Interested in Alternative Investing? This guide will walk you through everything you need to know.

What Are Alternative Investments?

An alternative investment is any asset that falls outside traditional equity, fixed-income or cash and does not trade on a stock exchange.

Most individuals who invest in alternatives do so with the broader goal of providing diversification to their investment portfolio through non-correlated returns and lower volatility than traditional investments.

How Do Alternative Investments Work?

Because alternative investments do not trade on a stock exchange, they are considered illiquid investments, meaning you cannot easily buy or sell your investment.

Most alternative investments are only open to accredited investors and have high minimum investments.

And generally, because the assets are not publicly traded and valuations are subjective, they tend to have much higher fees than equity investing.

Types of Alternatives

While there is no definitive definition of alternative investments, some of the most common types of alternative assets include:

Non-traded real estate. It can be a private REIT or individual commercial real estate property. The main difference is that non-traded real estate is not publicly traded and, therefore, not easily bought or sold.

Investment Grade Wine. Investment-grade wine has become an increasingly popular alternative asset due to its robust and non-correlated returns to the stock market. Just a decade ago, the United States accounted for only 1% of the wine market in 2011 but now accounts for one-third of the global sales.

Structured Products. They are derivatives packaged into a bond-like structure and sold to institutional and retail investors. The underlying performance of a structured product can be linked to the returns of an underlying asset like stocks, bonds, interest rates, or commodities.

Art. Once only available to the uber-wealthy who bought and sold physical pieces of work for $10 million+, there has now been an increase in the popularity of buying shares backed by art. While this concept seems strange initially, but it already exists in other asset classes like real estate and commodities. Art investing is a $17 trillion market with the returns to prove it. Between 1995 and 2020, contemporary art has outpaced returns on the S&P 500, returning 14% vs 9.5% for the S&P 500.

Private Equity. Private-equity funds aim to acquire usually private or sometimes public companies to sell them at a profit and return capital to investors.

Hedge Funds. are pooled investment funds that trade liquid assets like stocks and fixed income in addition to illiquid assets. Hedge fund investment strategies can vary but typically seek to produce returns while mitigating downside risk.

Liquid Alternatives. Are publicly traded ETFs or mutual funds that provide hedge fund-like strategies such as long/short, event-driven, relative value

The demand for alternatives is robust. According to J.P. Morgan Asset Management, alternative investing fundraising has increased substantially over the past decade. In 2011, alternative assets fundraising was $400 billion; in 2021, fundraising increased nearly 3-fold to $1.4 trillion in 2021.

Who Can Invest In Alternatives?

Historically this asset class was only open to institutional investors like pension funds or ultra-high-net-worth individuals, who had access to alternatives through the private banking arm of large banks.

However, after the 2012 passage of the JOBs Act, investing in alternatives became more accessible because the new law made the legal requirements for selling alternative investments to the public less onerous.

Since then, a wide variety of platforms have popped up, enabling everyday investors to invest like the ultra-wealthy. However, many platforms still require investors to be accredited investors, meaning they have an income of $200,000 or a networth greater than $ 1 million, excluding their primary residence.

What are the Advantages of Alternative Investments?

Alternatives offer unique advantages that are not provided in publicly traded markets.

Enhanced Returns

An analysis done by Morgan Stanley from (Data as of Jan 1, 1990, to Dec 31, 2021) shows that a portfolio of 80% stocks and 20% alternatives had an annualized return of 10.8%, while a portfolio of 100% stocks during that same period had returns of 10.64%.

Reduced Volatility

Compared to traditional investments, alternatives rely less on broad market trends and more on the strength of each specific investment, highlighting how adding alternatives can potentially reduce a portfolio’s overall risk. According to J.P. Morgan Asset Management, a portfolio of 80% equity and 20% bonds had a volatility of 12.54%, while a portfolio of 50% equity, 20% bonds, and 30% alts had a volatility of 9.36%.

Higher Yield

Alternative assets have the potential to deliver higher yields than you can earn in other parts of the market. For example, direct lending offers an estimated yield of 8.6%. Meanwhile, the U.S. High Yield bonds are forecasted to deliver 5.5% a year, investment grade bonds are expected to return 3.0%, while equities average 1.4%. These numbers highlight now investors can seek above-average yields outside the traditional equity and fixed-income market.

