Real Estate can best one of the best mechanisms for building wealth, if done correctly…

Real estate provides tremendous opportunities to create wealth through multiple mechanisms: passive income, asset appreciation, tax benefits, diversification, and leverage, and can also serve as an inflation hedge.

Real Estate has seen renewed interest when stock prices struggle, but real estate should not be considered a short-term investment strategy and does not come without risk.

Passive Income

As of this writing, the average dividend yield for publicly traded Equity REITs is 4.3%, according to the Motley Fool. Meanwhile, non-traded REITs had an average dividend yield of 8.1%.

Some REITs can pay significantly more in dividends, depending on the riskiness of the investment strategy.

Real estate investments can be an excellent way to generate stable cash flow.

Asset Appreciation

There are a large number of factors that can impact property appreciation: location, interest rates, property improvements, and even inflation, to name a few.

Most commercial properties focus on income generation or asset appreciation. According to the National Association of Real Estate Investment Trusts, the compounded Annual Total Returns for the FTSE Nareit All Equity REITs over the past 10 years was 8.36%.

Meanwhile, residential single-family homes i.e. your primary residence will benefit primarily from property value appreciation.

Since January 2012, the Compound Annual Growth Rate was 8.0% for single-family homes, according to the Federal Housing Finance Agency.

Inflation Hedge

Real Estate provides a natural inflation hedge. As inflation increases, real estate owners tend to increase rent for commercial real estate leases as they come due.

A Wall Street Journal article points out that inflation makes make new construction more expensive, creating less competition from new builds while bidding up the price of existing properties.

REIT dividend increases outpaced inflation in 18 of the last 20 years compared to Consumer Price Index (CPI).

And over twenty years between 2000 and 2020, the annual growth for dividends was 9.4% vs. 2.1% for the Consumer Price Index, according to an analysis done by REIT.com.

Tax Benefits

Generally speaking, real estate investors can deduct the normal maintenance expenses of investment properties and some significant expenses.

Significant tax deductions may include mortgage interest, property taxes, operating expenses, depreciation, and repairs.

Most individuals can deduct expenses for keeping their rental property in good operating condition.

It’s important to note that tax benefits generally only apply to individuals who invest in physical real estate, not REITs.

Diversification

Non-traded REITs have a correlation of 0.14 to stocks. Correlation is how two assets move in relation together.

A correlation of 1 means if Stock A moves up 10%, then Stock B will move up 10%.

Meanwhile, publicly-traded REITs have a correlation of 0.68, according to a real estate white paper study completed by TIAA.

Because of this, real estate is less likely to suffer losses simultaneously or to the same degree as stocks, helping reduce downside risk and mitigate volatility in a diversified portfolio.

Note: While publicly-traded REITs are not perfectly correlated to stocks, non-traded REITs or real estate investing through a residential or commercial property provides better diversification.

Leverage

For everyday investors, the number of ways individuals can borrow money for less than 10% is limited.

Leverage can amplify returns and reduce the total amount of cash required to invest.

Let’s take an example to illustrate the power of leverage using Cash on Cash Return.

Cash on Cash Return is your pretax cash flow (after all operating expenses) divided by your money invested.

If you put 25% down on an investment property, your cash-on-cash return would only be 8%. Meanwhile, if you put 10% down, your cash on cash return would be 20%.

That is the power of leverage in real estate investing. Leverage can amplify returns but can also losses. Considerable leverage should only be used by experienced investors.

What You Should Know Before Investing in Real Estate

Profits through real estate investing can depend on housing markets, employment, and even emerging technologies, among other factors. Market knowledge is crucial whether you invest in REITs or physical real estate.

You should do nothing until you have considerable knowledge of your market It’s critical to align your market with your capabilities, especially so with residential or commercial properties.

Understand The Different Real Estate Investing Strategies

There are 4 primary real estate investing strategies: Core, Core Plus, Value-Add, and Opportunistic. These strategies primarily focus on commercial real estate investing but can also be applied to individual investment properties.

