Quick Summary:

M1 Finance is an all-in-one investing, borrowing, and spending platform offering a semi-guided investment approach.

PROS

Commission-free investing

Automated investing is available at no additional cost

Digital banking, borrowing, and investment accounts in one place

CONS

Limited trading windows

No crypto or options trading is available

No tax-loss harvesting

At A Glance

- Account Minimum: $100 for taxable accounts, $500 for retirement accounts

- Trading Fees: $0 commissions or mark-up on trades

- Account Types: Taxable brokerage, IRA, Trust accounts

- Automation Features: Dynamic rebalancing, Investing schedules, smart transfers

- Fractional Share trading: Available on stocks and ETFs

- Margin Rates: 3.50% – 5.0%

- Community Pies: Investment options with your values in mind (LQBTQ, Women-Led)

- Automated Investing: Available

- Digital Banking: Yes, 1.3% APY and 1% cashback with M1 Plus

- Trading Window: 1 trading window per day (2 per day with M1 Plus)

Who Should Use M1 Finance?

M1 Finance is a good option for…

Beginner to intermediate investors looking for a long-term, semi-guided approach to investing.

M1 Finance is not a good option for…

- Day traders

- Individuals looking for entire control over their portfolio

- Individuals who are interested in investing in mutual funds, options, fixed income, or crypto.

What Is M1 Finance?

M1 Finance is a mobile-first fintech platform focusing on beginner to intermediate investors interested in long-term investing.

The company’s services include Robo-advisory services, a digital checking account, a credit card, and lines of credit.

M1 Finance was founded in 2015 by Brian Barnes and has $6 billion in assets under management as of 2022.

How Does Investing With M1 Finance Work?

M1 Finance uses a concept called a Pie-Based portfolio.

A pie is your selection of stocks and ETFs used to create your customized portfolio designed to meet your long-term goals. Each unique holding is considered a slice. All the slices make up your pie.

1. Create your pie-based portfolio.

A pie is your selection of stocks and ETFs used to create your customized portfolio designed to meet your long-term goals. Each unique holding is considered a slice. All the slices make up your pie.

2. Deposit your funds to be invested with M1.

3. During the trading window, your funds will be invested based on your selections.

4. If you want to change your targets, such as changing the percentage allocation or adding a new slice, your portfolio does not automatically buy and sell holdings to return your portfolio to your targets, but it will occur over time through M1’s Dynamic Rebalancing.

Note: The exception to the dynamic rebalancing rule is when you remove a slice from your portfolio. When a slice is removed from a Pie, M1 will liquidate the holdings and reinvest the money in that same Pie.

For Example, You deposit $500 into your M1 Investing account and allocate the money among the 5 pies you selected at 20% each. During the trading window, your investment will be aligned with the pies you select.

You only need $100 to start with a taxable brokerage account and $500 in a retirement code. Plus, M1 offers fractional shares so you can fully invest all of your money.

M1 Finance Features Explained

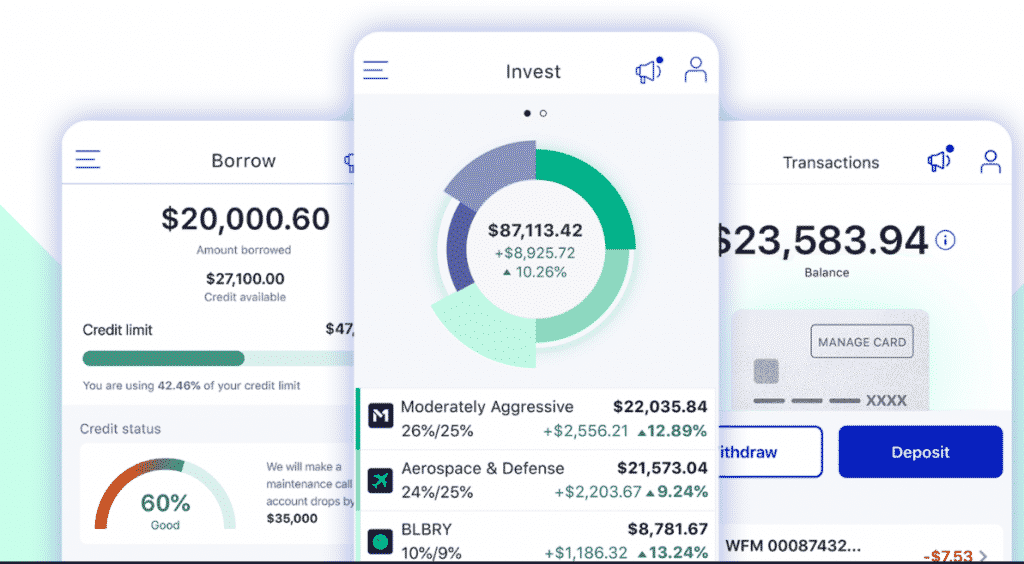

Investing, borrowing, and spending in one easy platform.

