In this review of Groundfloor vs. Fundrise, we’ll look at two popular real estate platforms and help you decide which fits your needs.

Groundfloor vs. Fundrise: At A Glance

Key Features | ||

Quick Summary | Real estate crowdfunding platform that makes short-term loans to investors who fix and flip properties. Interest rates range between 5% - 15% | Real estate investment platform that offers a wide variety of REITs and Funds with varying strategies and property types |

Minimum Investment | $10 | $10 |

Fees | None (Borrower pays) | 1%/yr |

Property Types |

|

|

What Is Groundfloor?

Groundfloor is a real estate crowdfunding investment platform that allows individuals to invest in short-term real estate debt. The company makes short-term loans ranging from 6 – 12 months to real estate “flippers” who fix and flip individual investment properties.

Before opening a loan to investors on their platform, Groundfloor thoroughly vets a borrower’s experience, creditworthiness, and business plan. Then, they assess the property value on an as-is and as-improved basis.

Groundfloor is open to accredited and non-accredited investors with a minimum investment of just $10.

This real estate platform was founded in 2013 by Brian Dally and Nick Bhargava and is headquartered in Atlanta, Georgia.

Read our full Groundfloor review.

What Is Fundrise?

Established in 2010, Fundrise is one of the oldest real estate investing platforms. Fundrise offers people an alternative option to investing in real estate without the stress and costs of traditional real estate investing.

Accredited and non-accredited investors can invest in real estate through Fundrise’s wide variety of eREITs and eFunds with a minimum investment of $10.

The company boasts a wide variety of investment options and strategies, goal-planning features, and a user-friendly investment dashboard.

More than 300,000 people use Fundrise today and have invested over $ 7 billion in properties throughout the U.S. Fundrise has had 21 consecutive quarters of returns, averaging 22.99% in 2021.

Fundrise is based in Washington, DC, and was founded by Ben Miller, who has over 20 years of experience in the real estate industry.

Read our full Fundrise review.

How Does Investing With Groundfloor Work?

When you open an account with Groundfloor, you can invest in short-term, collateralized (backed by the properties themselves) real estate debt instruments with a minimum investment of just $10.

Investing with Groundfloor involves lending money to real estate developers who are seeking financing for their projects. Here’s how it works:

1. Identify Investment Opportunities

Groundfloor identifies potential real estate projects that need funding: Groundfloor works with real estate developers who are looking for funding for their projects. These projects can range from single-family homes to large-scale commercial developments.

Groundfloor presents new investment opportunities on its platform weekly, ensuring investors always have the option to diversify into new projects.

2. Open Project to Investors

Once Groundfloor has identified a potential real estate project, they create an investment offering for it. This offering includes details about the project, including the loan amount, interest rate, loan term, and other relevant information.

3. Browse Investments

Investors can review and invest in the projects: Investors can review the investment offering and decide whether they want to invest in the project. Investors can choose to invest any amount, starting at as little as $10.

With this in mind, you can also use Groundfloor’s Investment Wizard, a feature that automatically matches available loans with your investment criteria. You can select and customize your portfolio with just a few clicks.

Most loans offered on its platform have yields between 7.5 to 14%, with a duration between 6 and 12 months.

