Can You Revolutionize Your Real Estate Investing with FundThatFlip- High-Yield Short-Term Loans for Experienced Investors.

Quick Summary: Fund That Flip is a real estate investing platform allowing accredited investors to invest in a wide range of residential real estate debt and prefunding notes.

PROS

Investments backed by collateral

Passive diversification through Real Estate Bridge Note Fund

CONS

Available to accredited investors only

$5,000 minimum investment

At A Glance

| Feature |  |

|---|---|

| Minimum Investment | $1,000 for note funds $5,000 for individual properties |

| Returns | 10.8% on average |

| Investment Type | Collateralized Debt |

| Early Redemption Options | None |

| Open To: | Accredited investors only |

| Fees | 1 – 3% spread. Difference between what is charged to each borrower and the rate paid to investors. |

| Dividend Reinvestment | No |

| Retirement Account Investing | Yes |

4.00

Bankrate Score

Minimum Balance

$0

What is Fund That Flip?

Fund That Flip is an online real estate crowdfunding platform for accredited investors to invest in short-duration, high-yield debt notes through real estate redevelopment projects, commonly known as “fix and flip” projects.

Founded in 2014 by Matt Rodak, Since inception, Fund That Flip has facilitated over $900 million of investments, with over 2,500 loans repaid, yielding an average return of 10.8%, with the average loan repaid in under 10 months.

The company is headquartered in New York City.

How Does Fund That Flip Work?

Fund That Flip lists new investment options on nearly a weekly basis. The company will list investment details and metrics to help you make the most educated decision before investing.

Most BDNs have an average duration of less than 1 year, and the average interest rate earned is around 10%.

