Vint is a fine wine investing platform that allows individuals to buy shares of SEC-qualified collections of wine.

Quick Summary:

Vint is a wine-investing platform that allows individuals to invest in shares of wine backed by physical bottles for just $25.

Overall Rating:

PROS

$25 minimum investment

Open to non-accredited investors

New collections every two weeks

CONS

No secondary market

What is Vint?

Vint is a one-of-a-kind wine investing platform that offers fractional ownership of fine wine collections through SEC-qualified shares.

This wine-investing platform was founded in 2019 by Nick King out of Richmond, Virginia.

Since its inception, the Vint platform has closed over $3mm worth of SEC-qualified offerings across 4,100 bottles and over 30 collections.

How Does Investing With Vint Work?

Investing with Vint is a 5 stage process, starting with initial research and thesis development to holding & exiting the investment.

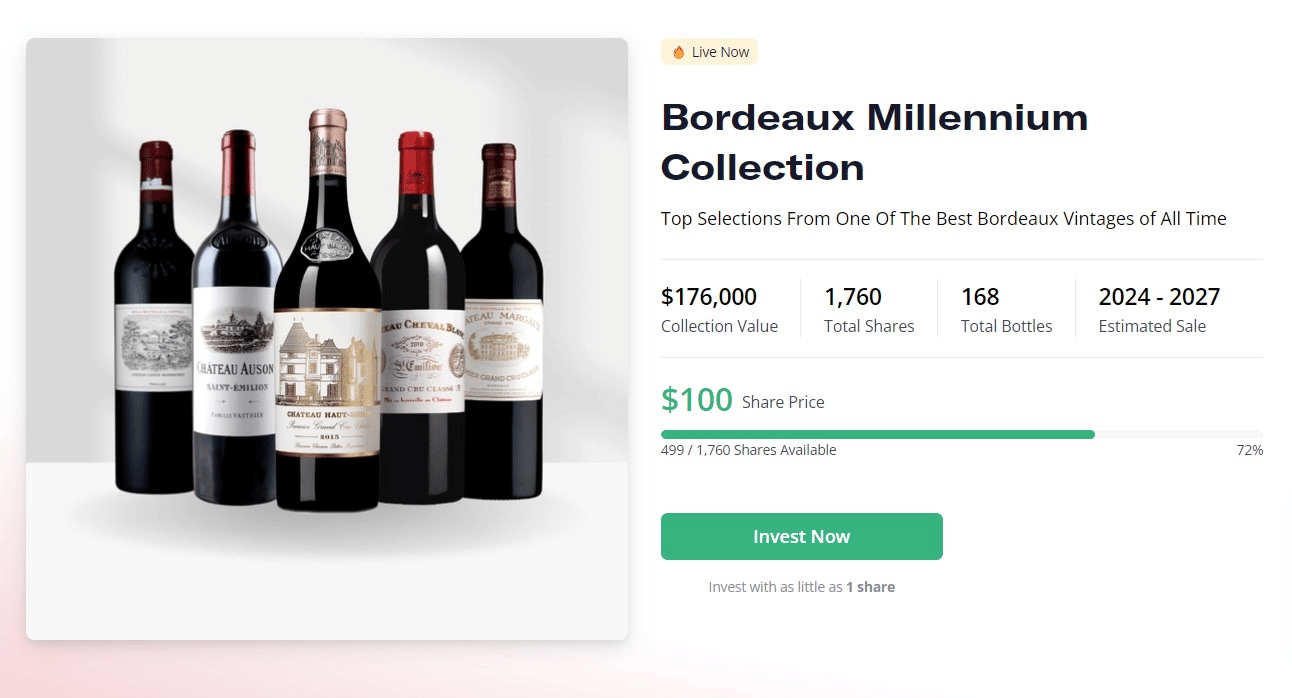

Collections will vary by size, theme, and even type of asset.

1. Market Research & Collection Building

Vint leverages extensive market research and analysis to develop an investment thesis before collection building. Investment theses are available for each live collection to help investors decide if the latest wine collection is right for them.

2. SEC Qualification

Vint files paperwork with the SEC to qualify the collections before going live on their site.Vint determines each collection’s share price before launching, which is the purchase cost of the wine and adds a sourcing fee of (8-10%).

