Yieldstreet is an alternative investing platform unlocking access to private markets… Allowing individuals to invest in assets such as art, maritime, private credit, and real estate.

Quick Summary:

YieldStreet is a platform that connects investors with alternative investment opportunities such as real estate, marine finance, and legal finance. These typically offer higher returns than traditional investments but also come with higher risks.

Overall Rating:

PROS

$25 minimum investment

Open to non-accredited investors

New collections every two weeks

CONS

Illiquidity

Alternatives have higher risk than traditional investments

At A Glance:

- Minimum Investment: $500

- Fees: 1 – 4% + annual flat expenses around $100 per year

- Investment Options: Real estate, Art, legal, private equity, private credit, Multifamily, Commercial REITs and funds, private equity

- Retirement account investing? Yes, in the Prism Fund

- Open To: Accredited & Non-Accredited Investors

- Liquidity Options? Yes, in the prism fund.

- Returns: 9.661IRR, net of fees since 2015.11.58% net of all fees across all clients since 2017

PROs and CONs

| PROS | CONS |

| Investments provide portfolio diversification | Most investments only open to accredited investors |

| Low stock market correlation | Limited liquidity options |

| Wide range of alternative assets | A high number of maritime investments defaults |

What is Yieldstreet?

Yieldstreet is a crowdfunding platform specializing in asset-backed alternative investments.

Alternative investments typically have less volatility and a low correlation to the stock market.

Yieldstreet primarily caters to accredited investors (individuals with an annual income above $200,000 or a networth above $1,000,000) who want to invest in alternative asset classes such as Art, Commercial, Consumer, Litigation Financing, Real Estate, and Corporate.

However, they do offer non-accredited investors investment opportunities through the Yieldstreet Prism Fund.

All of the loans on Yieldstreet’s platform are asset-based, meaning they are secured by collateral, providing a way to recoup your investment in the case of a default.

Founded in 2014 by Milind Mehere and Michael Weisz, a strong duo who collectively have extensive experience in entrepreneurship and alternative investing.

Since its inception, Yieldstreet has funded over $3.1 billion in investments and boasts over 400,000 registered users.

The company is headquartered in New York City.

How Does Investing with Yieldstreet Work?

To gain access to the majority of Yieldstreet investments, you are required to be an accredited investor; however, non-accredited investors have access to the Yieldstreet Prism Fund.

Once you open your Yieldstreet account, you can view all open and some recently closed investments.

Investment details include: the investment premise, expected returns, and fees, to name a few. You can also view metrics such as strategy, minimum investment, asset class, and if the investment is IRA eligible.

Investment Screening Process

To make it onto the Yieldstreet platform, investment opportunities must pass a rigorous screening process.

During due diligence, the investment team reviews and analyzes the investment opportunity. If it makes it through the investment team screening, it will then go to the investment committee for review.

The investment committee provides a review and challenge of the investment thesis in order to identify any overlooked risks.

Only after the asset passes through the investment committee is it open for investment on the Yieldstreet platform.

