Plant the seeds of your financial future and watch your wealth grow by investing in the versatile and reliable crop of wheat.

Wheat is one of the most important commodities in the world, providing food and raw materials for billions of people worldwide.

A commonly overlooked investment opportunity, there are several benefits to investing in wheat, including portfolio diversification, serving as an inflation hedge, and the potential for price appreciation as the demand for wheat increases.

This post will examine how to invest in wheat, the factors that impact the wheat market, and some no-nonsense tips for setting your investing journey off on the right track.

Let’s get into it.

An Overview

Investing in commodities should be considered as part of your investment portfolio. According to the Food and Agriculture Organization (FAO), the world wheat production in 2021-22 is estimated to be 778 million tonnes, with the largest producers being China, India, Russia, and the United States.

A combination of supply and demand factors, including weather conditions, production levels, trade policies, consumer preferences, and exchange rates, drive the global wheat market.

Factors that Impact the Wheat Market

Several factors affect the wheat market, including weather conditions, Supply and demand, trade policies, exchange rates, and consumer preferences.

Weather conditions

Wheat is a weather-sensitive crop, and any adverse weather conditions, like droughts, floods, or extreme temperatures, can affect its production and Supply, thereby influencing its price.

For example, in 2021, wheat prices rose to $8 a bushel, the highest in 9 years, which largely contributed to droughts in the U.S.

Supply and demand

Like other commodities such as oil or platinum, the supply and demand of wheat play a significant role in determining its price. If wheat supply is low and demand is high, the cost of wheat is likely to increase, and vice versa.

Trade policies

Trade policies such as tariffs and subsidies can have a significant impact on the price of wheat. For example, if a country imposes high tariffs on wheat imports, it may lead to higher wheat prices in that country.

Exchange rates

Wheat is a globally traded commodity, and fluctuations in exchange rates can affect its price. A stronger currency makes imports cheaper, while a weaker currency makes exports more expensive.

Consumer preferences

Changes in consumer preferences, such as a shift towards gluten-free or organic products, can affect the demand for wheat products and, therefore, influence the price of wheat.

Ways to Invest in Wheat

Your interest is now piqued if you’ve made it this far in the article. There are various ways to invest in wheat, including wheat stocks, ETFs, mutual funds, futures, and even investing in a tangible asset like farmland that produces wheat crop.

Wheat Futures Contracts

Wheat futures are a bet on the future price of wheat. It’s a contract between two parties, where one party agrees to buy a certain amount of wheat from the other party at a specific price and date in the future.

These contracts are traded on special exchanges, and investors can buy or sell them depending on whether they think the price of wheat will go up or down.

Wheat futures are most commonly used by farmers, millers, and other businesses involved in the wheat industry to protect themselves against price fluctuations.

However, wheat futures are also used by investors looking to profit by betting on the future price of wheat. These investors don’t want to buy or sell physical wheat; they want to make money by correctly predicting whether the price of wheat will go up or down.

Example:

- A farmer who expects to harvest a certain amount of wheat in the future can sell futures contracts to lock in a price for that wheat, protecting against a potential drop in price.

- On the other hand, a miller who needs to buy wheat in the future can purchase wheat futures contracts to lock in a price for that wheat, protecting against a potential price increase.

- Wheat futures are also used by investors who are looking to make a profit by betting on the future price of wheat. These investors don’t actually want to buy or sell physical wheat; they just want to make money by correctly predicting whether the price of wheat will go up or down.

Wheat Exchange-Traded Funds (ETFs)

A simpler approach to investing in wheat is through Wheat ETFs, or exchange-traded funds, which are investment funds that hold a portfolio of wheat-related assets, such as futures contracts, options, and stocks of companies involved in wheat production or processing.

Wheat ETFs can be a convenient and cost-effective way for investors to gain exposure to the wheat market without needing to buy individual wheat stocks.

There are several wheat ETFs available on the market, including:

- Teucrium Wheat Fund (WEAT) – This ETF invests in wheat futures contracts traded on the Chicago Board of Trade (CBOT), and seeks to track the performance of wheat prices.

- Elements Rogers International Commodity Agriculture ETN (RJA) – This ETF tracks the performance of an index that includes agricultural commodities, including wheat.

- iPath Series B Bloomberg Wheat Subindex Total Return ETN (JJWB) – This ETF invests in wheat futures contracts traded on the CBOT, and seeks to track the performance of wheat prices.

Wheat Farmland

A less common way to invest in wheat is a direct investment in farmland. This means investing in or buying physical farmland used for growing wheat crops.

This type of investment can be made through a company called Acre Trader, which specializes in farmland investing.

Investing in wheat farmland can provide investors with a steady source of income through the rental of the land to farmers or through the sale of the wheat crop. It can also provide a hedge against inflation and serve as a long-term investment.