Most people have multiple credit card cards, bank accounts, and brokerages. M1 offers a solid 1.30% APY on its digital FDIC insured checking account, 1.5% cash-back with its credit card, and margin rates between 3.50% and 5%. An integrated banking experience makes managing your finance a breeze and is definitely worth considering if you are frustrated managing your finances through different companies.

Investing

With M1, your investment portfolio is considered a pie, and your pie is made up of slices. There are 3 types of pies – Community Pies, Expert Pies, and Customized pies. Pies are the foundation of your portfolio.

M1 Customized Pies

Add your securities as slices of your Pie or build a Pie and use it as a smaller part of your overall Pie to organize your portfolio with ease.

Community Pies

Shareable community pies are baskets of publicly-traded companies created by M1 that allow you to invest with your values and goals in mind.

Two popular types of pies are minority-led business pies and sustainable business pies.

Minority-led business pie focus on women-led, minority-led, LGBTQ+ led, Black-led, AAPI-led, Latine-led, to name a few.

The sustainable business pie focuses on companies committed to sustainable policies and practices relative to the United Nations Sustainable Development Goals.

Expert Pies

M1 Expert Pies are a collection of portfolios that are made up of stocks and ETFs, which align to different investment goals ranging from general investing, retirement planning, and responsible investing.

An expert pie can be used for all, some, or none of your portfolio. Users cannot make adjustments to Expert Pies.

There are 80 Expert Pies to choose from currently.

Borrowing

Access a portfolio line of credit and borrow with rates as low as 3.50% and up to 40% of the value of your portfolio with M1 Plus.

- No required monthly minimum repayment.

- Pay the principal back at any time.

- No limitations on what the borrowed money can be used for.

- $2,000 minimum balance required

- No available for retirement or custodial accounts.

Without M1 Plus, borrowing starts at 3.5%. If you are approved, you have access to your funds in minutes. Interest will accumulate for each day that you use your portfolio line of credit.

Stay invested and pay for what you need. Tap into M1 Borrow’s flexible line of credit for things like:

- Increasing your buying power to make timely investments

- Getting liquidity without selling your investments

- Paying for other expenses, whether large or unplanned

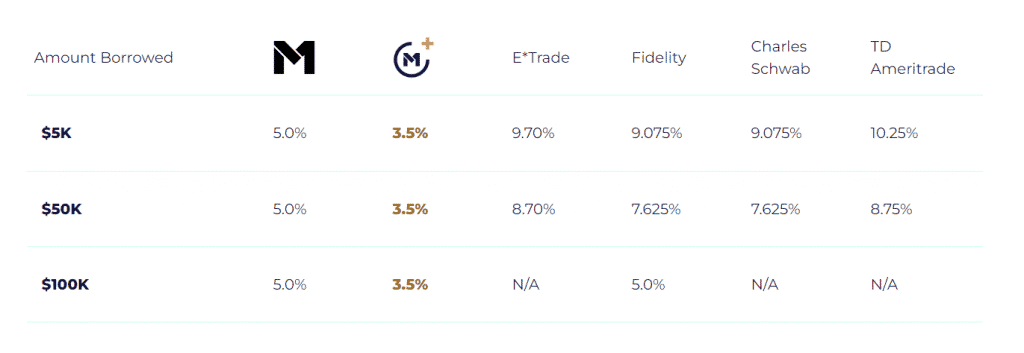

Compared to competitors, M1 Finance’s borrow rate is very competitive:

Spend

With M1 Spend, the company offers a high-yield checking account and credit card.

M1 Checking

- 1.30% APY. This is 33x the national average. You’ll earn more in two weeks than an entire year at a big bank.

- 1% cashback. Get a little back on eligible purchases made with your M1 Spend Visa® debit card.

- Send checks. Schedule one-time or recurring paper checks from the M1 app.

- Early direct deposit. Get your paycheck up to two days early. Who doesn’t like getting paid early?

