Index funds have soared in popularity over the past 30 years, making them one of the most popular investment choices among household investors.

The index fund recently celebrated its 30th birthday.

Over the past 30 years, index funds have soared in popularity among investors largely due to its implicit diversification, low fees, and passive investing strategy.

But with all those benefits, there are still drawbacks such as no opportunity for customization, and limited potential for outperformance.

Either way, if you want to become a savvy investor, understanding the advantages and disadvantges of index funds is crucial.

In this article, we will examine the PROS and CONS of Index Funds so you can make the most educated investing decisions.

Let’s get into it.

Pros of Index Funds

Index funds is that they offer a cost-effective, diverse, and low-maintenance investment strategy for long-term investors. Key benefits include low fees, broad diversification, tax efficiency, and consistent returns that closely track the performance of the market indices they represent.

Additionally, index funds provide a passive investment approach, which may outperform actively managed funds over time, with less risk and lower costs.

Low-cost investment

Actively managed funds charge an average fee of 0.70%, versus 0.16% for Passively managed funds, according to a recent Wall Street Journal Article.

Index funds generally have lower expense ratios compared to actively managed funds because they follow a passive investment strategy. For example, two popular index funds VOO and SPY, which track the performance of the S&P500 have expense ratios of just 0.03% and 0.09%, respectively.

This means they aim to replicate the performance of a specific index through passive management, requiring less frequent trading and lower management and transaction costs.

Therefore, investors can keep more of their returns over time.

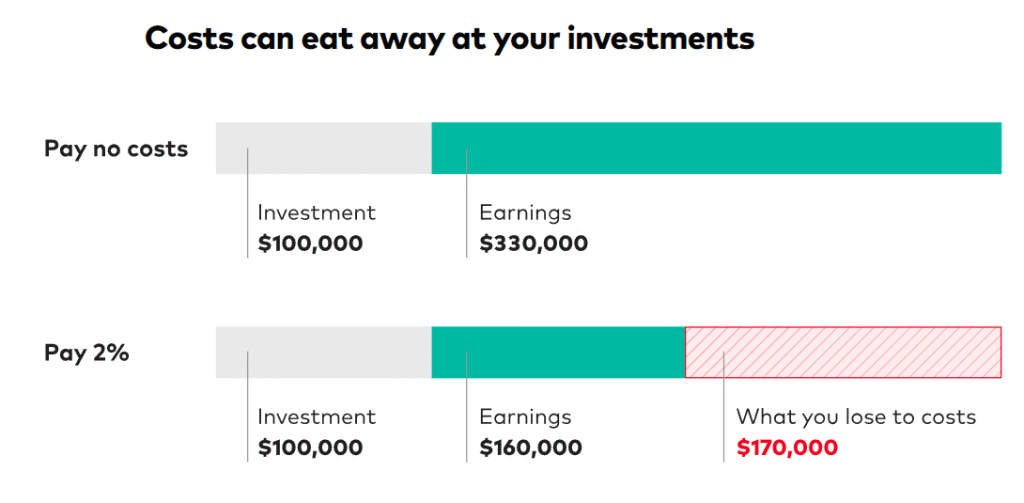

An article from Index Fund Giant, Vanguard highlights the impact of fees:

“Imagine you have $100,000 invested. If the account earned 6% a year for the next 25 years and had no costs or fees, you’d end up with about $430,000.

If, on the other hand, you paid 2% a year in costs, after 25 years you’d only have about $260,000.

That’s right: The 2% you paid every year would wipe out almost 40% of your final account value. 2% doesn’t sound so small anymore, does it?”

Source: Vanguard Group

Diversification

Index funds offer broad exposure to a wide range of assets, sectors, and regions within a single investment vehicle. By investing in an index fund, investors can effectively diversify their portfolios, spreading risk across multiple holdings and reducing the impact of poor performance by any single asset.

Easy Access and Simplicity

Index funds are easy to understand and access. Investors don’t need to research individual stocks or bonds and can instead focus on selecting the right index fund to suit their investment goals. Investors can access index funds through a discount broker like eToro.

This makes index funds an attractive option for beginner investors or those who prefer a passive investing strategy.

Most index funds trade as Exchange Traded Funds, making them widely available through brokerages and fund providers.

I started investing in index funds because I realized I knew little about investing, and it was the best decision I’ve ever made.

Performance

Numerous studies show that index funds often outperform actively managed funds over the long term, largely due to the lower fees associated with passive management.

By tracking the market, index funds can deliver consistent returns without the risks of poor management decisions or underperformance by individual securities.

Cons of Index Funds

While there are several advantages of index funds, investors should also be aware of their potential drawbacks.

Let’s look below:

Limited potential for outperformance

Index funds are passively managed, meaning they simply follow the composition of the underlying index. They do not employ active management strategies, such as stock picking or market timing, which means there is limited opportunity for outperformance.

Meanwhile, actively managedfund can dynamically select individual stocks and sectors, providing an opportunity for outperformance.

Let’s look below:

Concentration risk

Market capitalization-weighted index funds can sometimes be heavily weighted toward certain sectors or companies, leading to overconcentration in specific areas of the market.

For example, the Financial Times highlighted that just 5 companies the five largest companies in the S&P 500 Index (Apple, Microsoft, Amazon, Facebook, and Alphabet) made up approximately 22% of the index’s market capitalization. This level of concentration can expose investors to additional risks if these large companies underperform or experience severe declines.

Let’s look below:

Lack of customization

Lack of customization is a drawback of index funds because investors have limited control over the specific holdings within the fund.

This means that investors cannot tailor the portfolio to their individual preferences, values, or financial goals.

For example:

Investors who are interested in aligning their investments with their values, such as environmental, social, and governance (ESG) criteria or socially responsible investing (SRI) principles, may find it challenging to do so with a traditional index fund.

This is because index funds are designed to track a specific market index and do not allow for customization based on ESG or SRI considerations.

Tax Management: Index funds do not offer the same level of tax management as separately managed accounts or individual stock portfolios. For example, investors cannot sell specific holdings within an index fund to realize losses for tax purposes (tax-loss harvesting). This lack of customization may result in less tax-efficient outcomes for some investors. (Source: Schwab – “The Pros and Cons of Index Funds vs. Actively Managed Funds”)

Let’s look below:

Limited Risk Management

Since index funds are passively managed and aim to replicate the performance of the underlying index, they do not have the flexibility to dynamically hedge their positions response to market volatility, or adjust their holdings based on an investor’s risk tolerance or investing objectives.

Meanwhile, actively managed funds can reposition their portfolios to mitigate risk during periods of heightened volatility, and an individually selected portfolio can be adjusted to meet an investors investing objectives and risk tolerance.

Let’s look below:

Overweighting in High-Risk Sectors

Market capitalization-weighted index funds can be disproportionately exposed to high-risk sectors during periods of market volatility. This is because they allocate more weight to companies with larger market capitalizations, which can lead to a concentration of risk when these companies are part of volatile sectors.

The Bottom Line

Index funds provide a low-cost, diversified, and easily managed investment option, making them an attractive choice for long-term investors. However, their passive management may result in limited potential for outperformance and a lack of flexibility in addressing market changes.