In this Streitwise vs. Fundrise comparison, we will look at two popular crowdfunding platforms and help you decide which is right.

At A Glance:

KEY FEATURES | ||

QUICK SUMMARY | Real estate investment company that enables accredited and non-accredited investors to invest in commercial real estate through a non-traded equity REIT. | Real estate investment platform that offers a wide variety of REITs and Funds with varying strategies and property types |

MINIMUM INVESTMENT | $5,000 | $10 |

FEES | 3% upfront (upfront fee)

2% ongoing | 1%/yr |

INVESTMENT OPTIONS |

|

|

What Is Streitwise?

Streitwise is a real estate investment company that enables accredited and non-accredited investors to invest in commercial real estate through a non-traded equity REIT. Streitwise’s current offering is a professionally-managed, tax-advantaged portfolio of real estate assets.

Streitwise was founded in 2016, and the company is sponsored and managed by Tryperion Partners. The company was formed as a result Reg A+ JOBS act in 2012, which allowed private companies to offer shares to the general public and not just accredited investors.

Since its inception, Tryperion has acquired and managed over $750 million in commercial real estate properties and delivered 21 consecutive quarters of 8% annualized returns.

The company is headquartered in Los Angles, California.

What Is Fundrise?

Established in 2010, Fundrise is the oldest real estate crowdfunding platform. Fundrise offers people an alternative option to investing in real estate without the stress and costs of traditional real estate investing.

Fundrise boasts a wide variety of investment options and strategies, goal-planning features, and a user-friendly investment dashboard.

More than 300,000 people use Fundrise today and have invested over $ 7 billion in properties throughout the U.S. Fundrise has had 21 consecutive quarters of returns, averaging 22.99% in 2021.

You can open a Fundrise portfolio with just $10.

Fundrise is based in Washington, DC, and was founded by Ben Miller, who has over 20 years of experience in the real estate industry.

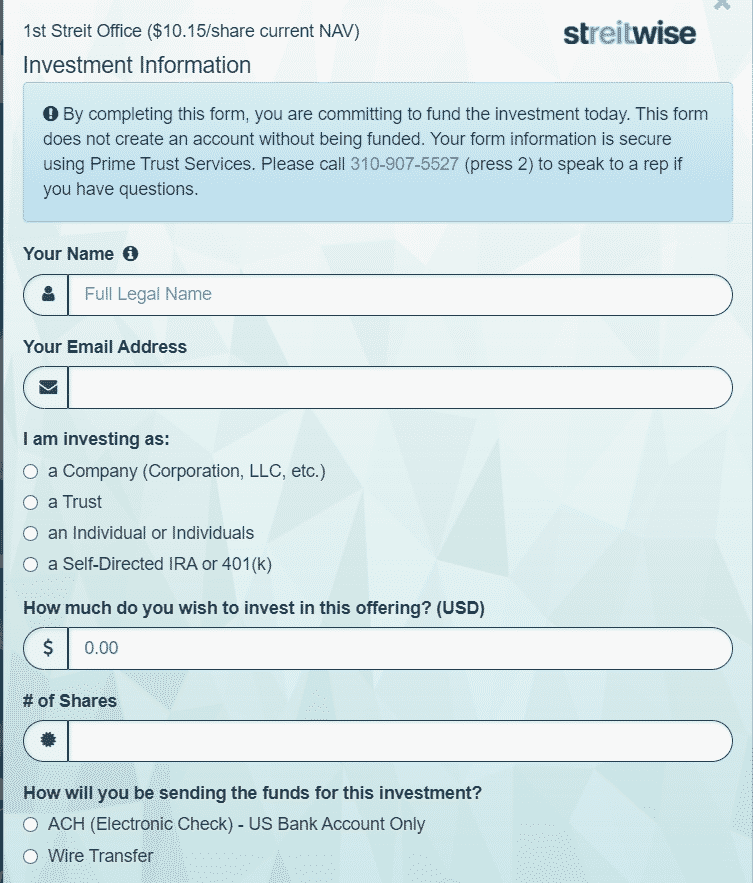

How Does Investing With Streitwise Work?

Streitwise offers accredited and non-accredited individuals the ability to invest in commercial real estate through a non-traded equity Real Estate Investment Trust.