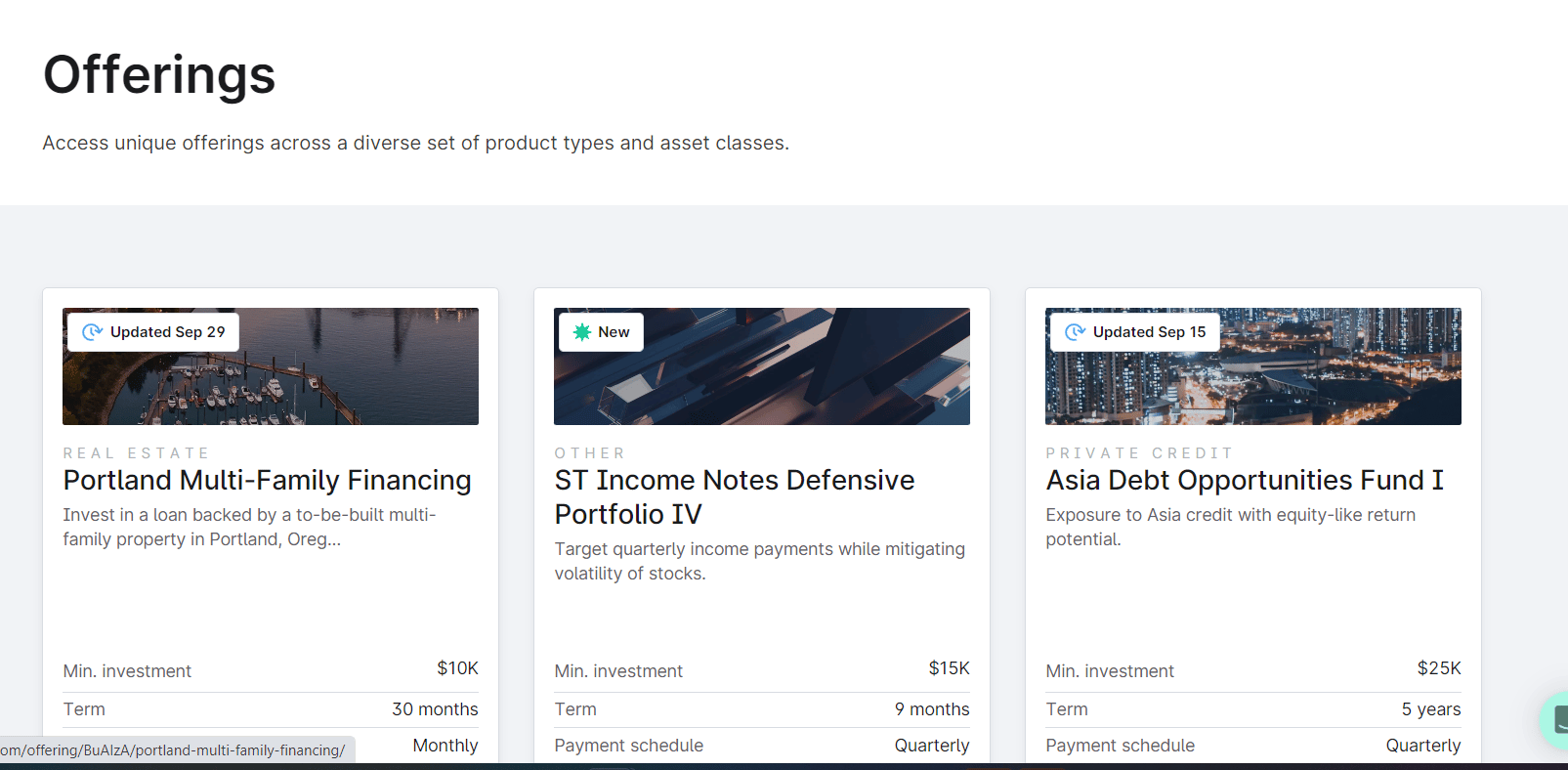

Investment Options

Yieldstreet offers 3 ways to invest in alternative assets:

1. Individual investments

2. The Yield Street Prism fund: an actively managed alternative fund

3. Short-Term notes

Investments focus on income generation, growth, or apply a balanced approach. Most investments are income-focused, while some real estate investments apply a blended approach.

Individual Investments

Individual investments have a minimum investment amount starting at $10,000 but can be as high as $50,000 for some offerings.

Individual offerings will list investment details such as minimum investment, term, interest rate, and investment premise.