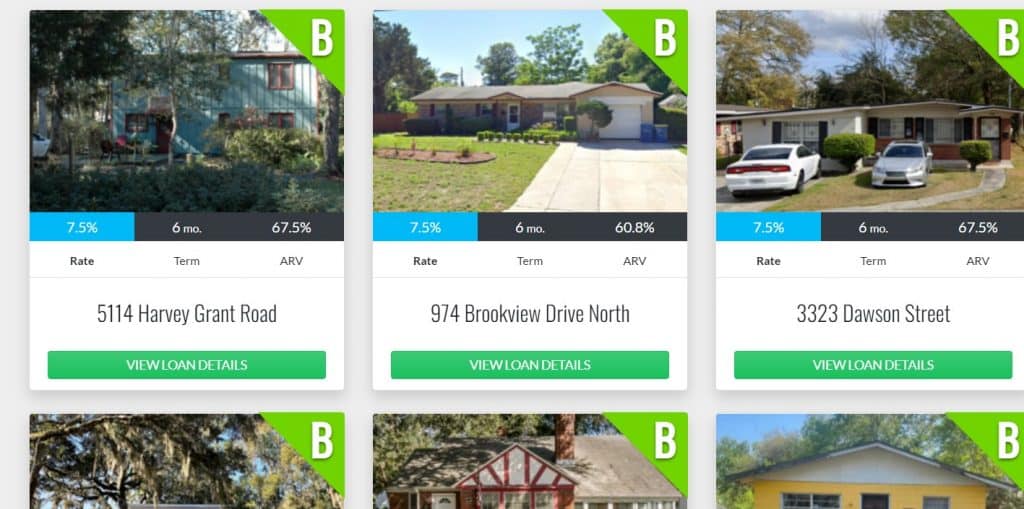

Once you open your account, you can browse available investments and view loan metrics such as rate, term, and ARV (after repair value).

Browse open investments and view loan details on Groundfloor

Note: Groundfloor stands behind each loan on its platform. The company prefunds loans before they launch on their platform. Because Groundfloor fully funded the loan, it shows faith in its underwriting and due diligence. Otherwise, if a loan does not live up to investors’ standards, they will be stuck with a possibly underperforming loan.

5. The project is funded

Once enough investors have invested in the project, the project is considered fully funded, and the loan is closed. The developer receives the funds and can begin work on the project.

6. Investors receive monthly interest payments

As an investor, you will receive monthly interest payments based on the terms of the investment offering. The interest rate is typically higher than what you would earn from a savings account or CD.

7. The loan is paid off

At the end of the loan term, the developer repays the loan, and investors receive their principal investment back, plus any accrued interest.

8. Investors can reinvest or withdraw their funds:

After the loan is paid off, investors can choose to reinvest their funds in another project or withdraw their funds from the Groundfloor platform.

Overall, investing with Groundfloor allows investors to earn attractive returns by lending money to real estate developers. However, it’s important to remember that all investments come with some level of risk, and investors should carefully evaluate each investment opportunity before investing their money.

How Does Investing With Fundrise work?

With Fundrise, you are investing in either Fundrise eREITs or eFunds. eREITs and eFunds comprise a basket of non-traded real estate properties, from multifamily apartments to industrial complexes. The eREITs and eFunds aim to seek a combination of dividend distribution and capital appreciation, depending on the strategy.

