Overall Rating:

Quick Summary:

A one-stop shop for single-family rental properties. You can research, buy, sell, and connect with partners for financing and property management.

PROS

30-day money-back guarantee

Easy to use research tools

Curated investment properties

Vacancy protection features

CONS

A large amount of capital required

At a Glance:

| Feature |  |

|---|---|

| Overview | Marketplace to purchase and sell single-family rental homes across the United States. |

| Type of Investments | Single-Family Rentals Roofstock tracking shares |

| Minimum Investment | Varies |

| Liquidity | None |

| Fees | Sellers pay a 3% fee of the sale price or $2,500 (whichever is greater) Buyers pay a fee equal to 0.5% of the purchase price, or $500 (whichever is greater) |

| Retirement Account Investing? | Yes |

| Accreditation Required? | No, for single-family rentals |

| 1031 Exchange | Yes |

Who Should Use Roofstock?

Investing with Roofstock is a good option if…

Individuals who want direct property ownership and do not mind handling the associated maintenance with property ownership.

Investing with Roofstock is not a good option if…

Individuals who do not have a lot of upfront capital or do not want the maintenance and tenant management responsibilities.

What is Roofstock?

Roofstock is an online marketplace where non-accredited and accredited investors can browse, compare, and ultimately buy or sell Single Family Rentals (SFRs) across 27 states.

Roofstock also provides property management services to property owners and the option to purchase shares of a managed rental property portfolio through its RoofstockOne platform.

Roofstock’s goal is to make investing in Single Family Rentals accessible to all investors regardless of their geographical location or expertise.

Since its launch in 2015, Roofstock has facilitated over $5 billion in real estate transactions and raised over $130 million in Venture Capital funding.

The company is headquartered in Oakland, CA

Why invest in Single Family Rentals?

According to Roofstock, there are 2 primary drivers that make Single Family Rentals an excellent investment opportunity.

- Non-correlated stock market performance makes for excellent portfolio diversification and building long-term wealth.

- Single Family Rentals have similar occupancy and operating margins to multifamily properties but with lower turnover. This is beneficial to owners because there can be significant time and expenses associated with turning over a property to a new tenant.

Sources: 1 Green Street Advisors 2016; 2 John Burns Real Estate Consulting 2019

How does Roofstock work?

Roofstock’s primary feature is buying or selling properties through the Roofstock Marketplace. In the Roofstock marketplace, you can review and analyze single-family rentals, short-term rental properties, or even portfolios of single-family rentals.

Let’s take a look at how using Roofstock works…

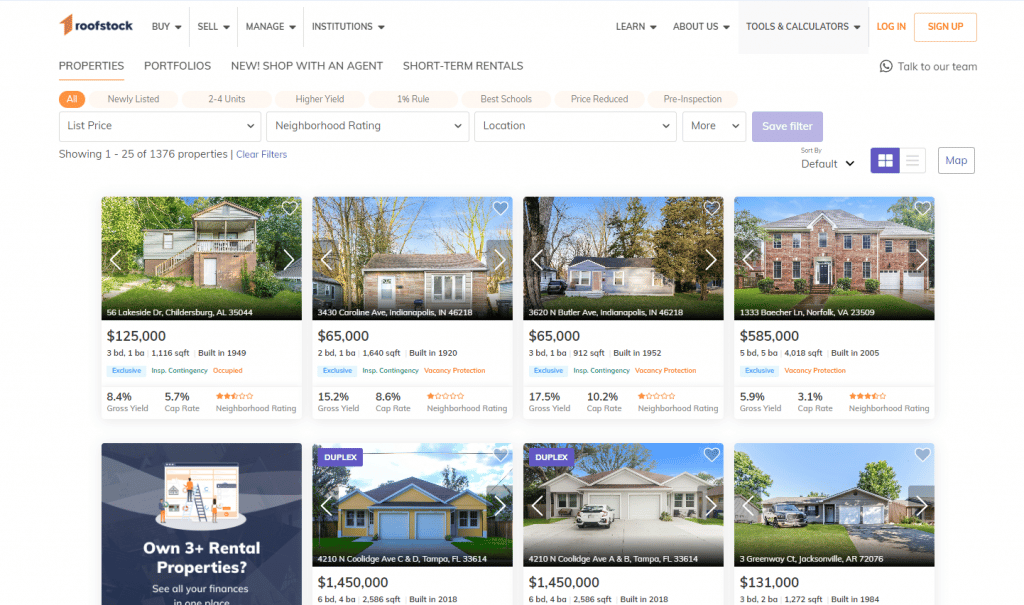

1. Search Roofstock Marketplace for Listings

After you sign-up for the Roofstock Marketplace, you can use custom filters to seamlessly narrow your search by list price, desired return, location and more. You can also sign-up for alerts and get notified when a property that matches your criteria becomes available.

Roofstock makes the research process faster by providing pictures, street views, floor plans, property inspection reports, current tenant lease information, and tenant payment history.

Other property filters include:

- Location

- Price

- Neighborhood rating

- Reduced price

- Cap rate

- Gross yield

- Monthly rent

Roofstock makes a once-piecemeal research process seamless because you can vet multiple properties without missing details or e-mail follow-ups.

Roofstock is a “one-stop shop” for gathering all the information a potential investor may want to know.

