Revolutionize Your Trading Strategy with moomoo: The Ultimate Platform for Advanced Investors.

Quick Summary:

moomoo is a comprehensive investing platform offering advanced trading tools for novice and seasoned investors. The platform provides access to various investment products, including stocks, options, and ETFs, and features advanced research and analysis tools.

Overall Rating:

PROS

- Advanced technical analysis

- International stocks

- Low margin rate

CONS

- No retirement accounts

- No covered call writing

- No crypto

In this MooMoo brokerage review, we look at another popular discount brokerage gaining traction. We dig into what MooMoo is, including its key features, to help you decide whether or not this investing platform is right for you.

Let’s get into it.

PROS

- International Stocks. With MooMoo, investors have access to Chinese and Hong Kong-listed stocks – a big plus for investors interested in international markets

- Low Margin Rate. MooMoo’s current margin rate is one of the lowest in the industry right now (6.80%)

- Advanced Technical Analysis. With over 63 technical indicators, 38 drawing tools, and the ability to create your own technical indicators with 190+ presets makes MooMoo is different than other brokerages.

CONS

- Only taxable brokerage accounts. MooMoo does not offer other account types like joint accounts or traditional or Roth IRAs.

- Some asset classes are are not available. No cryptocurrencies, Bonds, CDs, or mutual funds. Not a huge issue for many investors, but individuals should take note.

- No covered call option writing. This is a strange and significant con for options traders.

What is MooMoo?

Moomoo is a newer discount brokerage platform that provides online trading services for stocks, options, exchange-traded funds (ETFs), and international stocks. It’s a subsidiary of Futu Holdings Limited, a Chinese company that operates in the financial technology industry.

Moomoo aims to offer a user-friendly and innovative platform that enables individual investors to easily access financial markets and manage their portfolios. The platform provides features such as commission-free trades, real-time market data, advanced charting tools, and educational resources.

Moomoo also offers additional features and services such as margin trading, IPO access, and a social community for investors to share ideas and insights.

The company seeks to provide a comprehensive and accessible investing experience for both novice and experienced investors.

Who Should Use MooMoo?

MooMoo is good for…

Active traders in the domestic and international markets who need access to advanced trading tools.

MooMoo is not good for..

Investors who prefer a more traditional investment approach or who require personalized investment advice.

Key Features

Below we look at several key features of MooMoo, including investing options, fees, trading tools, customer service, fees, security, and platform usability to see how MooMoo stacks up.

Investing Options

Overall, MooMoo is generally on par with its peers. The company offers various investments, including stocks, options, ETFs, ADRs, and futures, plus access to margin trading.

The company does offer access to international stocks, and Forex, which is not available at most peers, but it also doesn’t offer covered call trading, which is strange.

However, like other discount brokerages such as Public and Webull, MooMoo does not offer trading in mutual funds, bonds, or fixed income.

Stocks

MooMoo offers access to a wide range of U.S. and global stocks, including popular companies such as Apple, Tesla, and Amazon. In addition, individuals have access to internationally listed stocks on Chinese and Hong-Kong exchanges.

Plus, investors can sign-up for IPO subscriptions, giving them access to new IPOs, and allowing them to capitalize hot companies early on.

Options

The platform allows users to trade options on stocks and ETFs for $0.65 per contract. MooMoo offers a range of options strategies, including calls, puts, and spreads. Plus, they provide real-time data, analysis tools, and educational resources to help users make informed decisions.

For some strange reason, MooMoo does not offer covered call trading, which can be a drawback for serious options traders.

American Depository Receipts

The company also offers trading in ADRs, which are shares of foreign companies issued by American Banks.

ETFs

MooMoo provides access to several ETFs (Exchange Traded Funds). Users can trade ETFs commission-free and access real-time quotes, news, and research tools to help make informed investment decisions.

Margin Trading

MooMoo also offers margin trading, which allows users to borrow funds to invest in securities, which can amplify gains (and losses). Users must meet certain criteria and maintain certain levels of equity to be eligible for margin trading.

MooMoo’s current margin rate of 6.80% is one of the lowest in the industry and considerably lower than Robinhood’s 11.50% margin rate.

Futures

Unlike most discount brokers, MooMoo offers access to futures trading across over 200 products, which can be a significant advantage for some traders.

Fees

MooMoo offers commission-free trading for stocks and ETFs. However, they charge a $0.99 platform fee for each trade executed, so it’s a bit misleading to say they are commission-free.

However, they do charge $0.65 per option contract, which is a standard rate; some other discount brokers do not charge fees to trade options. Not a huge deal but something investors should note if they are serious options traders.