Investment options include:

Private Credit

Litigation finance

Commercial real estate (Income and Growth)

Venture Capital

Art

Structured Notes

Supply chain financing

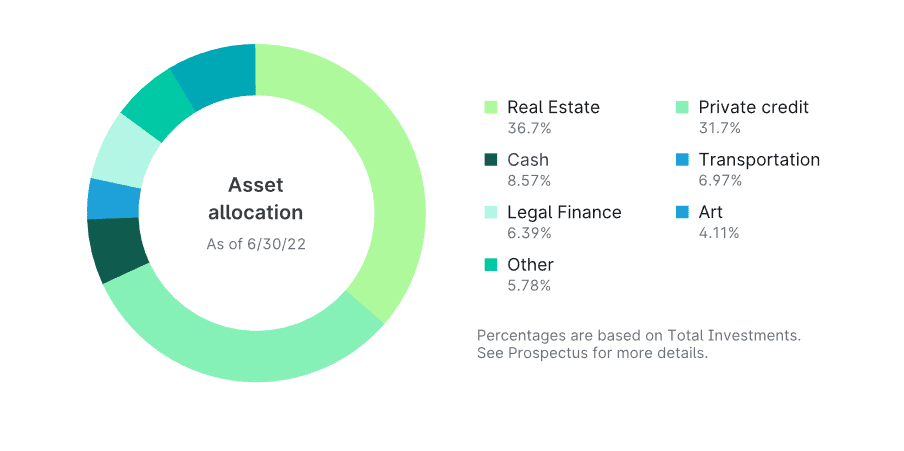

Prism Fund

The Yieldstreet Prism Fund is an actively managed investment fund that invests across 6 alternative asset classes. The fund provides quarterly distributions and liquidity options if you want to redeem your shares early.

There is a minimum investment of $2,500, and it is open to accredited and non-accredited investors.

The Prism Fund is an excellent way to get passive diversification across multiple alternative asset classes bundled into one fund.

The prism fund is ideal for investors who are unsure which alternative investment is best suited for their needs.

Prism Fund:

Minimum Investment: $2,500

Strategy: Actively managed alternative asset fund invested across 5 asset classes

Open To: All investors

Annual Management Fee: 1.5% of total assets invested. No load or redemption fees.