2. Make an Offer

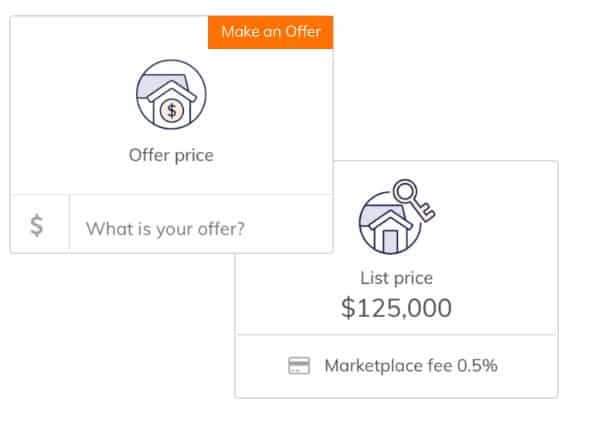

Once you find a property that you like, it’s time to submit an offer.

Submitting an offer is free.

If your offer is accepted, Roofstock charges a marketplace fee of 0.5% of the contract price or $500, whichever is higher. This fee helps cover Roofstocks certification, underwriting, and full-service transaction management services.

If you are financing the investment property, Roofstock can connect you with lenders to help you get pre-approved. Pre-approval will strengthen your offer compared to similar offers without proof of funds.

3. Close on your investment property

Once you are ready to close on your investment property, the closing process takes around 15 days if you’re paying cash on a pre-inspected property and around 30 days otherwise if you are financing a property.

The Roofstock transaction team guides you through escrow until the property is legally yours.

And if you are unhappy with your purchase, qualified Roofstock properties come with a 30-day money-back guarantee. Portfolio, select, short-term rental, VIP program, and multi-family properties are not eligible for the guarantee.

4. Start earning cashflow

Because most properties on the Roofstock marketplace are fully occupied, you start earning rental income as soon as the closing process is completed.

If your property is not occupied at the time of closing, many, but not all, properties come with vacancy protection if your property is not fully occupied within 45 days, or they will pay 75% of your lost rental income for 6 months until it is occupied.

How does Roofstock differentiate itself?

At face value, Roofstock may seem no different than any other online real estate platform such as Zillow or Redfin.

However, prior to Roofstock, there was non “one-stop shop” that enabled investors to view detailed quantitative, qualitative and financial information in one place and then purchase or sell a property within that same platform.

Information had to be pulled from various sources, and investments often required local expertise and knowledge that was not easily accessible online.

Only institutions with deep industry knowledge and connections could invest in single-family rentals at scale.

Roofstock created a platform to address the lack of accessibility and efficiency of a typical real estate transaction by streamlining the entire transaction process and ongoing property management services. The attractive benefits of real estate investing, including monthly cash flow and appreciation potential, are now available to a much wider audience.

How Roofstock Stands Out

- One-stop shop for researching, buying, selling, and connecting with partners for financing and property management

- No geographic barriers – access listings from high-performing markets nationwide

- Inventory from a range of sources with attractive investment potential

- Proprietary neighborhood scores to assess the quality of that area

- Powerful analytics

- Roofstock Support team

- Industry-leading money-back guarantee and vacancy protection for unoccupied properties

Roofstock One

Roofstock One is an alternative way for accredited investors to invest in a portfolio of single-family rentals fully managed by Roofstock.

Roofstock One has a minimum investment of $5,000, and investors can purchase in increments of $100 after that.

There is currently no secondary market for Roofstock One shares, but as the program ramps up, the firm intends to establish one. That said, the company recommends that investors have an investment horizon of at least 5 years.

The main difference between Roofstock One and Roofstock is:

1. You are required to be an accredited investor

2. Investors are purchasing shares that track the performance of a portfolio of rental properties. You do not have direct ownership of the properties.

Investing in shares of RoofstockOne is better for investors who want a passive investment and can focus more on creating targeting portfolios that align with their investment goals.

Roofstock Fees

There are no fees to sign-up on the Roofstock platform, and submitting an offer is free. If a bid is accepted, there is a 3% seller’s fee and a buyer’s fee of 0.50% when a property is bought or sold.

The Roofstock fees are used to pay for certification, underwriting, and full-service transaction management services.

In general, Roofstocks fees are between 1.5% – 2.5%, cheaper than using a traditional real estate agent, which have 5 – 6% commissions, according to real estate firm Redfin.

- Sellers pay a 3% fee of the sale price or $2,500 (whichever is greater)

- Buyers pay a fee equal to 0.5% of the purchase price, or $500 (whichever is greater)

- No recurring fees

In addition, property owners are responsible for the other traditional property ownership costs such as:

- Mortgage

- Property taxes and insurance

- Maintenance and repairs

- Property management fees (if applicable)

Roofstock Alternatives

In reality, there are not many real estate investing platforms that have the same business model as Roofstock. Groundfloor is a company that provides loans for fix and flip properties. Meanwhile, DiversyFund is a real estate firm that offers the option to invest in a portfolio of professionally-managed commercial real estate.

| Features |  |  |  |

|---|---|---|---|

| Overall Rating | |||

| Minimum Investment | $5,000 | $10 | $500 |

| Fees | Sellers Fee: 3% Buyers Fee: 0.50% | None | 2% |

| Investment Type | Equity | Debt | Varies |

| Open To All Investors? | |||

| Retirement Account Investing? | |||

| Current Promotions | None | None | None |

| Sign-Up | Read Review | Read Review |

The Bottom Line: Is Roofstock Worth It?

For ordinary investors like you and me, Roofstock provides a valuable marketplace quipped with many investor tools that make investing in Single Family Rentals as painless as possible.

However, given the high barriers to entry, limited liquidity, or maybe you are just starting to get into real estate investing, you may be better off with real estate crowdfunding or REITs, which have much lower barriers to entry, with early redemption options.

Nonetheless, if you are dead-set on owning a physical investment property, Roofstock provides an opportunity to invest in properties you may not have been able to locate or where you could not find a property that meets your investment criteria.