Quick Summary:

DiversyFund is a real estate crowdfunding platform that invests in multifamily real estate through a non-traded REIT (Real Estate Investment Trust).

Overall Rating:

PROS

Low $500 minimum investment

Fund managers have skin in the game

Preferred Equity Investment

CONS

Limited investment options

Complicated fee structure

At A Glance:

- Minimum Investment: $500

- Targeted IRR: 10 -20%

- Fees: 2% Asset Management Fee + other fees

- Investment Type: Multi-family real estate Public Non-Traded REIT

- Type of Investment: Preferred Equity

- Open To: Accredited and non-accredited investors

- Investment Strategy: Value-add through renovations and natural appreciation

- Liquidity Options: None. You cannot sell your shares back early

- Investment Length: 5-year lock-up

- Types of Accounts: Individual, Joint, Trust, Entity

- In-house property management: Yes

Who Should Invest With DiversyFund?

DiversyFund is a good option if…

You are Interested in capital appreciation and are comfortable locking up your money for 5 years.

DiversyFund is not a good option if…

You are looking for passive income. Dividends are automatically reinvested. All profits are made when the investment property is sold.

What is DiversyFund?

DiversyFund is a real estate crowdfunding platform that invests in multifamily real estate through a non-Ttraded REIT (Real Estate Investment Trust). The REIT currently manages 12 multifamily assets across 6 states with a current market value of $175 million.

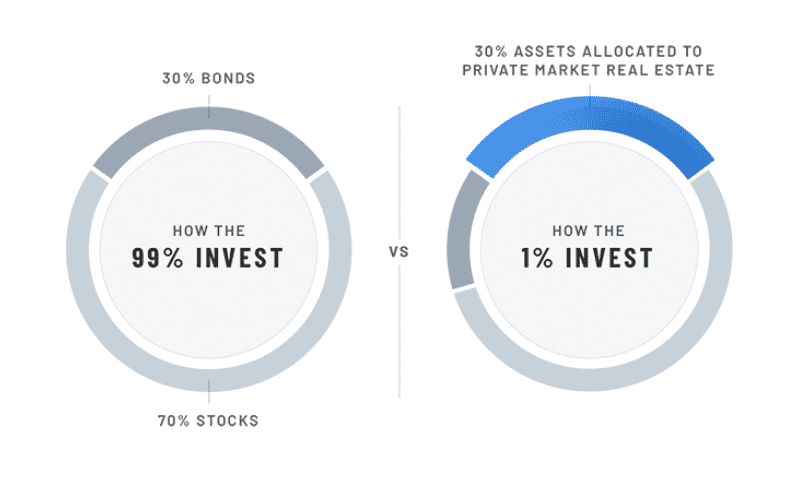

DiversyFund’s goal is to make real estate investing available to all investors, not just the ultra-wealthy. DiversyFund is open to accredited and non-accredited investors with a minimum investment of $500.

Founded in 2016 by Craig Cecilio and Alan Lewis, the DiversyFund platform boasts 28,000 investors and is headquartered in beautiful San Diego, California.

Investment Options Explained

Overview: Diversy Growth REIT II is the company’s only investment option. This REIT invests in multifamily apartments and creates value through a value-add strategy method.

After properties are acquired, renovations are performed to increase value, which, in turn, allows for increased rents.

Type of Investment: Preferred Equity. Preferred Equity is less risky than common equity but riskier than Mezzanine Debt.

DiversyFund investments are qualified as a preferred equity class of shares in the Capital Stack. This means preferred equity investors are given preference relative to common equity investors as it relates to cash flow distribution.

In the case of DiversyFund, it is split into 2 parts. First, investors first receive a 7% return on their investment, then the sponsor is entitled to a ‘catch-up’ return of 53.85% of the preferred returns, secondly, Diversyfund receives 35% of the remaining profits, and investors receive 65%.

Offering: Growth REIT II: Public Non-Traded REIT (Real Estate Investment Trust)

IRR: Targeting between 10% and 20% return rate for each property

Minimum Investment: $500

Targeted Loan to Cost: 65% – 75%. This means DiversyFund will finance 35 – 25% of the properties. In general, the lower the LTC, the less risky the project is deemed.

Investment Strategy: Value-add

Investment Timeline: 5 Years

Early Withdraws: No

Dividends: Monthly, but they are reinvested automatically to fund renovations

Own and Manage All Their Properties: Many real estate crowdfunding platforms serve as a middleman, commonly referred to as the sponsor of the deal; connecting investors with developers. DiversyFund manages the entire process in-house. For some investors, this can provide peace of mind, and illustrates the company is well-positioned and manage an end-to-end real investing deal.

Investment Target Details:

- Type: multifamily real estate (apartment buildings only)

- Size: 100+ units

- Markets: across the US

What Kind of Returns Can I Expect?

DiversyFund targets an Internal Rate of Return of 10% – 20%. Investors make money from dividends and asset appreciation. All dividends are reinvested and returns are not realized until assets are sold, which is approximately 5 years after the asset is purchased.

Dividends:

Investors receive a dividend every month from the rent collected. The dividend is automatically reinvested in order to fund the renovation of the properties.

Reinvesting is part of the fund’s growth strategy as it also allows investors to take advantage of compounding interest.

Asset Appreciation:

Assets appreciate in value as they are renovated because the properties provide additional value-add to tenants in the form of enhanced amenities. Real estate also naturally appreciates over time.

Appreciation represents a far more substantial portion of the investor’s return compared to dividends from rents. The appreciation is realized upon the sale of the assets when the fund reaches its term.