Broader Investment Opportunity

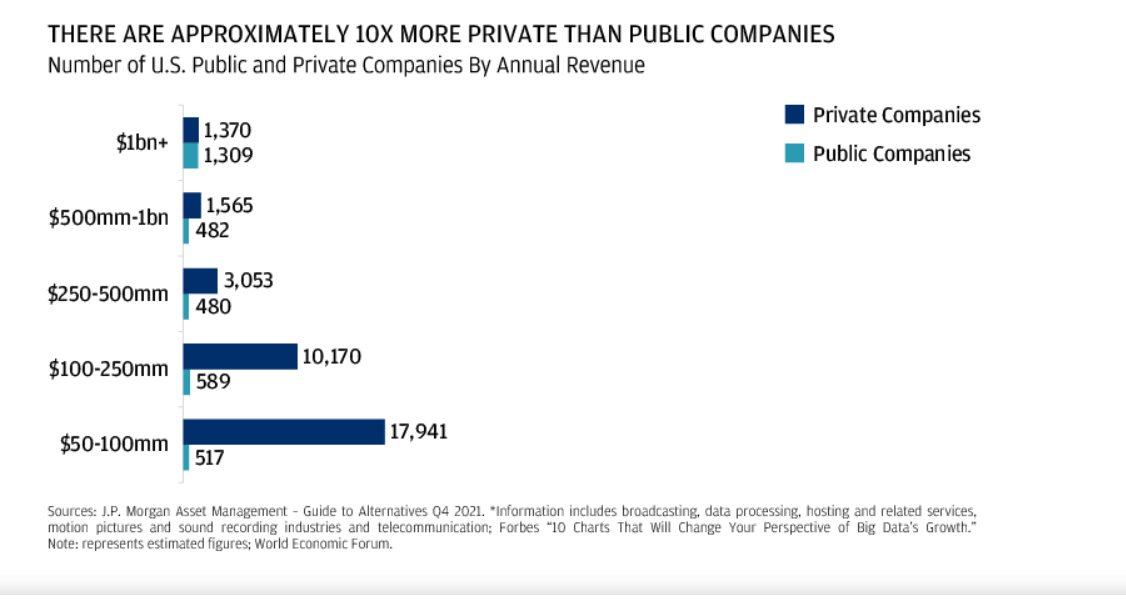

There are approximately 10x more private companies than publicly traded companies in the U.S. This means investors are missing out on a sizeable investing opportunity.

What are the Disadvantages of Alternative Investments?

While alternative investments can provide a wide range of benefits, there are some drawbacks investors need to be aware of.

Higher Minimum Investment

While there is no hard and fast rule for the minimum amount you need to invest in alternatives, minimum investments start at $10,000.

Limited Liquidity

It may be challenging to sell your alternative investment. While some platforms that offer alternatives may provide liquidity, they may be infrequent and not guaranteed.

Longer Lock-Up Periods

Meaning shares or interests may not be able to be redeemed/sold daily. This helps allow for exposure to less liquid assets.

Higher Fees

Alternatives can have management fees between 1.5% and 2% of invested assets, while the average Exchange Traded Fund has a fee of 0.42%, and the average mutual fund has a fee of 1.42%.

No External Price Verification

Because there is no active market, you cannot open your brokerage price and view the latest bid/offer, making valuations challenging. Many alt platforms will often provide valuations on at least a quarterly basis, but investors cannot verify asset prices on a whim.

How To Invest in Alternative Investments

Unless you are a private bank client, which requires investable assets of $10 million or more, the number of platforms that offer alternative investments is still limited compared to stock trading platforms.

However, over the past decade, there has been an increasing number of alternative investment platforms. If you want to invest in alternative investments, there are an increasing number of niche investing platforms that cater to specific alternative assets:

How to invest in wine: Vinovest or Vint

How to invest in real estate: Fundrise or Groundfloor

How to invest Art: Masterworks

How to invest in Hedge funds, Private Equity, Private Credit: Yieldstreet

Who Should Invest in Alternatives?

Alternative Investments are good for…

Individuals looking to add diversification and reduce volatility in their investment portfolio.

Alternative Investments are not good for…

Investors with a short-term investing horizon or may need to liquidate their position early.

How to Use Alternatives As Part of Your Investment Strategy

Alternatives should be used for an outcome-oriented approach. The first step is to identify the challenge you are trying to address, e.g. income, capital appreciation, or diversification. Once the challenge is identified, you should allocate funds to the said asset that should provide the desired solution.

For example, if your goal is income generation, you may want to consider investing in private credit.