There are other fees that investors should be aware of, such as regulatory fees and margin interest fees. For example, the SEC (Securities and Exchange Commission) charges a small fee for each sale of a security, which is typically a few cents per share.

- Stocks: $0 Commission

- ETFs: $0 Commission

- Options: $0.65 per contract

- Platform Fee: $0.99 per order

Trading Tools Tools

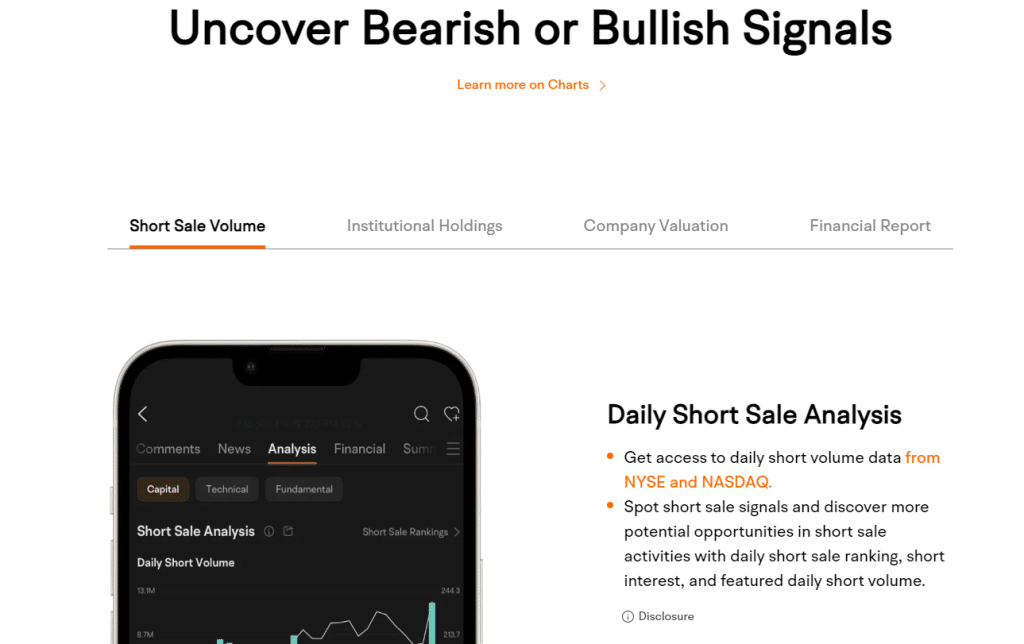

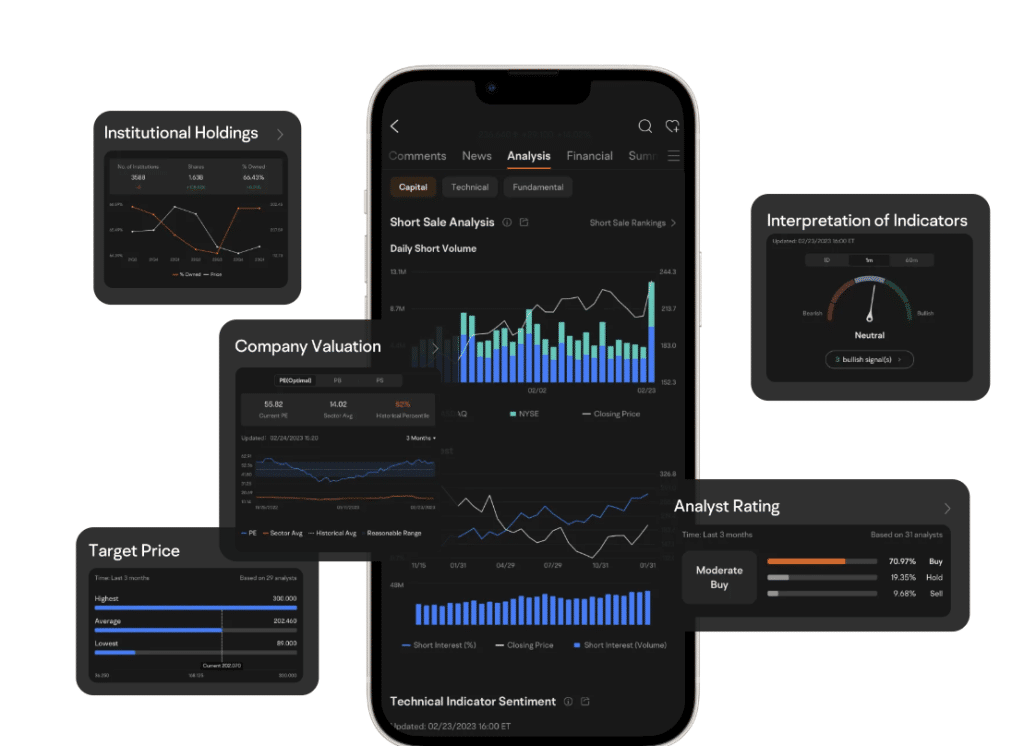

MooMoo offers a wide range of trading tools and features for its users. Here are some of the key trading tools available on the MooMoo brokerage platform