However, investing in wheat farmland also involves significant risks and challenges, such as dealing with natural disasters, changes in weather patterns, crop failures, and fluctuations in commodity prices.

It requires expertise in farming practices, crop management, and land management, as well as the ability to handle legal and regulatory issues related to owning and operating farmland.

Alternatively, you could invest in farmland through a real estate investment trust (REIT) or a farmland investment fund, which allows them to pool their investments with other investors to purchase and manage large-scale agricultural operations.

Wheat-Focused Mutual Funds

Wheat mutual funds are a type of investment fund that invests in companies involved in the production, processing, and distribution of wheat and wheat-related products.

These funds provide investors with exposure to the wheat market, allowing them to benefit from potential increases in the price of wheat.

Wheat mutual funds are professionally and actively managed by professionals who aim to outperform their respective benchmarks. As a result, mutual funds tend to have higher fees than passively managed ETFs.

Wheat Stocks

Another way to indirectly invest in wheat is through publicly traded companies that are involved in the wheat market.

Here are a few examples:

- Archer Daniels Midland (ADM): ADM is a global agricultural processing and commodities trading company that is involved in the production and marketing of wheat, as well as other grains, oilseeds, and food ingredients.

- Bunge Limited (BG): Bunge is a global agribusiness and food company that is involved in the production, distribution, and marketing of wheat, as well as other grains, oilseeds, and agricultural commodities.

- The Andersons, Inc. (ANDE): The Andersons is a diversified company that operates in the agricultural, grain, and rail sectors. It is involved in the storage, handling, and merchandising of wheat, as well as other grains and commodities.

- GrainCorp Ltd (GNC.AX): GrainCorp is an Australian-based agricultural company that operates in the grains and oilseeds sectors. It is involved in the storage, handling, and marketing of wheat, as well as other crops.

However, these investment strategies may not capture the potential diversification and other benefits of commodity exposure in a portfolio because there are other factors that may impact their stock price, like their financial structure or the performance of an unrelated part of the company.

Wheat Contract For Difference

A wheat contract for difference (CFD) is a derivative that allows investors to speculate on the price movements of wheat without actually owning the physical commodity.

With a wheat CFD, the investor agrees to exchange the difference in the price of wheat from the time the contract is opened until it is closed.

In a wheat CFD, the investor takes a long (buy) or short (sell) position on the price of wheat. If the investor believes that the price of wheat will rise, they take a long position, and if they believe the price will fall, they take a short position.

One advantage of trading wheat CFDs is the ability to leverage your position, meaning you can gain exposure to a larger amount of wheat than you would be able to with the same amount of capital in physical trading. However, it’s important to note that leverage can also amplify losses, and therefore carries additional risk.

Note: Contracts for difference (CFDs) are not currently available to US investors due to regulations put in place by the Commodity Futures Trading Commission (CFTC) in the United States.

The CFTC has not approved the use of CFDs in the US, citing concerns over the potential risks and lack of transparency in these products.

PROS of Wheat Investing

- Price Appreciation: Wheat is a staple food item in many countries, which makes it one of the most traded commodities in the world. This high demand can result in a stable and potentially profitable investment.