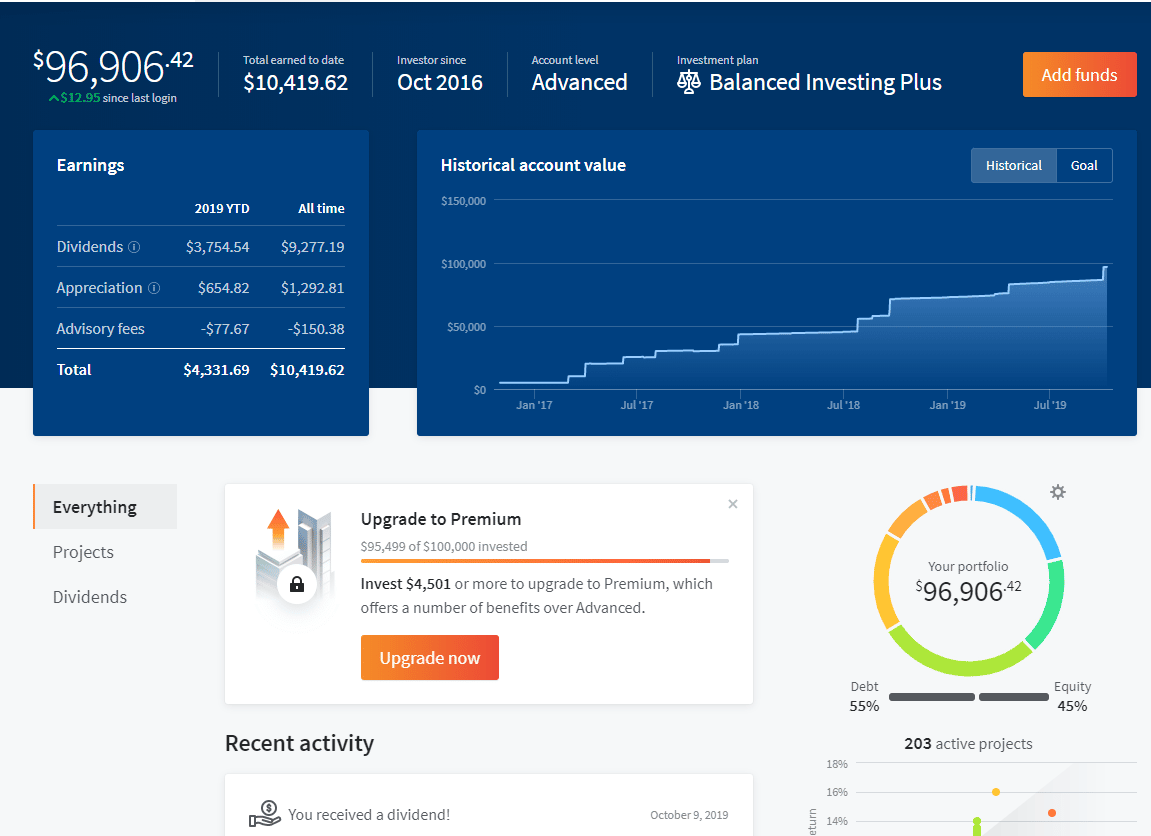

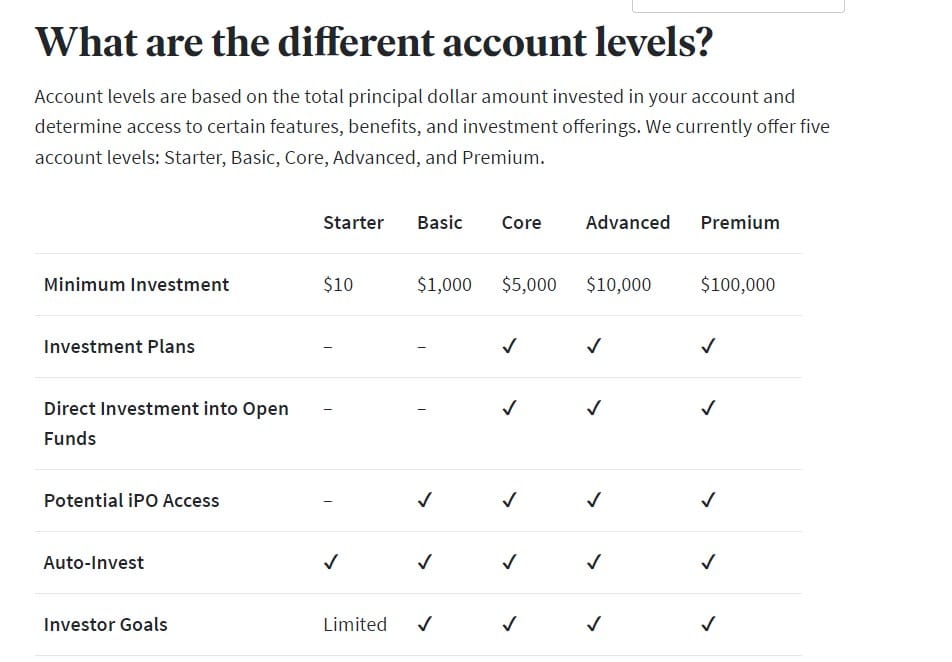

When you open an account with Fundrise, they offer a wide range of account levels; Basic accounts require a minimum investment of $10, and its Advanced Portfolio requires a minimum investment of $10,000. The premium level is reserved for accredited investors only, with a minimum investment of $100,000.

Fundrise has an easy-to-use Investor Dashboard

However, Fundrise’s most popular account is its Core Portfolio which has all the options and benefits most investors need. A Core account requires a minimum investment of $5,000.