- No minimum balance to open an account

M1 Credit

Earn up to 10% cashback. Get 10%, 5%, or 2.5% cash back on purchases with some of the most popular brands—and 1.5% standard cashback on everything else.

Reinvest your rewards. Use the M1 platform to reinvest the cash you earn for long-term impact.

Advanced security. Freeze your card anytime and get Visa Signature® benefits, including Visa® Zero Liability.

$95 annual fee. The card has a $95 annual fee, waived with an active M1 Plus membership.

Make managing your finances easy. Seamlessly manage your checking and credit card through M1 Spend.

Auto-Invest Explained

With M1 auto-invest, you can:

- Invest all your cash automatically

- None of your cash (auto-invest turned-off),

- Or anytime your cash exceeds a pre-specified amount by $25.

Your cash is auto-invested into your pie, and you maintain your pre-determined investment targets without any manual adjustments.

For example:

Minimum Cash Balance: $0

Trading will occur once your cash balance exceeds $25. All cash will be invested based on your target allocations, and the remaining cash will be $0.

Account Fees

Account minimums: $100 for brokerage, $500 for retirement accounts

Fees: There are no commissions or mark-ups on trades.

Misellaneous Fees: Wire Transfer: $25, Check request: $25, Returned Checks: $30

IRA Management Fees: None

There is a $100 minimum to open a brokerage account and a $500 minimum for retirement accounts. M1 Finance does not charge any commissions or mark-ups on trades.

However, other miscellaneous fees may apply. A full list of fees can be found here.

Account Types Available

M1 offers 3 types of investing accounts:

- Taxable brokerage

- IRA (Traditional, Roth, or SEP)

- Trusts

- M1 Finance supports 401k rollovers and the ability to transfer in IRA. If you open an IRA, there are no management fees, but there is a $100 closing fee and an outgoing account transfer fee.

M1 Plus Explained

M1 Plus is a premium service offering enhanced investing, checking, borrowing, and spending accounts benefits.

M1 Plus is free for the first 3 months and $125 thereafter.

It’s not a bad deal because their credit card offers 1.5% cash-back on all purchases and higher cash-back rates at select merchants.

Plus 1% APY on their digital checking account. Given most credit cards have an annual fee of $75 – $95 per year and the average checking account offers just .05% APY, it’s definitely worth considering.

Worst case, sign-up for a year and right away set a calendar reminder to cancel it.

Required M1 Plus Disclosure: M1 Plus is a $125 annual subscription offering products and services from M1 Spend LLC and M1 Finance LLC, both wholly-owned, separate but affiliated subsidiaries of M1 Holdings Inc

Let’s take a look at the full list of features available with M1 Plus:

| FEATURE | INVEST | BORROW | SPEND: CHECKING | SPEND: CREDIT |

|---|---|---|---|---|

| WITH M1 PLUS | Ability to trade in AM or PM trading windows | Borrow at 3.5% | Earn 1.3% APY 1% Cashback 4 ATM Fee Reimbursement per month 0% International Fees | $95 Fee waived for members Earn 2.5% – 10% Cashback at certain Merchants 1.5% Cashback everywhere else |

| WITHOUT M1 PLUS | AM only trading windows | Borrow at 5% | 1 ATM Fee Reimbursement per month 0.8% – 1% International Fees |

Mobile App

M1 Finance has a mobile app available in the Apple and Google Play store. The app has a 4.6 out of 5-star rating in the Apple store and a 4.4 out of 5 stars in the Google Play store. The mobile app is very user-friendly.

Account Protections

M1 Invest accounts: Securities in M1 Invest accounts are insured up to $500,000 by the SIPC.

M1 Spend Checking accounts: M1 Spend checking accounts may be insured for up to $250,000 by FDIC insurance.

Latest Technology: All data transferred and stored within M1 systems are protected with military-grade 4096-bit encryption. Plus, M1 offers two-factor authentication (2FA).

Alternatives To M1 Finance

If you’re looking for an alternative to M1, There are a few competitors in the Robo-advisory space.

| Features |  |  |

|---|---|---|

| Overview | Automatically investing your purchases | Earn stock when making purchases using your debit card |

| Number of Trading Windows | One per day | Four per day during weekdays |

| Types of Accounts | Taxable brokerage and IRA | Brokerage, IRA, and custodial accounts |

| Cryptocurrencies | No | No |

| Fees | $3 – $5 per month | $1, $3, or $9 per month |