Distribution Rate: 8%

Distribution Frequency: Quarterly

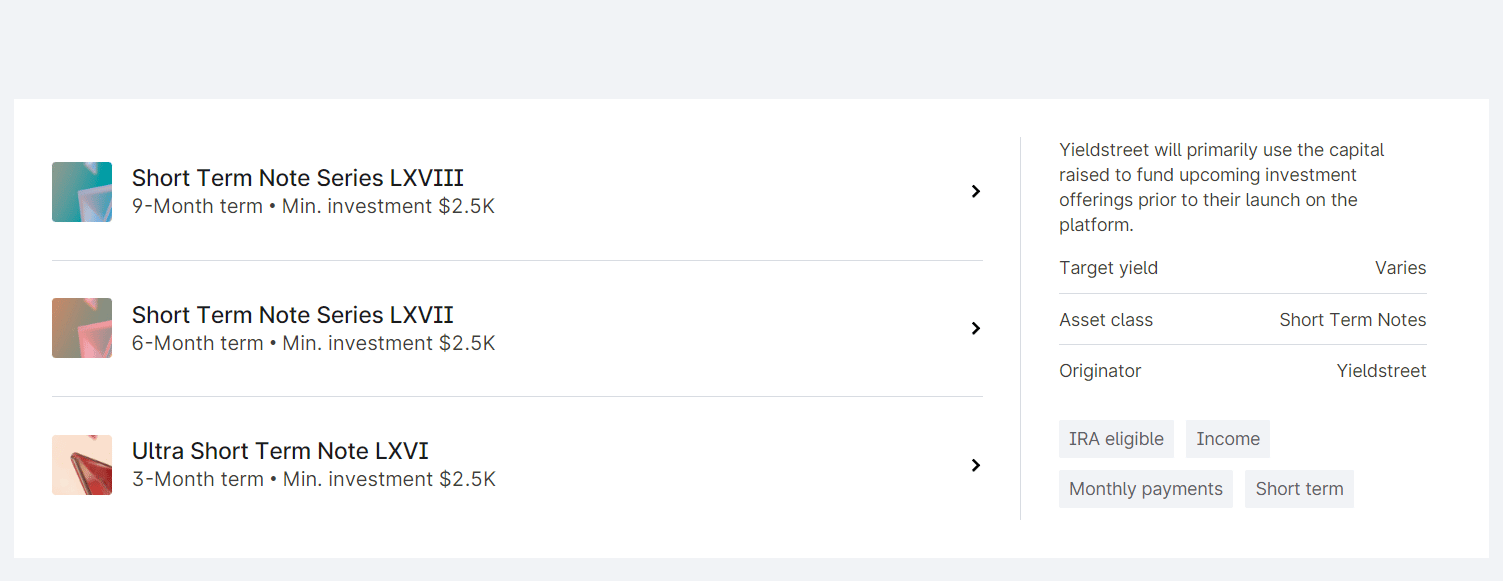

Short Term Notes

Short Term notes are one of Yieldstreet’s most popular investment options.

Short term notes are a way for companies to receive cash before a crowdfunded platform is fully subscribed (meaning the company successfully raised the required capital from investors).

Prefunding is quite common in real estate and alternative asset space.

Yieldstreet holds a first lien position in the notes. This means in the case of default, before an investment is fully subscribed, Yieldstreet will absorb up to the first 5% of the losses.

Yieldstreet’s Short Term notes provide accredited investors a way to earn a yield higher than you could in an FDIC checking account or CD.

It’s a good place to put cash while deciding where to invest your money next.

Short Term Notes:

Minimum Investment: $500

Duration: 2 – 9 months

Yield: Average 4.6%

Annual Management Fee: None

Open to: Accredited investors only

Short Term Notes have a minimum investment of $500, with a duration between 2 and 6 months, with an average yield of 4.6%. You must qualify as an accredited investor if you want to invest in short term notes.

Other companies that offer short term notes? Read in the case of default about Stairs by Groundfloor

Returns

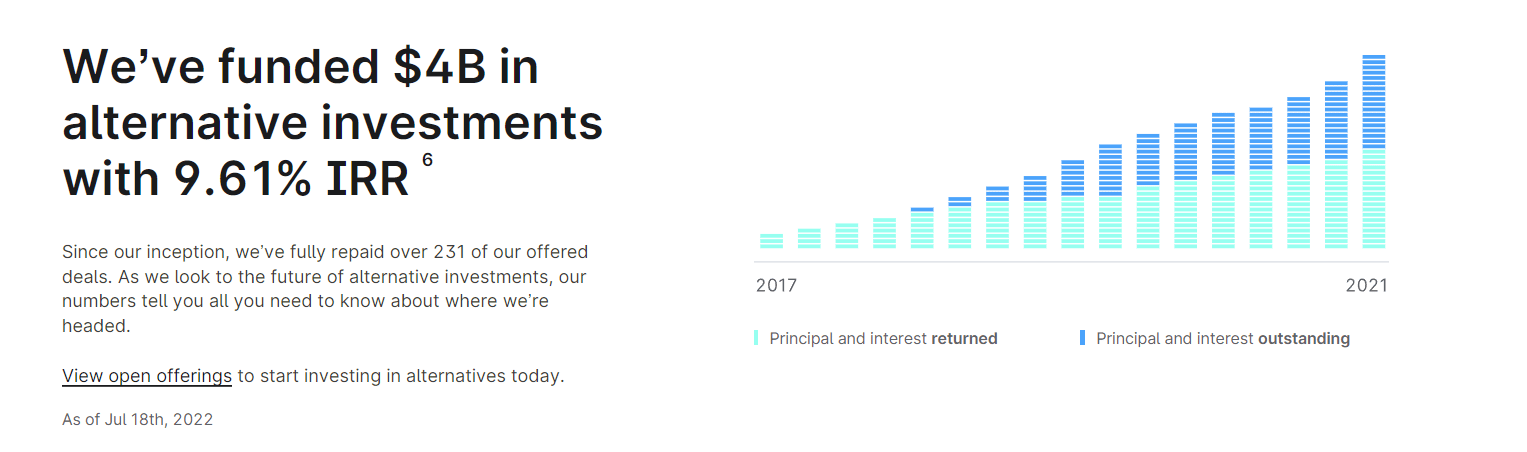

Yieldstreet returned 9.61% IRR Net Annualized Return across all asset classes, net of fees since 2015.