Streitwise is different than other real estate investment problems because they own and operate the properties on their platform. Many other platforms serve as a middleman, connecting real estate sponsors and investors.

The company’s current REIT offering is (1st Streit Office). This REIT offering comprises two commercial properties and any future properties the company acquires.

The current offering has a minimum investment of $5,055 (500 shares at $10.11/share) and targets an 8-9% dividend, net of fees. You can invest as an individual, trust, company, or self-directed 401K or IRA.

Read our full Streitwise Review

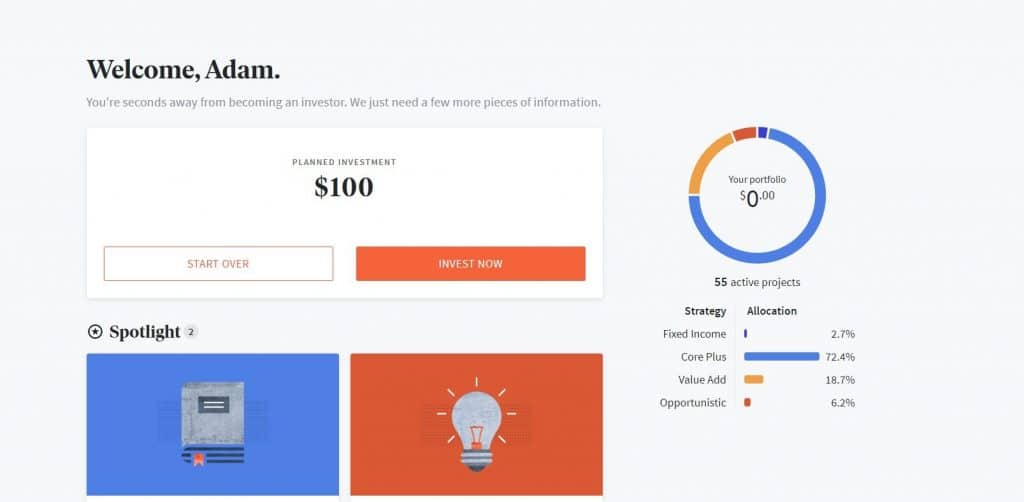

How Does Investing With Fundrise Work?

With Fundrise, you are investing in either Fundrise eREITs or eFunds. eREITs and eFunds comprise a basket of non-traded real estate properties, from multifamily apartments to industrial complexes. The eREITs and eFunds aim to seek a combination of dividend distribution and capital appreciation, depending on the strategy.

When you open an account with Fundrise, they offer a wide range of account levels; Basic accounts require a minimum investment of $10, and its Advanced Portfolio requires a minimum investment of $10,000. The premium level is reserved for accredited investors only, with a minimum investment of $100,000.

However, Fundrise’s most popular account is it is ‘Core’ portfolio, which has all the options and benefits most investors need. A Core account requires a minimum investment of $5,000.

You can create a customized investment strategy at the Core account level and above. Investors can customize their portfolio by diversifying across a wider variety of funds with specific objectives, such as income, growth, and balanced.

Read our full Fundrise Review

Streitwise: Key Features Explained

- $5,000 Minimum Investment. This is the minimum amount required to invest in Streitwise’s REIT. Note that the amount may vary slightly depending on its most recent NAV. While Streitwise’s minimum investment is considerably higher than Fundrise, you need to have a core account, which also requires a $5,000 minimum investment to gain access to most Fundrise features.

- Focused Investment Strategy. Streitwise applies a 4-pronged approach to acquire and manage a diversified portfolio of value-oriented investments home to creditworthy tenants that provide a source of steady and growing dividends for their investors.

The firm focuses on non-gateway markets, typically more moderately priced at higher capitalization rates. In addition, Streitwise finances acquisitions with modest leverage to minimize the risk of principal loss. Taken together, this is a winning investment plan.

- Early Redemption Option. Streitwise allows investors to redeem their shares after 1 year, with no penalty after 5 years. After year 1 and until year 2, an investor can redeem their share for 90% of NAV.

| Time Held | Redemption Percentage |

|---|---|

| Less than 1 year | No redemption allowed |

| 1 year until 2 years | 90% of NAV |

| 2 years until 3 years | 92.5% of NAV |

| 3 years until 4 years | 95% of NAV |

| 4 years until 5 years | 97.5% of NAV |

| 5 years or more | 100% of NAV |

- Over $5 million skin-in-the-game. The founders invested over $5 million in their own money with Streitwise. This means there is a shared alignment between the owners and investors. Fundrise owners do not have much of their money invested in Fundrise REITs and Funds.