3. Collection Goes Live For Investors

Once a group is filed and approved by the SEC, the collection goes live on the Vint site, and investors can start purchasing shares.Vint provides potential investors with extensive research and historical price data for each collection. They also offer commentary on why this collection was picked for investors.If investors decide to purchase shares, they can link their bank or Alto IRA account and select the number of shares they would like to purchase.

4. Holding & Selling

Like real estate and other alternative investments, wine and spirits are medium to long-term investments with a 3 – 7 year holding period. Each collection will have an expected sale date, but they are estimates, and the actual sale may occur before or after that date.Vint is always watching the wine markets and constantly communicates with partners and potential buyers so they can execute at the best price for their investors.

5. Proceeds Returned to Investors

When a collection sells, Vint returns 100% of the profits to shareholders on a pro-rata basis, and investors receive a 1099-DIV tax form.

Historical Performance

Suitable wine investments have a medium to long-term holding period between 3 and 7 years. And considering that Vint was founded in 2019, there is no historical performance data as a reference.

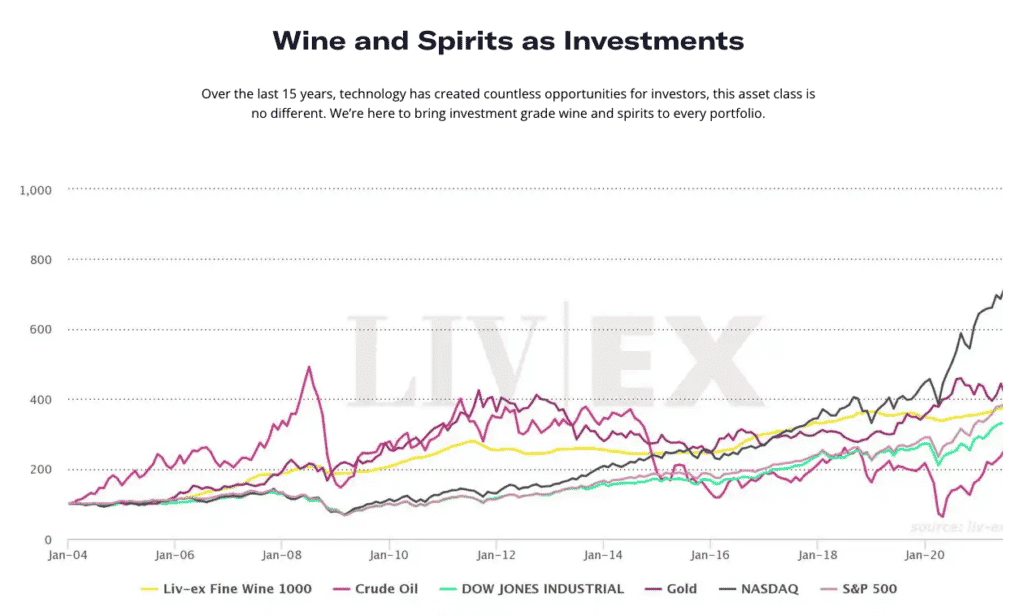

However, wine, in general, outperforms stocks making wine investing an increasingly popular alternative investment.

In 2022, Liv-ex 1000, a composite of the most widely traded investment-grade wines, is almost reaching double-digit returns in 2022, while the S&P 500 is down double digits returns in 2022.

Historically Strong Returns. Over 121 years, fine wine has returned 8.5% annually. The fine wine and market provide consistent returns on par with most notable indexes, like the S&P 500.

Lower Volatility. When the economy crashed in 2008, the S&P dropped 38% while the Liv-Ex 1000 fell less than 1%, making fine wines an excellent way to reduce volatility in your investment portfolio.

Non-Correlated Returns. Fine wine investing offers a unique opportunity to invest in an asset class that historically has non-correlated returns with the overall market. Historical performance indicates that wine has a 0.12 correlation to traditional markets.

How Does Vint Stand Out?

In the relatively obscure market of alternative investments, Vint stands out from the crowd by offering low minimum investments, no ongoing fees, SEC-qualified shares, and by showing faith in its investment theses by purchasing the wine it sells to investors.

