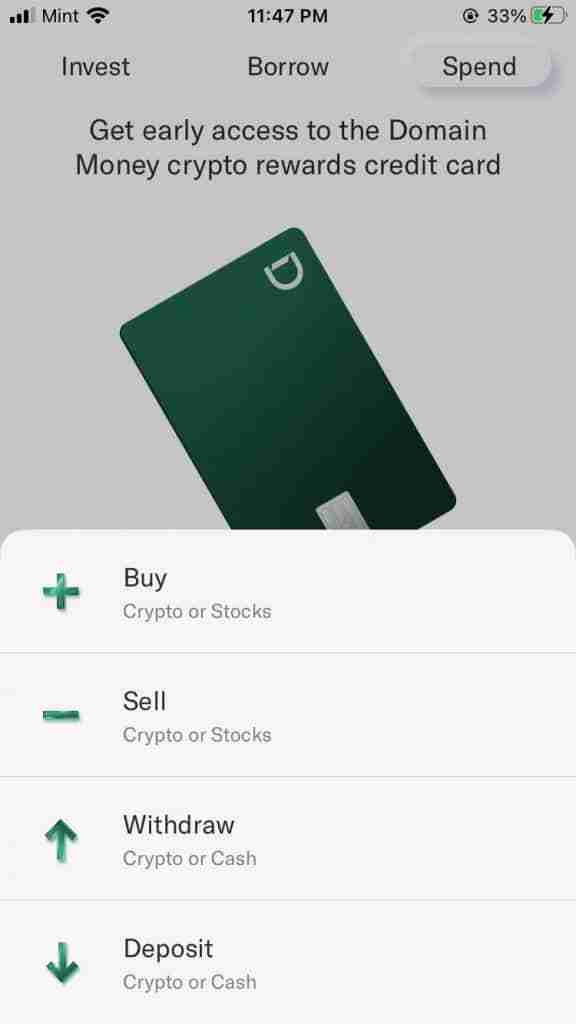

The self-directed platform is straightforward to use. Once you set up your account, you go to the investment option, and there are 4 clear buttons: Buy/Sell Crypto or Stock and Withdraw/Deposit Cash/Crypto.

From there, Domain shows a list of popular cryptocurrencies and stocks available for trading

Cryptocurrency Trading

Their self-directed trading platform offers 49 cryptocurrencies and the ability to transfer to Domain-supported assets such as Bitcoin, Bitcoin Cash, Ethereum, and Litecoin, to name a few. Domain charges a crypto transaction fee: of 1.49%

Signal

An interesting feature offered by Domain is Signal. Signal allows you to get expert ratings, social media sentiment, key financial metrics, and relevant news at your fingertips. This feature is only available for cryptocurrencies.

Let’s look at the key features of Signal:

Social Sentiment

- This asset has the largest increase in positive sentiment on social media, week over week.

Trading Activity

- This asset has had the largest increase in trade volume over the past two days.

Project Development

- This asset has the largest increase in development activity, week over week.

Additional Features

Domain Spending

Domain plans to release cryptocurrency rewards credit cards for their customers. While little has been released regarding their credit card, we know that Domain Money offers crypto rewards to you that can be used to invest in crypto. The card will sync with your Domain Money account to make spending seamless.

Domain Borrowing

Domain Money’s margins programs are a yet-to-be-released feature. The Borrowing option will allow for borrowing of up to 40% of their portfolio assets at 7% APR.

Domain Earn

Domain Money will allow eligible customers to earn interest on crypto held at Domain Money, whether purchased using Domain Money or transferred in.

Fees and commissions

The Domain Money platform allows its customers to trade stocks with zero commission. However, cryptocurrencies have a 1.49% transaction fee.

In addition, the company has a 1% annual management fee if you invest in one of Domain’s actively managed strategies. The fee is assessed at the beginning of each month and is calculated using your average balance from the previous month.

Annual Management Fee: 1% for actively managed portfolios

Back-End Fees: Strategies with cryptocurrencies may also incur back-end service provider fees at execution.

Crypto Transaction Fee: 1.49%

Performance Fee: None

Stock Commission: None

Is Domain Money Safe?

Domain money has end-to-end encryption and a cold-storage vault.

- End-to-end encryption: Domain encrypts your information end-to-end and stores your data with AES-256 encryption. Plus, industry-leading protocols and authentication ensure you can keep your money, account data, and investments safe.

- Cold-storage vault: Domain’s partner holds most of your crypto in an offline, air-gapped Cold Storage system. A small number of your assets are stored in a Hot Wallet, which their partners insure.

- SIPC Insurance: Coverage up to $500,000 for cash and securities. Remember, digital assets are not subject to any protections.

Sign-Up Process

Domain Money is a mobile-first platform, so you don’t have the option to sign-up through a desktop.

The sign-up process was straightforward, and I was ready to start trading in minutes. They ask you basic questions in-line with other brokers, so nothing special.

Once I signed up, I could easily navigate the mobile app. It’s incredibly user-friendly and makes for a seamless investing process.

Alternatives To Domain Money

Domain Money launched its investment platform with 47 cryptocurrency currencies and 5 actively managed strategies. While it’s not as big as Coinbase or Gemini in terms of its coin offering, it’s still bigger than other competitors, such as Webull, which has less than 30 cryptocurrencies on its platform.

Domain money customers also can invest in professionally managed portfolios, a feature not available at Coinbase or Gemini.

Domain Money charges a 1.49% fee per transaction, per sale. This is on the higher end for investing large amounts, but on the lower end for smaller amounts – thus making it ideal for beginner crypto trading enthusiasts.

Coinbase and Gemini usually have flat trade rates between $1 and $2, with 2% percentage fees.

Domain Money vs. Titan Invest

| Feature |  |  |

|---|---|---|

| Overall Rating | ||

| Actively Managed Portfolios | ||

| Number of Crypto Portfolios | 4 | 1 |

| Self-directed Investing | ||

| Retirement Account Investing | ||

| Fees | 1% | 1% |

Titan invest offers investment options very similar to Domain Money. Domain Money and Titan are asset management firms offering cryptocurrencies and equities. However, Domain focuses more on crypto, and Titan focuses more on equities.

To find out more about Titan, read our Titan Invest review.

The most significant difference between the platforms is that Domain Money offers self-directed investing and professional investment strategies. Titan only gives investors access to an investment platform that contains four equity and one crypto fund with no self-directed investment options. However, Titan allows customers to invest via an IRA, a feature not available at Domain Money.

Also, in a market downturn, Titan provides a dynamic market hedge for its equity strategies to mitigate downside risk, a feature not available at Domain Money.

That said, Domain offers more features on its platform and therefore better for most investors.

Is Domain Money Worth It?

Domain Money is changing the investing game across stocks and crypto.

Their integrated platform provides users with an easier way of managing their money for digital assets and, stocks & ETFs.

While their portfolio strategies have yet to be proven, Domain is one of the few companies offering professionally managed crypto strategies.

The company charges a 1% management fee but offers no investment advice. While this fee is on par with its closest competitor, Titan Invest, Titan provides a more hands-on approach and insight into its investment approach.

If you invest in a mainly crypto strategy, I think it is worth it. But, if you are thinking about the 100% stock portfolio, you would be better off investing in an index fund like VOO or SPY for a fraction of the management fee.

However, if you want to get exposure to the digital asset and equity markets simultaneously, not shying away from taking some risk, then Domain Money could be right for you.