- Streitwise owns and operates all of its investments. Why does this matter? Most other real estate crowdfunding platforms serve as intermediaries for 3rd party companies, receiving a portion of the profits and costing investors more money.

- Transparent Fee Structure. Streitwise is upfront about its fee structure. There are no hidden fees buried in its offering documents. While a

3% upfront fee(upfront fee now waived) and 2% ongoing fee seems steep, it’s similar to most real estate crowdfunding companies because they bury most of their fees in the offering circular.

- Modest Leverage. Streitwise only borrows 50% to fund its current project. Modest leverage reduces risk and maximizes returns. Especially in the current market environment, modest leverage makes for a safer investment.

- Open To All Investors. Streitwise is open to accredited and non-accredited investors in the US and worldwide. Plus, they offer accounts for individuals, companies, and retirement accounts.

Fundrise: Key Features Explained

- $10 Minimum Investment. You can open an account and start investing in real estate with just $10. You are limited in your investment options at this level – you can only invest in either the Income Fund or Flagship Fund. You only get the full benefit of Fundrise features when you open a ‘Core’ account with a minimum investment of $5,000.

- Early Redemption Option. If investors want to redeem their shares of the eREITs or eFund, they can place a redemption request at any time. However, any eREIT or eFund redemptions processed before an investment is five years old are subject to a flat 1% penalty. Also, Fundrise does not guarantee liquidity; they may stop purchasing shares back if unfavorable market conditions exist.

- Dividend Reinvestment. If you enable dividend reinvestment, dividends earned are automatically reinvested quarterly according to your investment plan.

- Create and Manage Investor Goals. This feature allows you to invest with a defined goal to track your progress toward achieving your objectives. Investor goals are only helpful if your investment horizon is 5 years or longer. Streitwise does not have an option to create and manage goals.

Common goals include saving for a large purchase or retirement. The Investor goals tool is expected to show you how your portfolio could grow over time through continued investment, appreciation, and dividend/distribution income.

Once your goal is set, the goal tracker will monitor if your portfolio is on track, needs attention, or is off-track and then guide you towards making adjustments to help you meet your goal.

Investor Goals is available to all taxable accounts beginning at the Starter account level.

- Automated Investing. You can schedule automatic investing to your Fundrise portfolio, at any time, with $10 increments. Auto-investments are allocated according to your chosen plan, and Fundrise may offer new investments to invest in automatically as they arise.

- 1%/yr Fee. Fundrise charges a yearly asset management fee of 0.85% plus a 0.15% advisory fee, so 1%/yr for AUM. All dividends are net of fees. So for every $1,000 invested, you will pay $10 in fees. However, there are other fees buried in the offering circular that Fundrise does not advertise.

Fundrise does not charge transaction fees, sales commissions, or additional fees for enabling features on your accounts, such as dividends or auto-investment.

- 21 Consecutive Quarters of Positive Returns. Since its inception, Fundrise has delivered 21 consecutive quarters of positive returns with a net 11.58% return across all clients since inception. Their best quarter returned 9.40%, and their worst quarter was 1.15%.

- Multiple Account Levels. The Fundrise platform consists of five levels of accounts with varying minimum balance requirements. Depending on the level of account opened, you will have access to different investment options.

Fundrise’s most affordable option is its ‘Starter’ portfolio. This low-cost package starts at $10. The portfolio includes access to Fundrise’s registered products, dividend reinvestment, and auto investing.

If you open a ‘Starter’ portfolio, you can invest in the Income Fund, which focuses on cash flow generation, or the Flagship Fund, which focuses on income and capital appreciation.

However, the Starter portfolio does not have IRA access or other advanced functionality. For $1,000, you can upgrade your account to the Basic Plan. With the Basic Plan, you can define your investment goals, open a taxable IRA, and invest in the Fundrise iPO.

Neither the Starter nor Basic plans grant access to Fundrise’s non-registered investment programs. After that, there are 3 higher-level plans: Core, Advanced, and Premium. These plans have a higher minimum balance but also come with more advanced features, including additional investment options such as an Opportunity Zone Fund.

