Rocket Dollar is a provider of self-directed retirement accounts that can be used to hold alternative assets.

Quick Summary:

A self-directed retirement account that enables individuals to invest in alternative assets.

Overall Rating:

PROS

Greater flexibility in the investments you can hold

Removes leg work of opening an account

Built-in tax breaks

CONS

Pricey monthly Fee

It can take several weeks to open an account

At A Glance:

This rocket dollar review will look at an increasingly popular investing tool: self-directed retirement accounts. These investment vehicles allow individuals to hold alternative assets outside traditional stocks, bonds, and mutual funds.

- Overview: Provider of self-directed retirement accounts.

- Account Types: Traditional & Roth IRA, Solo 401K

- Fees: Depending on account tier, $15 or $30 a month, plus a one-time setup fee of $360 or $600

- Investment Options: Anything legally permissible

- Account Minimum: None

What is Rocket Dollar?

Rocket Dollar is a provider of self-directed retirement accounts.

The company facilitates the ability for individuals to invest in alternative assets like real estate and private equity through a self-directed IRA or solo 401k.

Historically, traditional retirement accounts only allowed investments in conventional assets like ETFs, mutual funds, and target date funds. As a result, this created a gap in the market where individuals could easily add alternative investments to their retirement portfolios.

Rocket Dollar does not offer alternative investments per se. Instead, they set up the legal structure so you can invest in a self-directed IRA through your favorite real estate crowdfunding platform.

The company aims to empower individuals by making investing in alternative assets safe, simple, and fast.

Rocket Dollar was founded in 2018 by Henry Yoshida and Thomas Young. In September 2021, Rocket Dollar received a Series A investment round of $8 million, led by Park West Asset Management.

Their office is headquartered in Austin, TX.

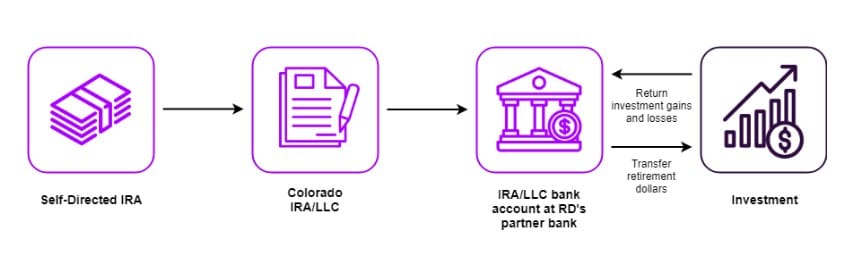

How Does Rocket Dollar Work?

Rocket Dollar is different than most traditional retirement account providers. Most providers limit you to a predefined selection of investment options, usually exchange-traded funds, mutual funds, and targeted retirement funds.

Rocket Dollar does the opposite.

With Rocket Dollar, there are no investment options. You can invest in anything that is legally permissible, real estate and farmland, to name a few.

Rocket Dollars opens an LLC for IRA accounts, and a trust for Solo 401(k) plans to facilitate the transactions.

The LLC or trust is the legal owner of the account, where all transactions are required to be conducted, and expenses and income received is held.

Because the LLC is the legal owner of the account, it is commonly referred to as “checkbook control” because you can write checks for any legal investment from the LLC or trust.

There are several advantages of putting your assets in an LLC, one being ease of record keeping.

Investment Options

Rocket Dollar does not provide a predetermined set of investment options. Instead, they only set up the legal structure for investing and then you are free to invest in any assets you desire.

The IRS implements some restrictions for what is considered a permissible investment. For example, a self-directed retirement account cannot purchase life insurance, collectibles (stamps, cars, art), gems, and some coins and metals.

The good news is that there are many more permissible investments than restricted assets.

