At A Glance:

| Feature |  |  |

|---|---|---|

| Trading Commissions | $0 | $0 |

| Type of Investment Account | Taxable Brokerage and IRA | Taxable Brokerage |

| Fractional Share Trading | No | Yes |

| Cryptocurrencies | No | Yes |

| Mobile App | Yes | Yes |

| Margin Trading | No | Yes |

| Reoccurring Fees | Yes, $3 and $5 a month platform fee | No |

What Is Acorns?

Acorns is an investing and banking app that allows individuals to invest their spare change by rounding up purchases to the nearest dollar and investing the difference.

Acorns is built on making investing available to individuals who don’t necessarily have the resources to purchase large quantities of securities but instead focuses on micro-investing through fractional shares.

Acorns automatically rounds up your purchase to the nearest dollar and invest in a portfolio of ETFs across 7,000 stocks and bonds whenever you make a purchase.

Founded in 2012, the company has 8.2 million customers and $3 billion in assets under management (AUM).

What Is Robinhood?

Robinhood is a mobile-only discount brokerage that offers commission-free stock and options trading with an account minimum of just $1.

Robinhood aims to democratize trading by becoming one of the first brokerages to offer commission-free trading.

The company is publicly traded on the NASDAQ and has 31 million users.

Robinhood is headquartered in San Francisco, CA.

How Does Acorns Work?

Acorns is a micro-investing app that helps individuals invest small increments of money through round-ups. Basically, when you open an account with Acorns and opt-in for “round-ups,” debit card purchases are rounded up to the nearest dollar.

Once the round-ups reach five dollars, Acorns automatically invests the money on your behalf, making it a truly seamless investing process.

It’s important to note that you do not have the ability to buy individual stocks or bonds, only a type of portfolio ranging from conservative to aggressive investing strategies.

Round-Up Example:

For example, if you made a debit card purchase for $3.50, Acorns would round up each purchase to $4.00, and the difference, $.50, is set aside until the $5 threshold is met.

Once the $5 threshold is met, that amount is automatically invested.

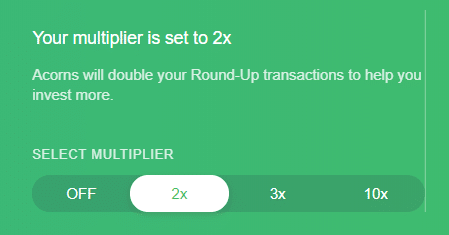

There are also round-up multipliers – you can adjust your round-ups to be 2x, 3x, or even 10x, the rounded amount to magnify your investing.

How Does Robinhood Work?

Robinhood is a commission-free trading app that allows you to buy and sell stocks, options, ETFs, and cryptocurrencies.

You can trade stocks, and US options, ETFs, and cryptocurrencies through Robinhood with a taxable investment account. Unlike traditional brokers, Robinhood does not provide investment advice or guidance like a full-service brokerage.

When you open an account with Robinhood, there are two types of accounts, an instant account which is free to use, and Robinhood Gold, which costs $5 monthly.

Head-to-Head Comparison

Below we will look at 5 key features of Acorns and Robinhood and see how these online brokerages stack up against each other.

Investment Options

Winner: Robinhood

Robinhood offers a wide range of individual stocks, ETFs, options, ADRs and cryptocurrencies. However, Robinhood does not allow trading in mutual funds, bonds, closed-end funds, or foreign stocks. Meanwhile, while Acorns only allows you to invest in a “type” of a portfolio based on a specific strategy conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive.

Acorns does enable individual stock trading like Robinhood does.

Robinhood Investment Options:

- U.S. Exchange-Listed Stocks and ETFs

- Options Contracts for U.S. Exchange-Listed Stocks and ETFs

- ADRs for over 650 Globally-Listed Companies

- Crypto such as bitcoin and six other cryptocurrencies

You cannot trade the following with Robinhood:

- Mutual Funds

- Bonds

- Closed-end funds

- Foreign-domiciled stocks

Acorns Investment Options:

Acorns offers 5 different investment portfolios in its Core account:

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

The 5 portfolios are comprised of various ETFs, but you don’t have the option to pick individual stocks or bonds, only the level of aggressiveness in your portfolio.

The type of portfolio you select will determine the composition of your portfolio. For example, a sample conservative portfolio will likely contain bond ETFs such as:

iShares Short Treasury Bond – SHV

SPDR Bloomberg Barclays 1-3 Month T-Bill – BIL

Goldman Sachs Access Treasury 0-1 Year – GBIL

JPMorgan Ultra-Short Income – JPST

iShares Ultra Short-Term Bond – ICSH

You can find the complete list of investment options on Acorn’s website.