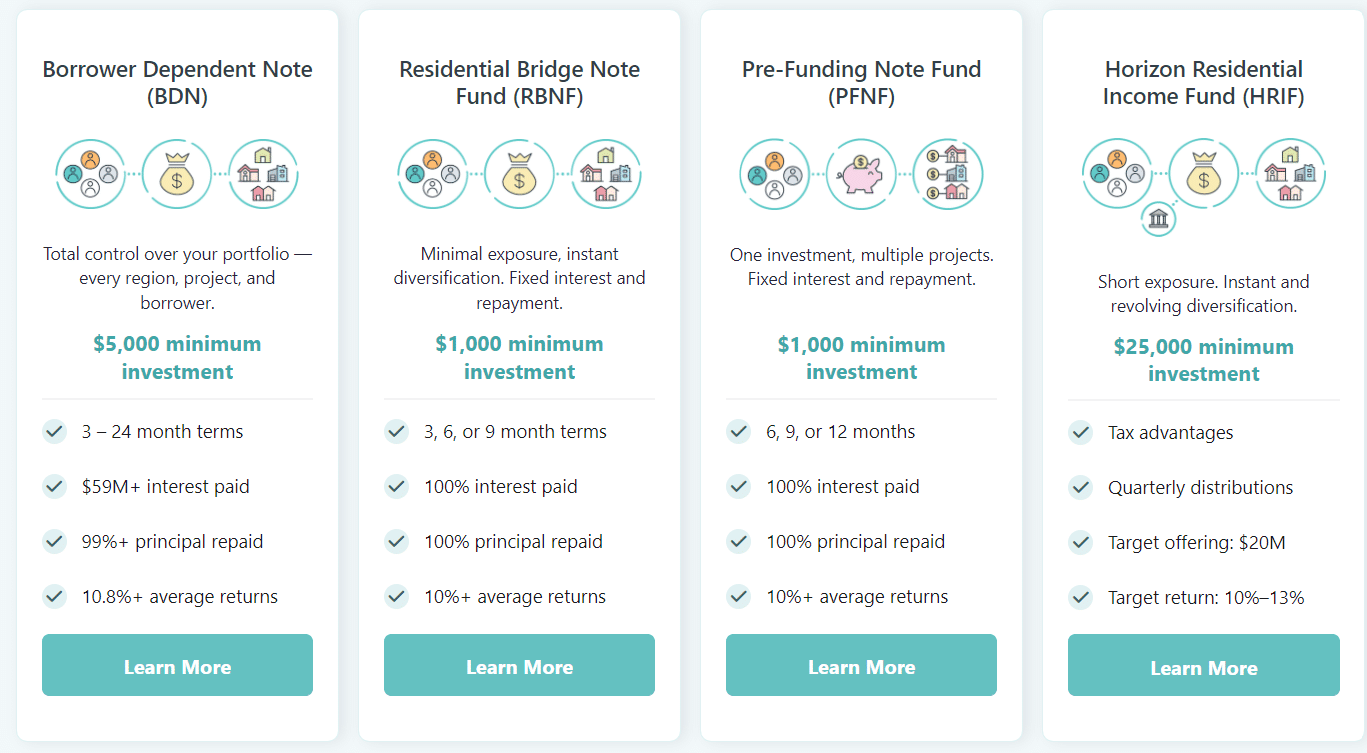

FTF has 3 investment options. The company’s primary offering is individual property investing via a Borrower Dependent Note (BDN). A Borrower Dependent Note is an unsecured debt instrument, and each BDN is secured by a first position lien on the underlying property (the collateral).

Individual BDNs have a minimum investment of $5,000, and borrowers are required to make monthly interest payments which go directly to your linked bank account.

When you invest in a BDN, it is possible for a borrower to prepay their loan ahead of schedule, but the borrower will be required to wait a specified number of months before doing so.

Note: Without getting too technical, FTF points out that a BDN is not secured because the collateral is not pledged directly to the holder of the BDN (investor) but is pledged to the Indenture Trustee for which the investor benefits as a BDN holder.

The other way you can invest is through FTF notes. Fund That Flip notes are comprised of two types of notes, a Residential Bridge Note Fund (RBNF) and a Pre-Funding Note Fund (PFNF). FTF notes have a lower investment minimum of $1,000.

Investment Options

Fund That Flip offers four ways to invest. The Residential Bridge Note Fund, Pre-funding note Fund, Horizon Residential Income Fund, and Borrower Dependent Note.

Let’s look at each investment option in detail.

Residential Bridge Note Fund (RBNF)

The RBNF is designed to be representative of the entire book of business FTF originates and is comprised of BDNs and mortgages. Sometimes, the RBNF may also extend a line of credit to pre-fund mortgages.

Investing in this note is analogous to investing in a stock index fund such as VOO.

The RBNF is designed to create passive diversification. In other words, investors in this note won’t need to review and sign-up for new investments, instead, investors can now invest across the entire FTF book with one investment.

The RBNF is a very unique offering. I have not seen this structure across any of the other real estate platforms I’ve reviewed, the allows passive diversification across an entire book of business.

It’s also worth pointing out that because investors do not have the option to pick individual investments in the RBNF, the RBNF invests 10% of its total capital in the fund, therefore showing aligned incentives between investors and the company.

Pre-Funding Note Fund (PFNF)

The other note offered by FTF is their Pre-Funding Note Fund (PFNF). Through PFNF, individuals invest in a line of credit used to fund mortgages before they are open for investing through the FTF platform or sold to institutional whole loan buyers.

You can invest in PFNF for $1,000 and increments thereafter of $1,000. The typical duration of a PFNF is between 2 – 12 months, with yields between 8% and 9.50%.

The primary benefit of pre-funding notes is that they allow investors to earn yield without taking on repayment risk.

In addition, the fact that FTF prefunds its loans shows it stands behind the investments on its platform. If FTF prefunds a loan and doesn’t live up to investors’ standards, the company is stuck with the loan.

I’m a huge fan of prefunding note investing due to the short duration of the notes and the fact that you are investing in a Line of Credit and not a loan.

However, since I’m not an accredited investor, the Pre-Funding Note Fund isn’t an option. A great alternative for non-accredited investors is Stairs by Groundfloor, which allows non-accredited investors to invest in prefunding notes for just $1.

Performance & Investment Metrics

Returns can vary greatly when investing in real estate, so comparing real estate investment platforms can be challenging.