Some popular investments allowed in self-directed IRA and solo 401ks include:

- Real estate

- Gold bars

- LLC membership units

- Private placements

- Commodities

- Tax lien certificates

- Foreign currency

- Mineral rights

- Promissory notes

- Livestock and crops

Account Tiers

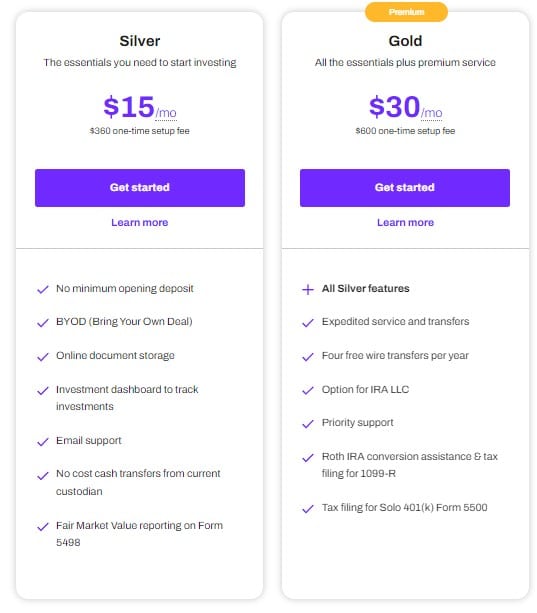

There are two account tiers when you open a self-directed IRA or solo 401k through Rocket Dollar.

The Silver Account is $15/mo and has a one-time setup fee of $360. Meanwhile, Rocket Dollar Gold, their white glove service account, is $30/mo and has a one-time setup fee of $600.

There are a few differences between the two tiers, the most significant difference being enhanced customer support and expedited service for account transfers and fulfillments.

For double the price, I don’t see considerable value-add for the Gold level account. Most users should be fine with the Silver tier while saving a few bucks.

Rocket Dollar Fees

Outside of the recurring monthly and one-time setup fees, there aren’t many other ancillary fees when you open a self-directed retirement account through Rocket Dollar.

Rocket Dollar does not charge fees based on assets under management, and there are no fees to close your account.

You can have $10,000 invested through Rocket Dollar or $100,000; the fee structure is the same for all users.

- Management Fees: None

- Setup Fees: one-time $360 or $600 depending on account tier

- Monthly Fee: $15 or $30, depending on the tier

- Account Closing Fees: None

- Wire or ACH Fees: You may incur wire or ACH fees

Opening An Account

Opening an account with Rocket Dollar is straightforward and can be completed online.

First, choose the right account for you and sign up in under 5 minute

Fund your account in just a few short days. You will need to contact Rocket Dollar’s support team if you want to initiate a rollover.

Invest. From there, you can write checks from your retirement account to fund any alternative asset.

Who Should Use Rocket Dollar?

Rocket Dollar is good for…

Individuals who want to invest alternative assets as part of their retirement strategy.

Rocket Dollar is not good for…

The recurring fees could significantly impact individuals who have a low account balance.

Alternatives to Rocket Dollar

Rocket Dollar’s closest competitor is Alto IRA.

The most significant difference between Alto IRA and Rocket Dollar is that Alto has a predefined selection of investable alternative assets that it offers through partnerships with alternative investing platforms.

Meanwhile, Rocket Dollar does not offer any investment options. Instead, Rocket Dollar setups up the legal structure, allowing you to invest through your self-directed retirement account. The most significant benefit of Rocket Dollar vs Alto is that Rocket Dollar provides flexibility. You can invest in anything legally permissible.

| Feature |  |  |  |

|---|---|---|---|

| Overall Rating | |||

| Monthly Fee | $15-30/mo | $10-$25/mo | None |

| One-time Setup Fee | $360 -$600 | $0 | None |

| Minimum Investment | None | $10/crypto $50/alternatives | $1,000 |

| Types of Accounts | IRAs, Solo 401K | IRAs | IRAs |

| Coins/Tokens on the Platform | None | 150+ | 29 |

| Types of Investors | Open to all investors | Open to all investors | Open to all investors |

| Open an account | Alto IRA Review | iTrust Capital Review |

The Bottom Line

As the ease of investing in alternative assets becomes more straightforward and more individuals pick up side gigs and start monetizing their hobbies, there will be an increasing demand for services from a company like Rocket Dollar.

While the fees charged by Rocket Dollar can be offputting for some investors, it may be worthwhile considering if you have an alternative asset like real estate or are investing in a friend’s business, the rationale for using Rocket Dollar tips scale.