You can create a customized investment strategy at the Core account level and above. Investors can customize their portfolio by diversifying across a wider variety of funds with specific objectives, such as income, growth, and balanced.

Groundfloor Key Features

$10 Minimum Investment. Groundfloor is truly democratizing real estate investing by removing barriers to entry. You can create a diversified portfolio by investing While Fundrise also has a $10 minimum investment, you need to invest at least $5,000 to access all of the platform’s features.

Investments Are Backed By Collateral. With Groundfloor, you are investing in real estate debt which has a much lower risk profile in the capital stack. Many other real estate platforms invest in equity or preferred equity, making them subject to a higher degree of risk.

Groundfloor Stands Behind Their Loans. Groundfloor prefunds most loans before they are sold on its platform. Doing this shows that Groundfloor has faith in its investment selection process. Because if the loan does not live up to investors’ standards, they could be stuck with the loan.

Greater Investment Control. Groundfloor allows you to fund multiple investments at once. Many other real estate platforms often only have a select few investment options at any given time. And with a minimum investment of just $10, you can fund multiple investments at once, giving you true investment freedom.

Advantageous Investment Structure. Most companies that offer real estate investments are structured as real estate investment trusts (REITs). When an individual invests in a REIT, it is pooled with other investors’ money and goes into multiple projects owned and operated by the REIT. Subsequently, the company, not the investors, decides which project to fund and how much investor money to put towards each project.

Therefore, investors rely on the REIT to pick appropriate investments and manage risk, barring everyday investors from total control over their investment portfolios.

No Self-Dealing. Many REIT-based offerings self-deal, which means the company offering the REIT may also be the project managers, leasing agents, or property managers for the underlying properties, creating a potential conflict of interest.

Making The World A Better Place. Groundfloor recently partnered with PadSplit to increase housing density and reduce gentrification in Atlanta and other metros.

Fundrise Key Features

$10 Minimum Investment. You can open an account and start investing in real estate with just $10. But, you are limited in your investment options at this level – you can only invest in either the Income Fund or Flagship Fund. You only get the full benefit of Fundrise features when you open a ‘Core’ account with a minimum investment of $5,000.

Early Redemption Option. Real estate, in general, is considered a long-term illiquid investment. However, if investors want to redeem their shares of the eREITs or eFund, they can place a redemption request at any time. However, any eREIT or eFund redemptions processed before an investment is five years old are subject to a flat 1% penalty. Also, Fundrise does not guarantee liquidity. They may stop purchasing shares back if there are unfavorable market conditions.

Dividend Reinvesting. If you enable dividend reinvestment, dividends earned are automatically reinvested quarterly according to your investment plan.

Create and Manage Investor Goals. This feature allows you to invest with a defined goal to track your progress toward achieving your objectives. Investor goals are only helpful if your investment horizon is 5 years or longer. Streitwise does not have an option to create and manage goals.

Common goals include saving for a large purchase or retirement. The Investor goals tool is expected to show you how your portfolio could grow over time through continued investment, appreciation, and dividend/distribution income.

Once your goal is set, the goal tracker will monitor if your portfolio is on track, needs attention, or is off-track and then guide you toward making adjustments to help you meet your goal.

Investor Goals is available to all taxable accounts beginning at the Starter account level.

Automated Investing. You can schedule automatic investing to your Fundrise portfolio, at any time, with $10 increments. Auto-investments are allocated according to your chosen plan, and Fundrise may offer new investments to invest in automatically as they arise.

Multiple Account Levels. The Fundrise platform consists of five levels of accounts with varying minimum balance requirements. Depending on the level of account opened, you will have access to different investment options.

Fundrise’s most affordable option is its ‘Starter’ portfolio. This low-cost package starts at $10. The portfolio includes access to Fundrise’s registered products, dividend reinvestment, and auto investing.

If you open a ‘Starter’ portfolio, you can invest in the Income Fund, which focuses on cash flow generation, or the Flagship Fund, which focuses on income and capital appreciation.