Core

It is a buy-and-hold strategy when you purchase a high-quality property that generates stable revenue. Core strategies include lower risk but also have lower returns. Expected returns generally hover sub 10% IRR.

A core strategy is ideal for investors looking for passive income, and since core properties are fairly stable, they don’t tend to generate capital appreciation.

Like the core real estate strategy, the core-plus approach focuses on a buy-and-hold approach but with slightly more risk.

Core Plus

Core-plus investors create value by renovating and increasing the property’s appeal, allowing an investor to charge higher rent.

This strategy builds long-term wealth through increased property value and increased passive income.

Core Plus strategies typically generate an internal rate of return of around 10-14%.

Value-Add

Investors with a higher appetite for both risk and reward might pursue value-add strategies. Value-add investments focus on properties that require capital and day-to-day management to achieve profitability.

Investments in value-add properties include renovations to attract a new type of tenant or to fill tenant vacancies. Pursuing value-add opportunities may also provide a way for investors to enter a market that is otherwise too expensive.

Value-add investments usually have a 5 – 7 year investment horizon and target an internal rate of return of around 15 – 19%.

Opportunistic

Opportunistic real estate strategies are the riskiest types of investments but also have the potential for the most reward. Most investments require considerable leverage, and properties may not provide any income for years.

Examples of opportunistic investments may include ground-up developments, acquiring an empty building, or land development.

Only seasoned teams of real estate professionals typically execute opportunistic real estate projects.

Opportunistic investment can have returns over 20%.

Ways To Build Wealth Through Real Estate

Many people commonly associate real estate investing with either buy and rent properties or fix and flip investments.

However, there are a wide range of real estate investment strategies. A suitable real estate strategy depends on your risk tolerance, available capital, and investment timeline.

Real Estate Crowdfunding

Real estate crowdfunding is a lesser-known method of investing in real estate. Real estate crowdfunding has really picked up in popularity over the past ten years after the passage of the JOBS Act.

Real Estate Crowdfunding is when individuals pool money together to provide financing for a residential or commercial property.

Most real estate crowdfunding is facilitated through online platforms like Fundrise and Groundfloor, connecting investors with borrowers or sponsors.

And if you are an accredited investor, there’s even a wider range of investment services and platforms available.

Restate crowdfunding provides access to investment opportunities that were not historically available to non-accredited investors.

In addition, real estate crowdfunding can generate passive income and capital appreciation. And most importantly, it does not require day-to-day management like a fix-and-flip or rental property.

Individuals who do not want the responsibility of managing day-to-day operations of a physical real estate property, and are looking for yields that are commonly higher than publicly-traded REITs.

The main drawback of non-traded real estate is that investments are fairly illiquid, meaning you cannot easily buy and sell your shares like a publicly traded REIT.

REITs

A REIT (Real Estate Investment Trust) is a company that owns, invests in, or provides financing for commercial real estate.

The term REIT is really just a tax concept, and as long as a company satisfies a long list of requirements set forth by the IRS, it can qualify as a REIT.

The most well-known qualification requirement is that the company must distribute at least 90% of its income to investors to qualify as a REIT. This allows the REIT to avoid double taxation: once at the corporate level and then again at the individual level.

REITs can be traded or non-traded; traded REITs are listed on a stock exchange and are easily bought and sold like stocks. Meanwhile, non-traded REITs do not trade on a stock exchange and are not easily bought or sold, some popular publicly-traded REITs include Vanguard’s VNQ and Vornado Realty’s VNO.

Buy A Home and Live In It

This isn’t a unique strategy. Residential property can be the key to wealth for many Americans.