However, some of Yieldstreet’s other classes have performed historically better, like their legal investments.

Yieldstreet returns by asset class:

Art: 10%

Legal: 13%

Private Credit: 8%

Real Estate: 9%

Transportation: 9%

Short Term Notes: 4%

I will note starting around 2020, there have been numerous complaints about above-average defaults in Yieldstreet’s maritime financing investments.

While there has been no definitive outcome from these inquiries, I want my readers to be aware of this.

Fees

Yieldstreet charges a management fee between 1 – 4% for individual investments. There are no fees for short-term notes.

The fees charged by Yieldstreet are on-par with other private investment platforms.

All targeted returns listed by Yieldstreet are quoted net of listing and management fees, but not the flat rate annual expenses.

The flat rate annual expense fee is charged on each investment and is deducted from your first interest distribution; this fee varies per investment and is applicable for each investment.

There are no fees to sign-up for the Yieldstreet platform.

I wish Yieldstreet was clearer that the returns are net of management fees, but not the flat rate annual expenses. This is a little misleading and could easily confuse potential investors.

While it’s listed in the offering documents, I’m sure plenty of individuals overlook the flat rate expenses.

Fees: 1-4%, depending on the investment

Plus

Flat Rate annual Expense (varies, but I saw $100 – $150 for the first year, then $30 – $75 a year thereafter)

User Experience

Yieldstreet has a cutting-edge website and investment platform making it easy to sign-up, browse investments, and manage your portfolio.

Compared to other crowdfunding platforms, the Yieldstreet website is incredibly intuitive, modern, and easy to use.

Yieldstreet also has an app for download in the Apple App Store and Google Play.

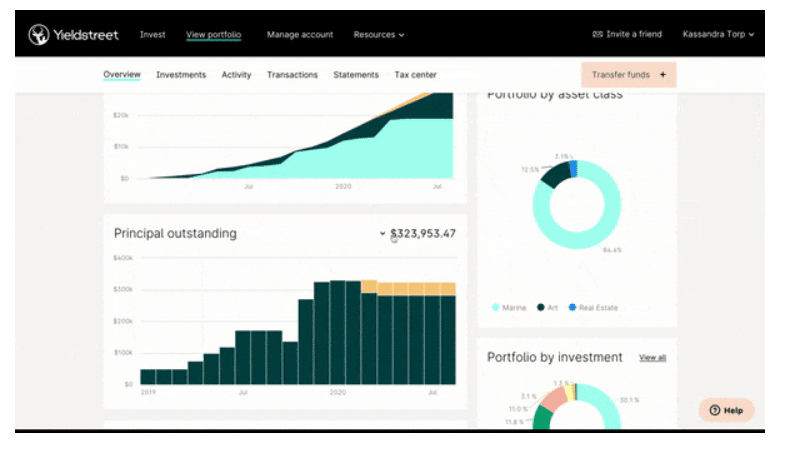

Portfolio Overview

The portfolio overview shows you a summary of your Yieldstreet investments and their performance.

Within this, you can view your account value, the total dollar amount invested, any accrued interest, and the cash in your Yieldstreet wallet.

The interest earned chart displays how much you have been paid over the life of your investments and your accrued interest. At the same time, the principal outstanding graph visualizes your investments and the principal repayments you’ve received.