Head-to-Head Comparison

Let’s a take a look of Streitwise vs. Fundrise compare.

Investment Options

Winner: Fundrise

Fundrise Has 11 active eREITs and 2 eFunds. eREIT strategies span from income generation to Midwest Region strategies. eREITs are a diverse family of funds, each pursuing a focused real estate investment strategy.

The eFunds are comprised of an Income Real Estate Fund, whose main objective is income distribution and currently has a 6.5% distribution rate.

Their other fund is The Flagship Real Estate Fund, which aims to generate income while also seeking long-term capital appreciation with low to moderate volatility and low correlation to the broader markets. The Flagship Real Estate Fund currently has a 0.75% distribution rate. The eFunds are your only investment option if you have a basic account.

Meanwhile, Streitwise currently has only 1 REIT open to investors: An equity REIT comprised of institutional-quality commercial buildings. While Streitwise’s REIT has historically performed well, delivering 21 consecutive quarters of distributions ranging from 8 – 10%, they don’t offer the breadth of real estate investing strategies available with Fundrise, so Fundrise takes the W here.

Returns

Winner: Streitwise

The Streitwise Equity REIT focuses on income generation, delivering 21 consecutive quarters of annualized returns between 8 – 10% since inception. Meanwhile, Fundrise returned an average annualized return of 11.58%, net of fees across all clients between 2017 and 2021.

However, since Fundrise has multiple investment options across different strategies, it’s difficult to compare apples to apples.

Streitwise’s closest competitor from an income generation perspective is Fundrise’s Income Real Estate Fund, which currently has a 6.5% distribution rate. And since Streitwise’s fund yields 8 – 10% with a strong track record, Streitwise is the winner in the returns category.

Account Fees

Winner: Streitwise

While Fundrise advertises a 1% management fee, other fees are buried in their offering circular.

For example, on page 82 (of 332), Fundrise lists a 2% “Acquisition and Origination Fee.” Interestingly, this fee is not listed anywhere except in the offering circular.

Alternatively, Streitwise is transparent: They charge an upfront fee of 3% (upfront fee now waived) of the amount invested and an ongoing management fee of 2%. The 2% management fee affects the taxable income that is the basis for the dividend payments – in other words, it reduces the dividend yield paid to investors.

Streitwise does not charge any other fees such as waterfall / profit-sharing fees, acquisition fees, developer fees, construction management fees, service fees, liquidation fees, property management fees, financing fees, disposition fees, or any other hidden fees that other non-traded REITs often hide from prospective investors by burying the hidden fees in the offering documents.

Ease of Use & Design

Winner: Fundrise

Streitwise leaves much to be desired in terms of website and platform design.

While it was easy to open a Streitwise account, I felt like I was diving back to 2008 when signing up on their platform. The user interface feels quite outdated. Not the end of the world. Have you ever seen Berkshire Hathaway’s website? (Warren Buffett’s company).

Meanwhile, Fundrise has a state-of-the-art website design and user account platform. This doesn’t discredit Streitwise in terms of performance or legitimacy. Still, Fundrise has invested considerably to make its platform user-friendly, which could be a heavily weighted factor for some potential investors.

PROs & CONs

Streitwise

PROS

- Strong historical performance

- Owns and operates all their investments

- Founders have ‘skin in the game’

- Early redemption features

- Transparent fee structure

CONS

- High minimum investment

- Early redemption fees

- Only 1 investment option

Fundrise

PROS

- Wide range of investment options

- Low $10 minimum investment

- Investor goal planning & tools

- Early redemption features

CONS

- Tiered-accounts limits features for some users

- Early redemption fees

Which Platform Is Better?

Winner: Fundrise

Fundrise has a more well-rounded platform with a lower investment minimum and more investment options ranging from income generation to capital appreciation strategies. Furthermore, Fundrise has a robust and user-friendly website and mobile app, making them a better choice for most would-be real estate investors.

That said, this was a close call. I like Streitwise because the owners have their own money invested in the firm. They also own and operate all their properties and have had strong historical performance while maintaining a focused investment strategy.

If you like these selling points, Streitwise could be a better option, but most investors would be more comfortable with all the perks and features offered by Fundrise.