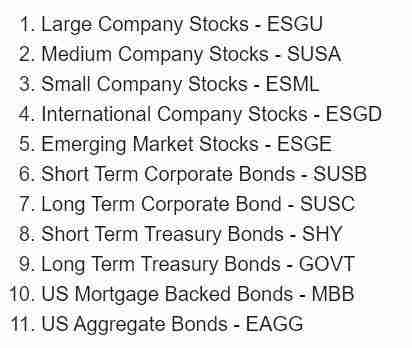

Acorns ESG

Acorns recently released a set of ESG portfolios (environmental, social, and governance.) Sustainable portfolios are made of Exchange Traded Funds (ETFs). Acorns offers 4 ESG portfolios – Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive.

Please note if you are aIf you are an exiting Acorns user and want to invest in an ESG portfolio, you will need to sell your core portfolio holdings, which may trigger a taxable event. This won’t apply to new users.

Pricing and Fees

Winner: Draw

While neither Robinhood nor Acorns charges any stock trading fees, but there are other fees investors should note.

Acorns doesn’t charge any transaction fees, withdrawal fees, or commissions on trades, making it a low-cost investment option for many individuals. Individuals who use acorns must pay a $3/mo fee for personal accounts, and $5/mo for family accounts. A Family account includes unlimited investment accounts for children. Plus personal investment, retirement, and checking accounts, bonus investments, and money advice.

At the same, a standard Robinhood account is free to use, but if users want advanced features like margin trading, s, third-party market research, and Level II market data from Nasdaq, then they must upgrade to Robinhood gold for $5 a month.

Robinhood Fees

- Trading Fees: Robinhood charges no trading fees or commissions for buying and selling stocks, ETFs, options, and cryptocurrencies.

- Cryptocurrency Transaction Fees: Robinhood charges a small fee for cryptocurrency transactions. The fee varies depending on the cryptocurrency being traded and market conditions.

- Deposit and Withdrawal Fees: Robinhood does not charge any fees for deposits or withdrawals made through ACH bank transfers. However, there may be fees associated with wire transfers.

- Account Fees: Robinhood does not charge any account fees, including annual fees or inactivity fees.

- Regulatory Fees: Robinhood may pass on certain regulatory fees, such as SEC and FINRA fees, to its customers.

Account Types

Winner: Acorns

Acorns offers 3 types of accounts; a taxable brokerage, an IRA retirement account, and a custodial account for children. Meanwhile, Robinhood only offers a taxable brokerage account, they do not offer retirement accounts or any other investment accounts.

Robinhood Account Types

Robinhood Instant: Robinhood Instanta is your standard taxable brokerage account with $0 monthly fees and is the type of account most Robinhood users have. With a Robinhood Instant account, you have access to the following features:

Instant Access To Unsettled Funds. A standard Robinhood account offers you access to up to $1,000 in unsettled funds. This means you can use your unsettled funds to trade right away instead of waiting 3-5 days for the funds to settle.

Unlike a Gold account, the Robinhood instant account does not grant users access to margin trading, advanced research, and advanced market data.

Robinhood Gold: Robinhood Gold is a more advanced account than Robinhood Instant. With a Robinhood GOLD account, you have access to margin trading, larger access to unsettled funds, third-party market research, and Level II market data from Nasdaq.

A Robinhood Gold account is $5 per month.

Margin Trading. Your first $1,000 of margin is included. For amounts over $1,000, you’ll pay 2.5% yearly interest. Your interest is calculated daily and charged to your account at the end of each billing cycle. It’s important to note that your margin rate is subject to change in Robinhood’s terms and conditions.

Instant Access To Unsettled Funds. With a Robinhood Gold account, you have instant access to funds transferred more than $1,000. In other words, instead of waiting a few days for your money to settle, you can use your cash immediately to start trading.

With a standard Robinhood account, you have access up to $1,000 in unsettled funds.

Third-party Market Research. Gold members have unlimited access to Morningstar’s premium research reports. There are approximately 1,700 stocks that have research updated regularly.

Level II Market Data. With Level II access, Gold members can view Level II Market Data. Members can view market data that shows multiple bid/ask prices from Nasdaq. With this information, investors can better understand the demand for security and availability.

Acorns Account Types

Acorns offers three types of investing accounts; a taxable brokerage, an IRA, and a custodial account.