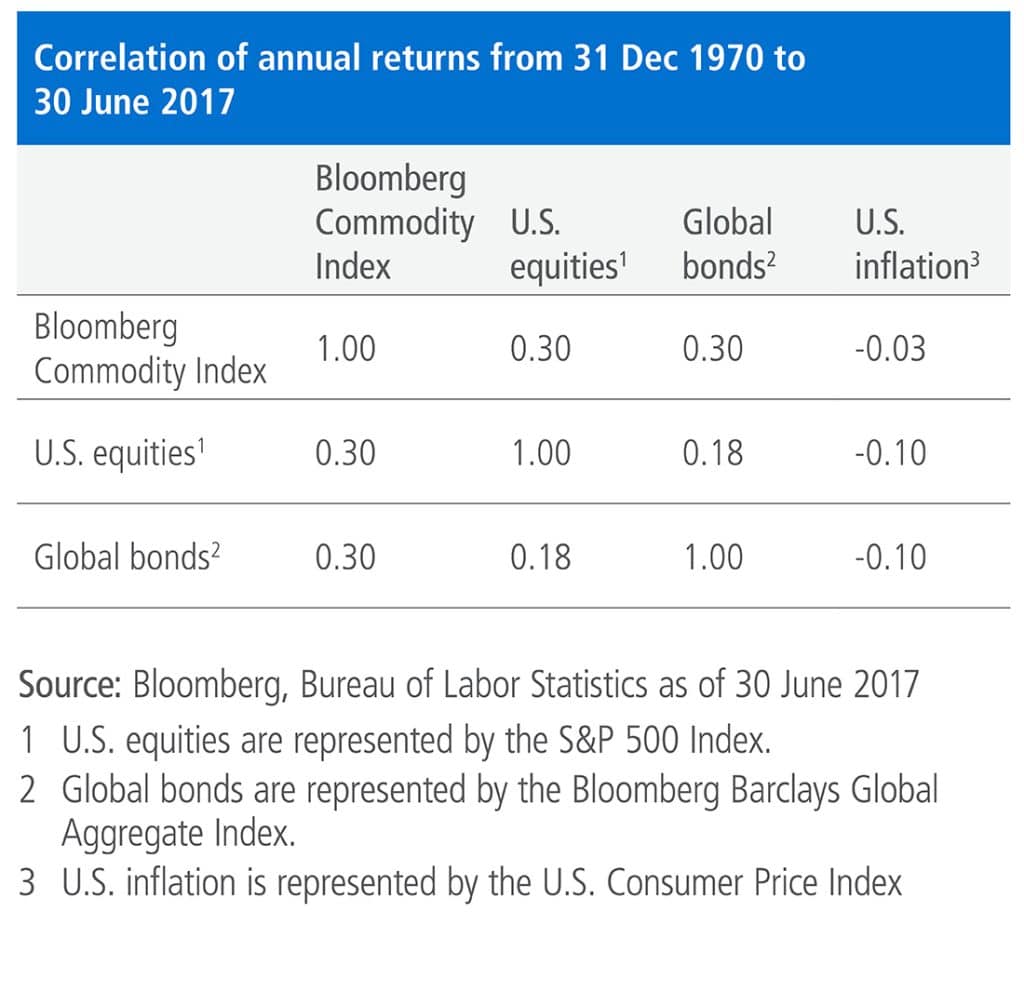

- Diversification: Wheat can be a valuable addition to a diversified portfolio, as it has a low correlation with other asset classes, such as stocks and bonds. Over the past 45 years, commodities have had a very low correlation with U.S. equities, according to an analysis done by investment manager PIMCO.

- Inflation Hedge: Wheat prices tend to rise with inflation, making it a potential hedge against inflation. Over the last decade, a 1% rise in unexpected inflation produced a 6% – 9% rise in commodities, according to research from investment manager Vanguard.

- Weather-Related Price Swings: Wheat production is heavily influenced by weather conditions, and unexpected weather events can cause significant price swings, which can create opportunities for investors who are able to anticipate and capitalize on them. Between 2006 and 2008, the price of wheat increased by 250%, allowing wise investors to take advantage of this price volatility.

CONS of Wheat Investing

- Volatility: Wheat prices can be highly volatile, which can make it a risky investment for those who are not experienced in trading commodities. For example, the price of wheat jumped from $7.70 per bushel to nearly $13 per bushel at the start of the Ukraine-Russia war, only to fall to around $8 per bushel just 6 months later.

- Supply Chain Disruptions: Supply chain disruptions, such as transportation issues, can have a significant impact on wheat prices. This can be particularly problematic for investors who have physical holdings of wheat.

- Competition: Wheat is a highly competitive commodity, and fluctuations in Supply and demand can be influenced by other food staples, such as rice and corn.

- Weather-Related Risks: While unexpected weather events can create opportunities for investors, they can also result in crop failures and lower yields, which can lead to price increases for consumers and lower returns for investors.

5 Tips for Successful Wheat Investing

Below are a few common sense tips to help you stay on top of your game when you are ready to start investing in wheat.

1. Keep track of Supply and demand

As with any commodity, the price of wheat is heavily influenced by Supply and demand. Keep an eye on global wheat production levels, as well as factors that can affect demand, such as weather, geopolitical events, and economic conditions.

2. Monitor the weather

Weather conditions can greatly affect wheat prices. Stay informed about weather patterns in wheat-producing regions to anticipate potential crop failures, which can cause prices to rise.

3. Diversify your portfolio

Wheat is just one of many agricultural commodities, so it’s important to have a diversified portfolio. Consider investing in other crops, such as corn and soybeans, to help spread out your risk.

4. Research the market

Before investing in wheat, research the market and the key players involved, such as producers, exporters, and importers. Understanding the market can help you make more informed investment decisions.

5. Choose your investment method carefully

There are different ways to invest in wheat, such as purchasing physical wheat, investing in commodity ETFs, or trading futures contracts. Choose the method that best fits your investment goals and risk tolerance.

The Bottom Line

Wheat is a globally-traded commodity that is used extensively in food production, making it an essential staple crop in many countries. Investing in wheat can be accomplished through various means, including futures contracts, ETFs, or direct purchases of stocks of wheat producers or processors.

However, wheat prices can be affected by a range of factors such as Supply and demand, climate conditions, and government policies. As with any investment, investing in wheat carries risks, such as fluctuations in prices and market volatility. Thus, conducting thorough research, consulting with a financial advisor, and considering your personal risk tolerance and investment goals are crucial before making any investment decisions.