However, the Starter portfolio does not have IRA access or other advanced functionality. For $1,000, you can upgrade your account to the Basic Plan. With the Basic Plan, you can define your investment goals, open a taxable IRA, and invest in the Fundrise iPO.

Neither the Starter nor Basic plans grant access to Fundrise’s non-registered investment programs. After that, there are 3 higher-level plans: Core, Advanced, and Premium. These plans have a higher minimum balance.

Head-to-Head Comparison

Below we will look at several categories like investment options, returns, and fees to see how Groundfloor and Fundrise stack up against each other.

Investment Options

Winner: Groundfloor

While Fundrise offers a wide range of investment options, individuals can invest in 11 active eREITs and 2 eFunds. These investment options range from income generation to Midwest Region strategies. The eFunds are comprised of an Income Real Estate Fund whose main objective is income distribution and currently has a 6.5% distribution rate. Their other fund is The Flagship Real Estate Fund, which aims to generate income while seeking long-term capital appreciation. The Flagship Fund currently has a 0.75% distribution rate. eFunds are your only investment option if you have a basic account.

Meanwhile, all of Groundfloor’s offerings are the same strategy, focused on income generation. However, regarding investment options, Groundfloor is constantly launching new deals on its platform, with varying degrees of risk, so Ground takes the W here.

All Loans on Groundfloor’s platform are collateralized real estate debt instruments with an average maturity of 6 – 12 months and an average interest rate of 10.5%.

Returns

Winner: Tie

To date, Groundfloor has returned 10.5%, on average. Meanwhile, Fundrise returned an average annualized return of 11.58%, net of fees across all clients between 2017 and 2021. Compare this to all public REITs, which returned 13.4% and 19.21% for the S&P 500 in 2021.

However, the returns of Groundfloor are a rough comparison at best. Groundfloor and Fundrise deploy different investment options and strategies with varying degrees of risk, so it isn’t easy to make a side-by-side comparison.

For example, Groundfloor investments are collateralized debt instruments focusing on income generation. In contrast, Fundrise investments vary from income generation to capital appreciation, with investments across the entire capital stack – equity, preferred equity, and debt, to name a few.

So in the category of returns of Groundfloor vs. Fundrise, it’s a tie.

Account Fees

Winner: Groundfloor

Groundfloor does not charge any fees to its investors. The borrower pays all fees. Meanwhile, Fundrise charges a 1% management fee based on the amount invested with Fundrise. So, if you invested $1,000 with Fundrise, you would pay $10 in fees every 12 months.

But… It’s important to note that Fundrise has additional fees buried in its offering circular.

For example, on page 82 (of 332) of the Fundrise offering circular, Fundrise lists a 2% “Acquisition and Origination Fee.” Interestingly, this fee is not listed anywhere except in the offering circular.

Note about fees: Many real estate investment platforms bury additional costs in their offering documents. So a word of caution when considering investing and are concerned about the fees a platform lists. The most transparent platform for fees for real estate investing is a company called Streitwise.

Pros & Cons

Groundfloor

PROS

- Wide range of investment options

- Low minimum investment ($10)

- No fees

CONS

- Only residential properties available for investing

Fundrise

PROS

- Investor goals and planning tools

- Low minimum investment ($10)

- Wide range of investment options

CONS

- Early redemption fees

- Tiered-account makes not all features available to all investors

Which Platform Is Better?

Winner: Groundfloor

Groundfloor has a winning investment strategy.

Their low investment minimum of $10 grants you access to all of their features. While Fundrise also has a $10 minimum, you need to invest at least $5,000 and upgrade to a Core portfolio to use most of the platform’s features.

In addition, Groundfloor’s short-duration notes are backed by collateral, offering higher returns for varying degrees of risk. Compared to Fundrise, which requires you to lock up your money for 5 years or pay a fee to withdraw your money.

Furthermore, all of Groundfloor’s investments are debt investments, which provide a higher degree of security when investing, while Fundrise’s investments span the entire capital stack.

That said, it is clear why Groundfloor is superior to Fundrise in the real estate investing platform space.