Invest [Taxable Brokerage]

It is a taxable brokerage account like Robinhood’s account. If you were to opt in, an Invest account automatically invests your rounded-up funds into a portfolio of ETFs based on your designated risk tolerance.

Acorns automatically rebalances your portfolio based on your preselected risk tolerance.

Later [IRA]

It is an Individual Retirement Account (IRA). Acorns automatically selects the right type of account based on your long-term goals with a later account.

You can make contributions to a Later account on a one-time or reoccurring basis.

Round-ups are not available with an Acorns Later account.

Early [Custodial]

Is a custodial account opened on behalf of your children, either a UGMA or UTMA account (Uniform Gift to Minors Act or Uniform Transfers to Minors).

If you want to open an Early Account, you need to purchase the Acorns Family Account for $5 per month.

Acorns Early works like your Acorns Invest and Later accounts, you can invest with as little as $5 into a wide range of ETFs. Round-ups are not available with an Early account.

Additional Services & Features

Robinhood offers users access to IPOs at the IPO price and fractional share trading and cash management. While Acorn’s Earn program and unique $1,500 referral bonus program make it too tough to call a winner.

Other Robinhood Features

- IPO Access. Robinhood offers individual investors public access to upcoming IPOs. This means everyday investors like you and me can purchase securities at the IPO price. IPO access was once only available to the ultra-wealthy and institutional investors.

- Fractional Share Trading. You can invest in 5,000 stocks and ETFs by purchasing fractional shares starting at $1, or as little as 0.000001 shares. Most popular fractional shares include Apple, Tesla, Amazon, and certain over-the-counter and American depositary receipt socks.

- Cash Management. Robinhood cash management enables you to earn interest on your swept cash. You will also get a debit card issued by Sutton Bank. You can use your debit card to buy groceries, pay bills, send checks, etc. Your cash earns a 0.30% annual percentage yield through Robinhood’s network of bank programs.

- Stock Lending. Stock lending provides an opportunity to earn extra income on stocks you already own. When you enable stock lending, Robinhood works to find borrowers, and you get paid if there is a match.If your stocks are on loan, you’ll still be able to sell them at any time and realize gains or losses as you would otherwise. You need to have at least $5,000 in your account to be eligible for Stock Lending.

Other Acorns Features

- Acorns Earn. With Acorns Earn, when a user purchases from one of Acorn’s 350 brand partners, the brand partner will automatically invest a set amount or percentage directly into your investment account. The Acorn’s Earn account also offers a Chrome plug-in that makes earning simple when shopping online.

Popular partner brands include Apple, Macy’s, Nike, Walmart, and Warby Parker, to name a few. - Acorns Spend. With Acorns Spend, you have access to all the standard features of a standard checking account, including a debit card and ATM access. There is no minimum balance or overdraft fees, plus access to 55,000 ATMs globally.

Mobile Experience

Winner: Acorns

The Robinhood app is extremely easy to use and user-friendly. The company was in hot water for making it too easy for users to trade by having enticing features such as confetti and free stock after a trade is executed. You can’t win, can you? However, the Robinhood app does have a lower rating than Acorns in both the Apple and Google Play stores, so Acorns takes the ribbon here.

Robinhood

Acorns

Pros & Cons

Robinhood PROs

- No commissions

- Access to margin trading

- Can trade before funds settle in your account

Robinhood CONs

- Only taxable brokerage accounts are available

- No access to in-depth market analysis

- No access to fixed-income products

Acorns PROs

- Low monthly fees

- Taxable Accounts or Retirement Accounts

- Additional investment contributions through Acorns Earn

Acorns CONs

- No ability to pick individual stocks

- No cryptocurrencies

- No margin trading

Who Should Use Robinhood and Acorns?

Robinhood is better for…

- DIY investors

- Taxable brokerages

- Margin trading

Acorns is better for…

- A hands-off investing approach

- Retirement accounts

- Micro-investing

The Bottom Line

In reality, it’s not possible to say Robinhood vs. Acorns is better. While both investing apps target younger investors, they have different operating models.

Robinhood focuses primarily on active traders and investors who are more interested in actively trading stocks, options, and cryptocurrencies.

Meanwhile, Acorns focuses more on a long-financial plan by only offering portfolios based on an individual’s level of risk they are willing to take; they do not enable individual stock trading and are therefore not geared towards active traders.

That said, if you are looking to be an active trader, Robinhood is better, but if you are looking to build long-term wealth and not consistently trade, then Acorns is the better choice.

Happy investing!