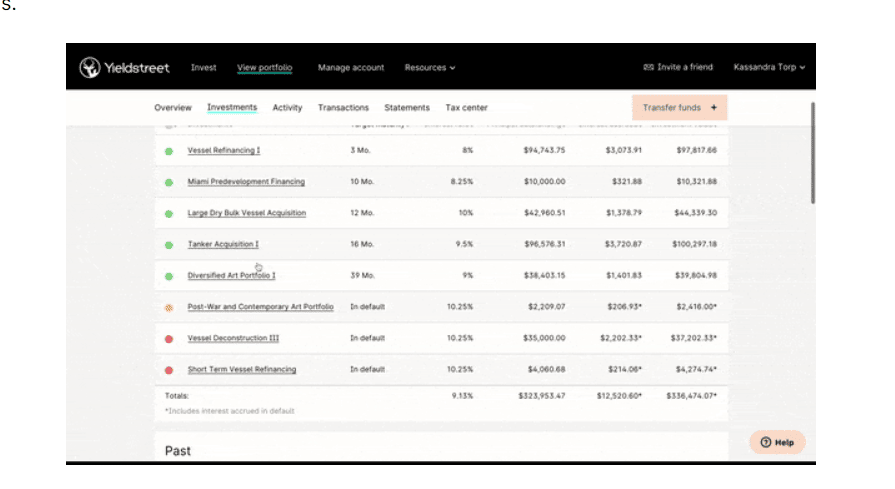

Investments and Details

The investments list shows you all of your investments with Yieldstreet in a sortable table, and performance status is reported for each of your active investments.

You can click on any investment to view its investment detail screen.

The information in the investment detail screen is similar to what is shown on the Portfolio overview.

However, here you can also see your investment value, interest earned, and payments for a specific investment.

If the investment is in default, you will see the interest accrued and principal outstanding in default broken out separately and the default date listed next to the investment’s performance status.

Activity

The activity feed in your Portfolio shows you the latest investment updates. The feed notifies you when you make new investments, when your investments start to earn interest when you receive payments and if there is a status update on any of your investments.

Transactions

The transactions screen shows you a list of all your processed and settled transactions. It includes investments, distributions, fund expenses, Wallet interest, deposits, and withdrawals.

The screen can be filtered by investor account, investment, year, and type of investment. The data can also be exported for an independent analysis.

Distribution payments may also be expanded to show additional details about the specific payment, such as any notes from our Investor Relations and Operations teams, the breakdown of principal and interest, or the effective date of the payment.

Other Features and Benefits

Yieldstreet also offers an FDIC-insured checking account called Yieldstreet Wallet.

The Yieldstreet wallet earns 1.90% annual interest on funds held, and your wallet is automatically created when you set up your investor account.

This is a good option if you want to keep cash on hand when new investments become available on the investment platform.

Yieldstreet Wallet: an FDIC-Insured High Yield Checking Account

Who Should Use Yieldstreet?

Yieldstreet is good for…

Individuals interested in adding alternative assets that have non-correlated returns to the stock market while reducing portfolio volatility.

Yieldstreet is not good for…

YieldStreet may not be a good fit for conservative investors, beginners, non-accredited investors, or those who are not comfortable taking on more risk, monitoring their investments closely and accepting the illiquidity.

Alternatives to Yieldstreet

In reality, there aren’t many competitors in the alternative investments space.

Yieldstreet’s closest competitor is Percent, an alternative investment platform founded in 2018.

Another competitor that focuses solely on commercial real estate investing is EquityMuliple. Equity Multiple is only open to accredited Investors.

And if you are interested in investing in fine wine as an alternative investment, you may want to check out Vinovest. With Vinovest, you can invest in physical bottles of wine and buy and sell them as you, please.

Is Yieldstreet Legit?

Yes, Yieldstreet is legit. They are backed by major venture capital firms.

However, I will note that Yieldstreet has been under hot water due to high-level defaults on their asset-backed investments. There are numerous reports about investors losing money, so tread cautiously, and please do your due diligence before investing.

Frequently Asked Questions

Is Yieldstreet FDIC Insured?

Individual investments and short term notes are not FDIC insured. Cash in your Yieldstreet Wallet is FDIC insured.

Can I Invest Through an IRA?

Yes! If you invest with Yieldstreet, you can open a Yieldstreet IRA. With a Yieldstreet IRA, there are no transaction fees, but there is an annual fee of $299 for portfolios with a balance less than $100,000 and a $399 annual fee for portfolios with a balance above $100,000.

Do I Need To Be An Accredited Investor?

You don’t need to be an accredited investor to invest in the Yieldstreet Prism Fund. However, individual investments, including short term notes require accreditation.