Trading Simulator

MooMoo offers a trading simulator that allows users to practice trading with virtual money before they start investing real money. This feature can help users learn how to trade without risking their actual funds, ideal for individuals learning how to become an investor., an excellent option for learning how to become an investor.

Real-time Market Data

The platform provides real-time market data, including stock quotes, charts, and news. This data can help traders make informed decisions about their trades.

Customizable Watchlists

Users can create and customize watchlists to track their favorite stocks and monitor market trends.

Advanced Charting Tools

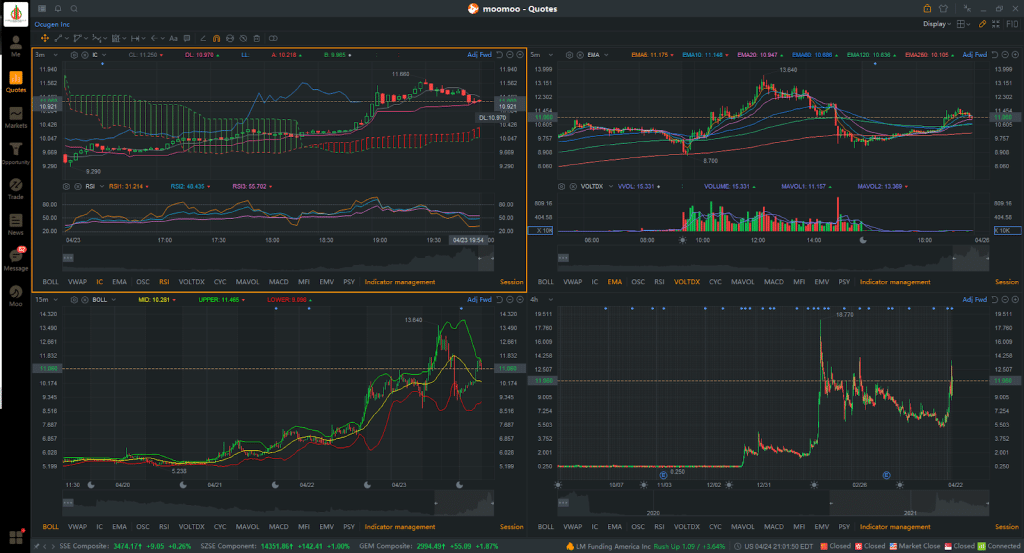

MooMoo offers advanced charting tools that allow traders to analyze market trends and patterns. You can access 63 advanced charting tools and 38 drawing tools, making MooMoo ideal for advanced traders interested in technical analysis.

Level 2 Quotes

The platform also provides Level 2 quotes, which show the current bid and ask prices for a stock, as well as the number of shares available at those prices.(elaborate on the importance of Level 2 quotes).

Trading Alerts

Users can set up trading alerts to be notified when a stock reaches a certain price or when a specific event occurs in the market.

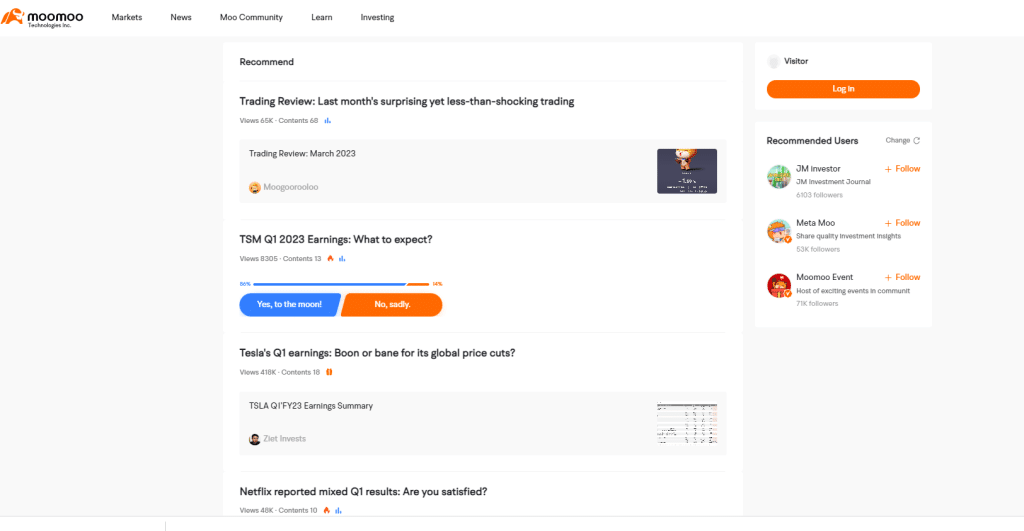

Community

Another great feature is the trading community, where you check out the top traders on MooMoo’s daily, monthly and all-time portfolios. This is very similar to eToro’s copy trader, but eToro allows you to automatically replicate a trader’s portfolio.