Investors receive any profits from the sale when the assets are sold.

Performance

DiversyFund targets an Internal Rate of Return (IRR) of 10% – 20%. Given investments in DiversyFund are considered Preferred Equity, these targeted returns are in-line with industry standards for preferred equity investments. However, there is no guarantee that DiversyFund will hit these targets.

There is limited data on DiversyFund given its REIT is only a few years old and the fund does not realize returns until approximately 5 years after an asset is purchased. DiversyFund lists returns of prior projects, but this is before the Growth REIT was launched.

- 2017: Average annualized returns of 18%.

- 2018: Average annualized returns of 17.3%

- In 2019, REIT investors saw a 5% dividend yield and DiversyFund expects this to increase as they finalize the renovation process and increase rents.

- Returns come from both dividends and appreciation realized at the time of sale.

Past performance does not guarantee future results.

Investing Strategy Explained

The DiversyFund Growth REIT II is a non-traded REIT designed to build wealth by investing in multifamily real estate using a value-add strategy over approximately 5 years.

The REIT acquires properties in areas with strong job and population growth, and vacancy rates below the national average.

- Acquisition Stage: The REIT uses the capital raised to acquire multifamily properties with approximately 150+ apartments.

- Renovation Stage: Individual units and common areas are renovated. Cash flow from the properties to fund the renovations over a period of time.

- Stabilize & Hold Stage: When the renovations are completed, the value-added means increased rents and stabilization for the property. The assets are held for several years allowing the property to naturally appreciate.

- Liquidation/Disposition Stage: The properties are appreciated naturally and through the value-added via the renovations. Properties are sold and all assets are liquidated and the investor receives their profits.

The easiest way to think of this strategy is someone who buys a run-down rental property, renovates, holds it for a few years, and then sells the property for a tidy profit.

How Do I Open An Account?

There is a 3-step account opening process with DiversyFund. It takes about 5-8 days for your account to fully open.

1. Creating an Account

Create a free account by clicking here. You’ll need to provide your name, email address, zip code, and phone number, and create a password.

2. Processing an Investment

Once you create your account, you can invest in the REIT.

You’ll need to provide your full legal name, a street address, and your SSN or Tax-ID number. As an investor, the Securities and Exchange Commission (SEC) requires that Diversyfund collects this information

Account Ownership

In Step 2 of the investment process, you can select the Form of Ownership. There are four options.

- Individual: Select this option if you are the sole investor.

- Joint: Select this option if this is a joint investment with your spouse or other.

- Entity: Select this option when investing via a company such as an LLC

- Trust: Select this option when investing via a trust

3. Escrow Period

When investing, the funds are held in escrow for approximately 5–8 business days to ensure Know-Your-Customer (KYC) and Anti Money Laundering (AML) compliance on all transactions. This is required to comply with US Regulations.

Their escrow service will occasionally request certain documentation such as proof of address, driver’s license, passport, or other to verify the owner of the investment.

Fees Explained

Most real estate crowdfunding platforms bury their fees in their offering circular, so I can appreciate DiversyFund laying them out clearly.

Platform Costs and Fund Fees

- Fund Asset Management Fee. 2% of the investment amount

- Offering and Organization Expense Reimbursement. These expenses are capped at 10% of equity dollars.

Real Estate Sponsor Fees

When the REIT II acquires property for its investors, fees are charged at the property level:

- Acquisition Fee – 1-4% of the total cost of a real estate asset

- Finance Fee – 1% of any loan amount used to acquire a property

- Disposition Fee – 1% of the total sales price of any property

- Construction Management Fee – 7.5% of construction costs for property renovations

- Guaranty Fees – 0.5% of any property loan amount payable to any affiliate required to guaranty the loan.

What Is A REIT, Anyway?

Real Estate Investment Trust. The term REIT is a tax concept. As long as a company satisfies a long list of requirements set forth by the IRS, it can qualify as a REIT. Many real estate crowdfunding platforms structure their company as a REIT.

Requirements to qualify as a REIT include:

● The kinds of assets it owns

● The kind of income it generates

● Who owns it

● How much of its income it distributes to its owners

Some REITs are public and some REITs are private. REITs can invest in multiple classes of real estate or just one class of real estate, for example, mortgages. The most well-known requirement for REITs is that they are required to distribute 90% of their income to their investors.

There are several tax advantages of qualifying as REIT, mainly avoiding double taxation: once at the corporate level and then at the individual level – that’s why the REIT distributes 90% of its income to the owners.

Who can use DiversyFund?

DiversyFund is open to investments from non-accredited and accredited investors who reside in the U.S. and are at least 18 years old.

Is DiversyFund Legit?

Yes. DiversyFund is legit.

- Annual audit by a 3rd party CPA firm

- SEC qualified in November 2018

Alternatives To DiversyFund

| Features |  |  |  |

|---|---|---|---|

| Minimum Investment | $500 | $10 | $10 |

| Fees | 2% | None | 1% |

| Property Types | Multi-family | Residential | Varies |

| Open To All Investors? | |||

| Retirement Account Investing? | |||

| Current Promotions | None | None | $25 – 50 in shares per referral |

Is DiversyFund Worth It?

DiversyFund is targeting a very specific audience with a value-add investment strategy and with no early redemption options. If you are serious about real estate investing, then DiversyFund is a good option.

However, individuals who are not familiar with real estate investing may not fully grasp why there are no liquidity options or yearly returns, which can be a bit concerning for some people.

While DiversyFund is open to non-accredited investors, a company like Fundrise offers more user-friendly features and is likely a better option for most investors.