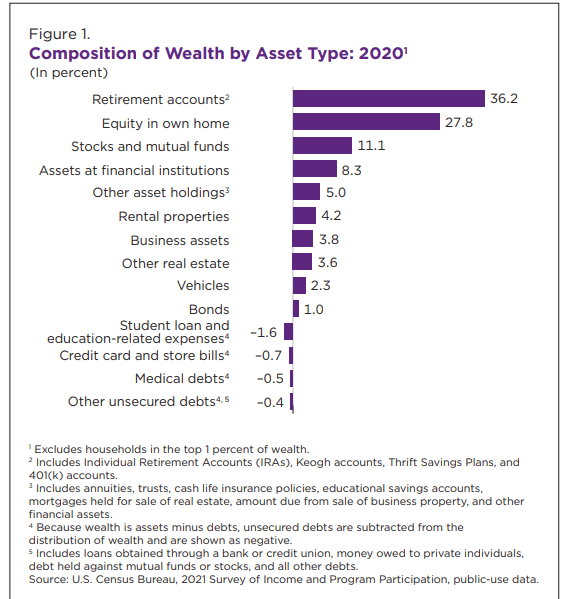

According to a census.gov study, equity in a home is the 2nd largest source of household wealth for 99% of Americans, just behind stocks and ahead of mutual fund investments.

Homeownership as a primary source of wealth isn’t a phenomenon, home ownership is a kind of forced savings mechanism because individuals cannot easily withdraw the equity in their homes and mortgage payments account for over 20% of Americans’ take-home pay, on average.

Fix-And-Flip Properties

Fix-And-Flip properties are a type of investment property that need renovations to make the property appealing to potential homeowners.

Fix and Flip properties can be incredibly profitable, according to AttomData, a nationwide leader in property data, the average gross profit generated by homes flipped in 2021 was $65,000.

However, the main drawback with fix-and-flip properties is that you need extensive capital to get started, considerable real estate market knowledge to ensure you are not overpaying for the property, and, lastly, the resources and time to hire the necessary labor to make the property sellable.

Skills Required For Fix-And-Flip Properties:

A large amount of upfront capital

Understanding of property and neighborhood

Resources and time to hire and manage labor to renovate the property.

If you are just starting to learn about real estate investing, a good alternative if you don’t have the time or money to dedicate is investing in fix and flips through a company called Groundfloor. They provide short-term loans for residential real estate with an average loan length of about 10 months.

With just $10, you can invest in real estate without buying property and earn about 10% on average.

Fix And Flipping houses is good for…

Individuals who have the time, money, and resources to manage a physical property and want to wash their hands of the property once it is renovated and sold.

Buy-and-Rent Properties

With buy and rent properties, there are three primary investment options:

Income Producing Rental Properties. The primary drawback with these properties is that you will likely pay a premium for this type of property due to the immediate cash flow you will be earning.

Buy and Renovate. It is when you buy a rental property and perform renovations, allowing you to increase rent. This strategy is known as a value-add real estate strategy. Buying and renovating can be considerably more profitable but also includes more risk.

Multi-Family Conversion. Involves buying a single-family home or property and converting it into a legal multi-family. This strategy is the riskiest because there are multiple legal considerations that could provide setbacks.

However, a multi-family conversion could be the most profitable of the 3 buy and rent strategies if appropriately executed.

1031 Exchange

A 1031 exchange allows investors to swap out one investment property for another, thereby deferring capital gains taxes owed.

A 1031 exchange is a good way for investors to upgrade to a more significant investment property that can generate additional rental income.

1031 exchanges can also be a great way to build wealth as the capital gains taxes you would have owed can now grow tax-deferred.

An investor must follow a strict set of rules for a property, such as the exchange must be made with a Like Kind Property.

Is Real Estate The Best Way To Build Wealth?

There is no “one-size-fits-all” when it comes to building long-term wealth. And most importantly, you need to ensure the investing opportunity aligns with your goals.

A well-diversified investment portfolio of stocks, bonds, and real estate works well for most people, but there are endless stories of successful real estate entrepreneurs and investors, which makes it that much more tempting.