For example, depending on where in the capital stack your investment stands can greatly influence your returns. For example, FTF investments are debt and lower on the capital stack and generally have lower returns and lower risk.

On the other end, common equity is higher on the capital stack and, as a result, generally has higher returns but also more risk.

Let’s take a look at FTF returns and performance metrics...

Since its inception, Fund That Flipped returned an average of 10.8% across $900 million invested. According to FTF, only 8% of loan applications are funded.

As of June 2022, 5.72% of its loan portfolio was 30 days or more past due and has been trending slightly upward over the past few months.

The company notes the two main reasons for an increase in delinquency are supply chain issues and numerous high-dollar loans that remain delinquent because they have a dependency on exit and repayment.

- Average Gross Yield: 10.8%

- Percentage of Principal Returned: 99.6%

- Number of Repaid Loans: Over 2,500

- Total Invested: Almost $900 million

- Approved for Funding: 8% of loan applications

- Delinquency Rate: 5.72% as of June 2022

Fees

Fund That Flip does not charge any ongoing management fees to investors.

Rather, FTF deducts a spread of 1 – 3 % between what it charges borrowers and what it pays to investors. Other real estate investing platforms will charge an ongoing management fee which is deducted from your balance on a yearly or quarterly basis, so this makes it a little more seamless for investors.

Fee Example: If a borrower pays 11%, FTF takes a 2% spread, and the investor will receive 9%. All yields listed are net of the spread, so what you see is what you get.

Liquidity

There is no secondary market or early redemption options if you want to sell back your BDN or RBNF, or PFNF early.

However, given the short duration of its notes (average repayment in 10 months), this is a very short timeline when it comes to real estate investing.

Many other real estate investing platforms require you to hold your investment for 3 -5 years or pay an early redemption fee of up to 3%, which can eat into your profits.

PROS & CONS

PROS

- Investments back by collateral. The investments offered on the platform are backed by collateral, meaning you can have peace of mind in case of a default.

- They Prefund their loans. This means the platform funds the loans before they are sold on their platform, which means they stand behind the loans they offer.

- Diversification through Real Estate Bridge Note Fund. Invest in multiple properties at once through the note fund providing diversification.

CONS

- Accredited Investors only. The platform is only open to investors who meet net worth or income requirements, which may limit its accessibility to some investors.

- Illiquidity. Real estate investments can be illiquid, meaning that it may be difficult to sell the investment quickly if the investor needs to access their funds.

- Trending increase in delinquencies. Recent analysis shows there is an increase in delinquency rates(30 days past due)

Who Should Invest With Fund That Flip?

Fund That Flip Is A Good Option For…

Individuals who want to invest in real estate but do not want to lock up their money for extended periods of time (3-5 years). And at the same time, maintain a lower level of risk by investing in debt securities.

Best Alternatives

Fund That Flip’s closest competitor is Groundfloor. Both companies focus on residential real estate debt investing and offer prefunding investing. However, the main difference is the FTF is open to only accredited investors, while Groundfloor is open to all investors.

| Features |  |  |  |

|---|---|---|---|

| Overall Rating | |||

| Minimum Investment | $5,000 | $10 | $500 |

| Fees | 1-3% taken as a spread | None | 2% |

| Investment Type | Debt | Debt | Varies |

| Open To All Investors? | |||

| Retirement Account Investing? | |||

| Current Promotions | None | None | None |

| Sign-Up | Read Review | Read Review |

Bottom Line

Fund That Flip is definitely worth considering if you are an accredited investor interested in investing in short-duration real estate debt. While their returns are on par with its closest competitor, Groundfloor, FTF is able to stand out against the crowd.

I like that all BDNs are secured by underlying collateral, thereby providing additional security for investors. In addition, the Real Estate Bridge Note Fund, which provides passive diversification across FTF’s entire book of business, is a very unique offering that I have not seen available on any other real estate investing platforms.

Lastly, I can really appreciate the level of transparency and explanations of the company’s operating model and structure, not something I have seen in other real estate crowdfunding platforms. I spent some time listening to the FTF podcast, which provides a level of detail I have not seen before.