Customer Service

MooMoo offers customer service through several channels to assist investors with their questions and concerns. However, the company does not offer telephone support outside regular trading hours, which could be an issue for some users, but is common practice among discount brokers.

Live Chat

Investors can access live chat support through the MooMoo app or website. This allows them to quickly connect with a support representative and receive real-time assistance.

Investors can send an email to MooMoo’s customer support team to get help with their questions or issues.

Phone

MooMoo also provides phone support for investors who prefer to speak with a representative over the phone. The phone support team is available during regular trading hours.

Social Media

MooMoo also maintains active social media accounts on platforms such as Twitter, Facebook, and LinkedIn.

Investors can use these channels to ask questions or provide feedback. MooMoo aims to provide responsive and helpful customer service to assist investors with their needs.

Platform Design & Ease of Use

The MooMoo brokerage platform is designed to be user-friendly and accessible on both mobile and desktop devices.

Mobile Platform

On mobile devices, the MooMoo platform has a clean and intuitive design making for a seamless investing experience.

The home screen features a customizable watchlist where users can quickly view their favorite stocks and the latest market news.

The bottom navigation bar allows users to easily access different sections of the app, including the trading screen, account information, and news feed. The trading screen provides real-time market data and allows users to buy and sell stocks, options, and other securities with just a few taps.

Desktop Platform

On desktop devices, the MooMoo platform has a more traditional design, with a top navigation bar that provides access to different sections of the platform, including the trading screen, account information, a news feed, and research tools.

The trading screen provides real-time market data, advanced charting tools, and options trading capabilities. The platform also offers a range of research tools, including analyst ratings, earnings reports, and SEC filings, to help users make informed trading decisions.

Whether you’re using the mobile app or trading on your desktop, the MooMoo platform is designed to provide a seamless trading experience with easy access to real-time market data, customizable watchlists, and advanced trading tools.

Safety and Security

As with any investment platform, safety and security are important considerations.

MooMoo takes several measures to ensure the safety and security of its users investments and maintains industry-standard safety and security features.

- SIPC Insurance: MooMoo is a member of the Securities Investor Protection Corporation (SIPC), which provides insurance protection for up to $500,000 of securities and cash in case of broker-dealer failure.

- Account Protection: MooMoo uses encryption technology to protect user data and account information. Additionally, the platform offers two-factor authentication to add an extra layer of security.

- Regulatory Compliance: MooMoo is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These organizations oversee the securities industry and enforce regulations to protect investors.

- Bank-Level Security: MooMoo uses bank-level security to protect user data and account information.

While no investment platform can guarantee 100% safety and security, MooMoo takes several measures to protect its users’ investments and personal information.

Best Alternatives

There are several alternatives to consider if you are looking for a stock brokerage platform other than moomoo.

eToro is a social trading platform that allows users to copy the trades of other successful traders. It offers trading in stocks, ETFs, cryptocurrencies, commodities, and more. eToro also offers social features, such as a newsfeed where users can share ideas and insights with other traders and use the copy trader features to replicate top traders investing strategies.

eToro is better suited for traders who want to engage in social trading and trade a wider range of instruments, albeit with no fees. Ultimately, the choice between these platforms will depend on your specific needs as an investor or trader.

Public is a social investing app designed for long-term investors interested in building a diversified portfolio of stocks and ETFs. It allows users to buy fractional stock shares, making it easy for investors to invest in expensive stocks with small amounts of money.

Public also offers social features, such as a feed where users can follow other investors and share insights and ideas. Public charges no commissions for trading but does charge a $5 monthly fee for premium features such as margin trading.

The Bottom Line

Overall, MooMoo is a good option for traders who want to leverage their advanced technical analysis tools or may wish to take advantage of their low margin rate. However, their $0.99 platform fee per trade, lack of cryptocurrency offerings, and no covered call trading could draw the line for some investors.

That said, if you are a beginner trader who does not require advanced technical tools or does not plan on trading with margin, then better options are available.