Low Minimum Investment & No Ongoing Fees

You can start investing with Vint with a minimum investment of just $25, unlike other wine platforms with minimum investments starting at $1,000.

When you invest with Vint, there are no ongoing maintenance or account fees. Instead, Vint adds an 8 – 10% sourcing fee to the purchase price of the wine collection, that’s it.

SEC Qualified Securities

Vint is the only SEC-qualified platform that focuses on wine & spirits investing. An SEC-qualified offering circular supports each offering.

You can read their offering on the United States Securities and Exchange Commission website.

Skin-In-The Game

To align itself with the best interests of its investors and as a source of revenue for the company, Vint purchases 0.50% – 10% of each wine collection.

Open To All Investors

Other alternative investment platforms are only open to accredited investors or have a high minimum investment, making their investment opportunities out of reach for many investors.

Vint is open to all investors, non-accredited investors, and accredited investors.

New Collections Every 2 Weeks

Vint aims to offer new collections every 2 weeks. Each new collection varies in value, shares available, and price, which can range from $25 – 100, depending on the collection.

Each new collection provides key highlights and a collection description to help you choose.

What Vint Could Improve?

No Secondary Market

Unlike other wine investing platforms, selling your shares back to Vint or in a secondary market is not an option.

However, Vint has indicated they intend to build a secondary market for Vint shares.

How Do I Open An Account?

Opening an account with Vint is easy.

Just enter your name, address, email, phone number, and social security number. Thereafter, you will be required to perform standard KYC checks to verify your identity and AML checks completed by Vint’s vendor.

Note, you can only open an account with Vint if you are based in the U.S.

Alternatives to Vint

Vinovest

Vinovest is Vint’s closest competitor. Unlike Vint, when investing through Vinovest, you purchase physical bottles of wine instead of shares backed by wine.

Vinovest has a minimum investment of $1,000, while Vint has a minimum of just $25. However, Vinovest charges an annual fee of 2.85% for its lowest tier account compared to an 8 – 10% sourcing fee for Vint. It’s unclear if Vinovest also charges a sourcing fee.

Neither wine investment platform requires you to be an accredited investor to start investing in wine wines.

Unlike Vint, Vinovest does offer a secondary marketplace for wine investors if you want to sell your investment early.

Cult Wines

The biggest and oldest player in wine investing is London-based Cult Wines. This wine investment platform has been around since 2007 and has $320 million in wine assets.

The company traditionally focused on European markets and only recently started focusing on American markets, with offices now in New York City.

Cult Wine has a minimum investment of $10,000 for its lowest investment tier, with fees starting at 2.95%.

The Bottom Line

Diversification is key to a well-balanced investment portfolio. Wine investing is an interesting topic, and the proliferation of alternative asset investing has become more common among everyday investors.

With a minimum investment of $25, you don’t have to put serious capital at risk to start investing, but I wouldn’t empty my 401K and invest it all in wine.

However, at the level at which the wine market and alternative investing have matured is astounding.

According to Grandview Research, the global wine market is expected to reach nearly $500 billion and grow at a 6.5% Compounded Annual Growth Rate.

These numbers highlight the global demand for wine and the economies of scale it has achieved, making it truly a global commodity.

Frequently Asked Questions

Couldn’t I Just Buy The Wine Myself?

Vint removes the hassle of investing in physical bottles of wine. Vint brings value to users by handling sourcing, transportation, insurance, storage, and sale.

All you have to do is invest & monitor your portfolio.

Vint’s sourcing channels & expert investment committee allow Vint to source wines with attractive investment characteristics at advantageous prices.

Do I have to pay taxes on my wine investments?

Yes. After an investment is sold, each investor will receive a 1099-DIV on a pro-rata basis.

How Is The Wine Kept Safe?

All wine is insured and held safely at one of Vint’s storage partners’ climate-controlled professional storage facilities, where they are monitored, insured, and kept in pristine condition. Vint’s storage partners include Domaine & Octavian.

How Does Vint Assure The Wine is Authentic?

Vint works with its sourcing partners to ensure the provenance of each bottle in a collection. Their sourcing partners are well-vetted industry experts with a long track record in the wine industry.

Is Vint Legit?

Yes, Vint is legit. Vint is qualified under Reg A+ of the JOBS Act. You can view their SEC-qualified offering documents.